The News

Bill Ackman’s turn as an anti-DEI provocateur has turned the investor, well-known enough on Wall Street but not far beyond, into a culture warrior. It’s also been very good for business.

Shares of his Amsterdam-listed investment firm have been on a tear since Ackman took to X to criticize corporate diversity efforts, support Israel, stump for long-shot presidential candidates, question childhood vaccine schedules, and bash the student protests that have taken over college quads across the country.

Ackman owns about 27% of the fund, which means the transformation to a right-wing meme stock has earned him $280 million. There’s no obvious explanation other than Ackman’s political turn: He’s added half a million X followers over the same period.

Pershing Square Holdings, which went public in 2014, lets retail investors own Ackman’s private investment book. It trades the same stocks as his onetime activist hedge fund, which is now essentially a family office.

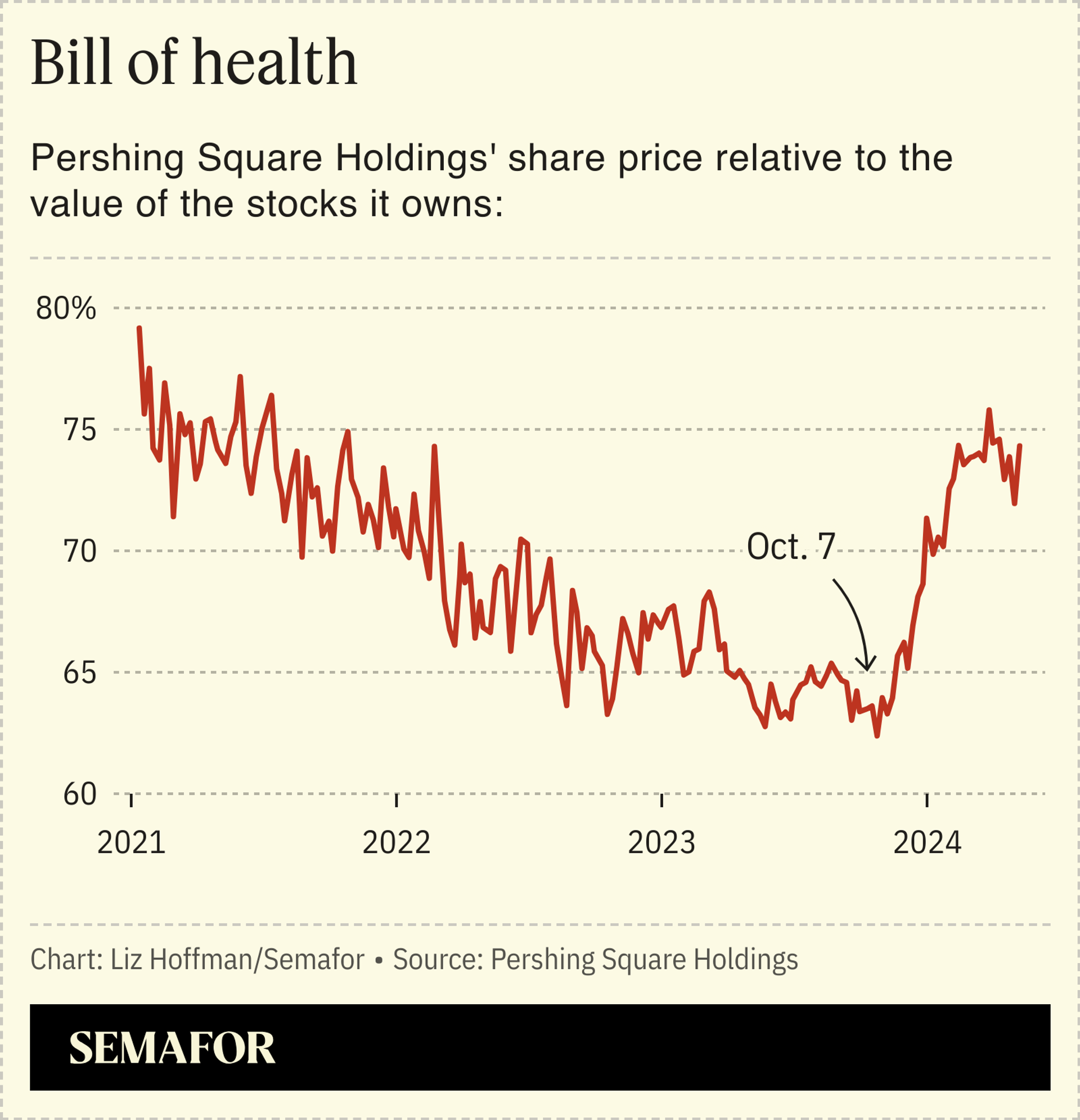

Despite posting some of the industry’s best returns, Pershing Square traded at a steep discount to the price of the stocks it owned, a gap that was only partly explained by the hefty fees it charges. It basically boiled down to a “lack of trust in Ackman” and worries that he’d pull “another Valeant,” one investor wrote, a disastrous investment that lost $4 billion and forced Ackman to publicly apologize to his investors.

“Great story Bill, how about the massive discount on PSH? Seriously frustrating,” one investor responded to an Ackman tweet last year bragging about a recent tennis win. In 2017, activist hedge fund Elliott bought a chunk of Pershing’s shares and tried to pressure Ackman to liquidate it. To fend off the attack, Ackman personally borrowed $300 million from JPMorgan and bought control of the fund, he said on Lex Fridman’s podcast in February.

The gap between Pershing Square’s stock price and the value of its investment portfolio bottomed out at around 35% in September. It began narrowing when Ackman started publicly attacking university presidents at Harvard, his alma mater, and MIT, where his wife works. Today it’s 25%, worth more than $1 billion in market value.

In this article:

Liz’s view

Ackman broke out his own activist playbook to close the gap. Pershing Square bought back stock, joined the FTSE 100, and started paying a dividend. It turned out all he needed to do was open his mouth.

As the meme-stock craze proved, fanboys can prop whole businesses up. Elon Musk’s true believers kept Tesla afloat for years. And the place where Ackman has done most of his recent ranting — Musk’s X platform — is a true amen chorus for the kind of grievance-tinged politics that Ackman has embraced.

European rules prevent Ackman from saying much publicly about his fund (a spokesman declined to comment for this story) but that’s about to change. He’s launching a US version that he has hinted could raise $10 billion or more. US rules are stricter in some ways than in Europe — he can’t charge performance fees or borrow as freely — but laxer in one important way: Ackman can talk.

Documents for the new fund say Ackman intends to use his X account to talk about investments “as well as his views on macroeconomic, geopolitical and other developments.” If those views were worth $1 billion to a mostly unknown and unloved Amsterdam-listed fund, imagine what they’d be worth to madding crowds in America.

Much of the attention on the vocal new ultra-rich has been on “how loud billionaires convert their wealth into power,” as a recent New York Times op-ed headline put it. The trade works the other way, too.

Room for Disagreement

The market hasn’t rewarded left-leaning investors the same way. BlackRock has retreated from a progressive boardroom agenda of climate change, diversity, and corporate do-goodery. “Speak softly and invest money,” executive Mark Wiedman told me last year, when I asked what the money-management giant had learned from its turn through the political wringer.

Notable

- “Vast wealth uniquely insulates the rich from the consequences of their speech,” Bill Cohan writes for the Times. “All gas, no brakes.”