The News

China’s manufacturing “overcapacity,” fueled by government subsidies, is giving its companies an edge over the United States in Africa’s transition to green energy, analysts say.

W. Gyude Moore, senior fellow at the Center for Global Development, speaking at the Semafor World Economy Summit (WES) on Thursday, said that China’s reported overcapacity — whereby its production capability significantly exceeds domestic demand — enabled its companies to offer competitive prices for green energy technologies in low-income countries.

“If we’re going to switch over to clean energy, are we going to use solar panels produced in Canada that are more expensive or the ones from China?,” he posed.

US Treasury Secretary Janet Yellen, during her trip to Beijing earlier in April, warned of the potential impact on jobs and prices in other markets if China seeks to offload excess production through exports rather than domestic consumption. Beijing hit back, describing the claim of overcapacity as a “vicious attempt to curb and suppress China’s industrial development,” disguised as an economic concept.

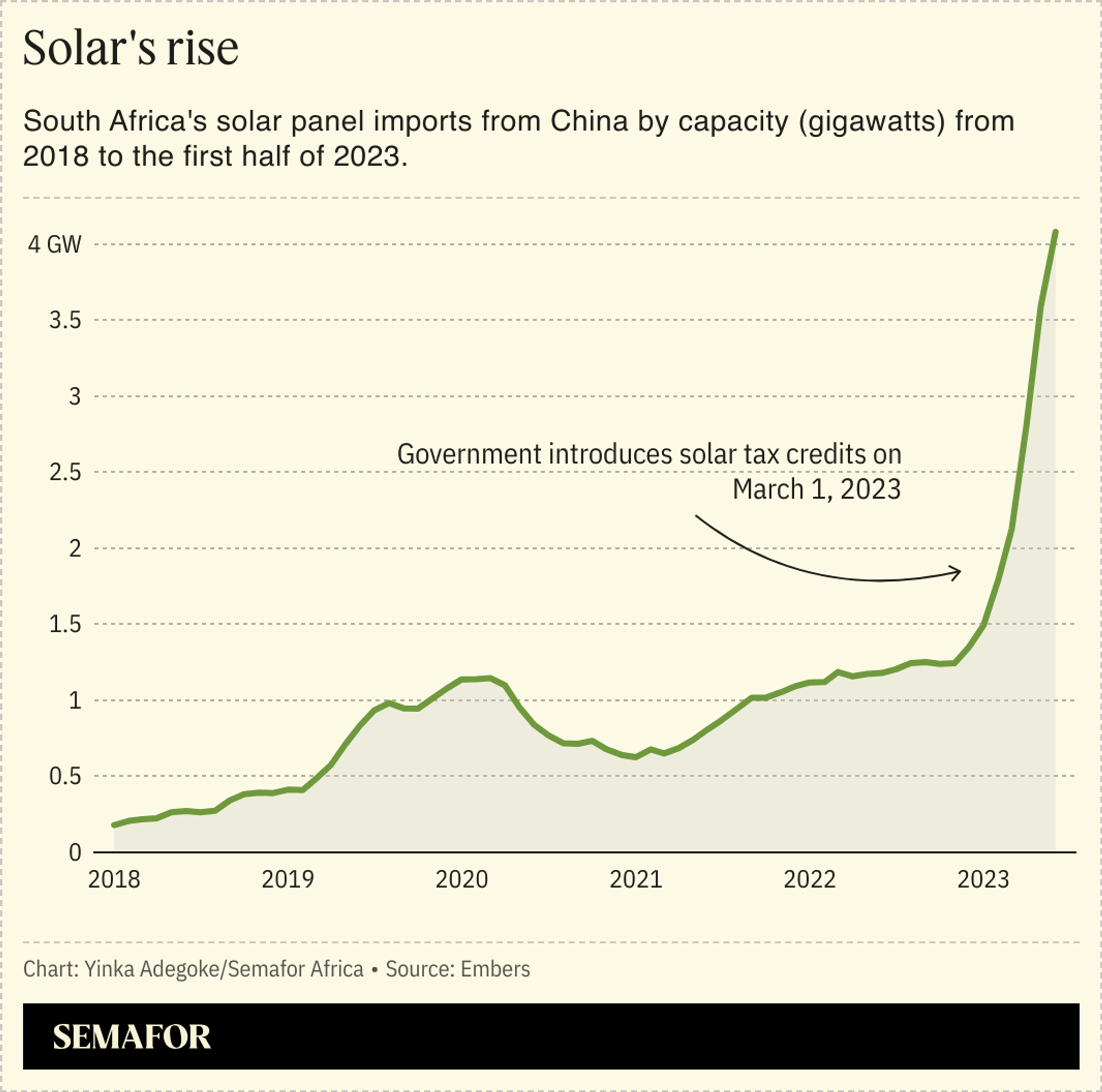

The debate comes amid a surge in China’s exports of green energy technologies globally, as well as their demand in Africa. China’s electric vehicle export volume in 2023 was seven times that of 2019, while its solar cell export volume was five times that of 2018 — an increase of 40% from 2022, according to a new Rhodium Group report.

South Africa quadrupled its solar panel imports from China in the first half of 2023 to 3.4 gigawatts as people looked to escape long-running power outages by state utility Eskom.

Know More

China currently has an advantage over the US in accessing critical minerals in Africa needed for the global energy transition, including cobalt which is used to manufacture electric vehicle batteries. A recent report by the United States Institute of Peace (USIP) pointed to the United States’ near 100% dependence on ‘foreign entities of concern’, mainly China, for critical minerals including graphite, manganese and cobalt, as a national economic and security concern. It recommended a renewed focus on ‘commercial diplomacy’ to enable the creation of new mineral supply chains around the world, including in Africa. The DR Congo, for example, is home to 70% of the world’s cobalt deposits.

Zainab Usman, Africa program director at the Carnegie Endowment for International Peace think tank in Washington D.C., told the Semafor WES that China and the US were both adjusting their approach to reflect the desire by African countries to undertake greater local processing and value addition, as opposed to simply exporting unprocessed minerals. DRC, Namibia and Zimbabwe are among African countries that have passed legislation banning the export of unprocessed minerals, although waivers have been issued in some instances due to challenges including insufficient smelting capacity.

“They (African countries) want to go up the value chain to ensure that they are doing some processing of these minerals domestically, some refining, and then eventually also participating in manufacturing components of clean energy and electric mobility hardware,” Usman said.

She highlighted the opening of a Chinese-built lithium refinery in Zimbabwe last year and a yet-to-be-implemented US memorandum of understanding signed with DRC and Zambia in December 2022 to develop a cobalt supply chain.

Martin’s view

The US, which itself is offering subsidies to companies in the green technology space to ramp up production, is keen to slow down China’s advances and potential international dominance in the sector. Yellen told CNBC in April that every option was “on the table,” including imposing tariffs on Chinese exports related to green energy. Biden on Wednesday also called for higher tariffs on Chinese steel.

Africa accounts for over 40% of the world’s critical mineral reserves, and countries such as DRC and Zambia are therefore uniquely positioned to take advantage of their vast mineral resources to grow local industries and create jobs. African countries must, however, first guarantee manufacturers efficient, adequate power supply to enable the processing of minerals. This requires massive investment in a mix of green and non-green energy sources.

Global powers, meanwhile, are not only competing for access to critical minerals in Africa but also a market for green energy technologies on the continent.

Room for Disagreement

Calisto Radithipa, chief commercial officer at Kemcore, which supplies chemicals used to process minerals, said the US still had opportunities to invest in projects on the continent.

“It’s not too late – opportunities for deals still abound,” he told Semafor Africa. “This means that numerous projects, resources, and assets remain available for development or acquisition. However, the US has not been actively engaged or bidding aggressively for these assets.”

Radithipa said the mining sector in Africa needed development funding as local entities lack access to capital markets to finance exploration endeavors compared to their foreign counterparts. He also said the US could provide funding for local participants in mineral supply chains and de-risk projects by offering off-take to ensure their financial viability.

The View From The Lobito Corridor

Running through Africa’s copper belt, the Lobito Corridor is the US government’s flagship project on the continent. It has been described by some analysts as Washington’s answer to China in Africa. The multibillion-dollar project entails construction of almost 350 miles of rail in Zambia, along with hundreds of miles of feeder roads connecting DRC and northwestern Zambia to global markets via Angola’s Port of Lobito.

“This is a huge push for the US government, but we need to do it at a high level of standard,” Scott Natthan, CEO of the US Development Finance Corporation, said at Semafor’s WES.

Samaila Zubairu, CEO of the Africa Finance Corporation (AFC), said Africa was “potentially the growth engine of the world going forward.”

“We know that for the energy transition to happen we need five times more minerals and metals than we have today. Most of the supply chain today is in Asia and we can’t increase by five times with the same architecture,” he argued.