The Scoop

ALTÉRRA, the UAE’s $30 billion climate-focused fund, has attracted global fund managers to finance green projects in developing countries by capping its own returns on risky investments, the fund’s CEO told Semafor.

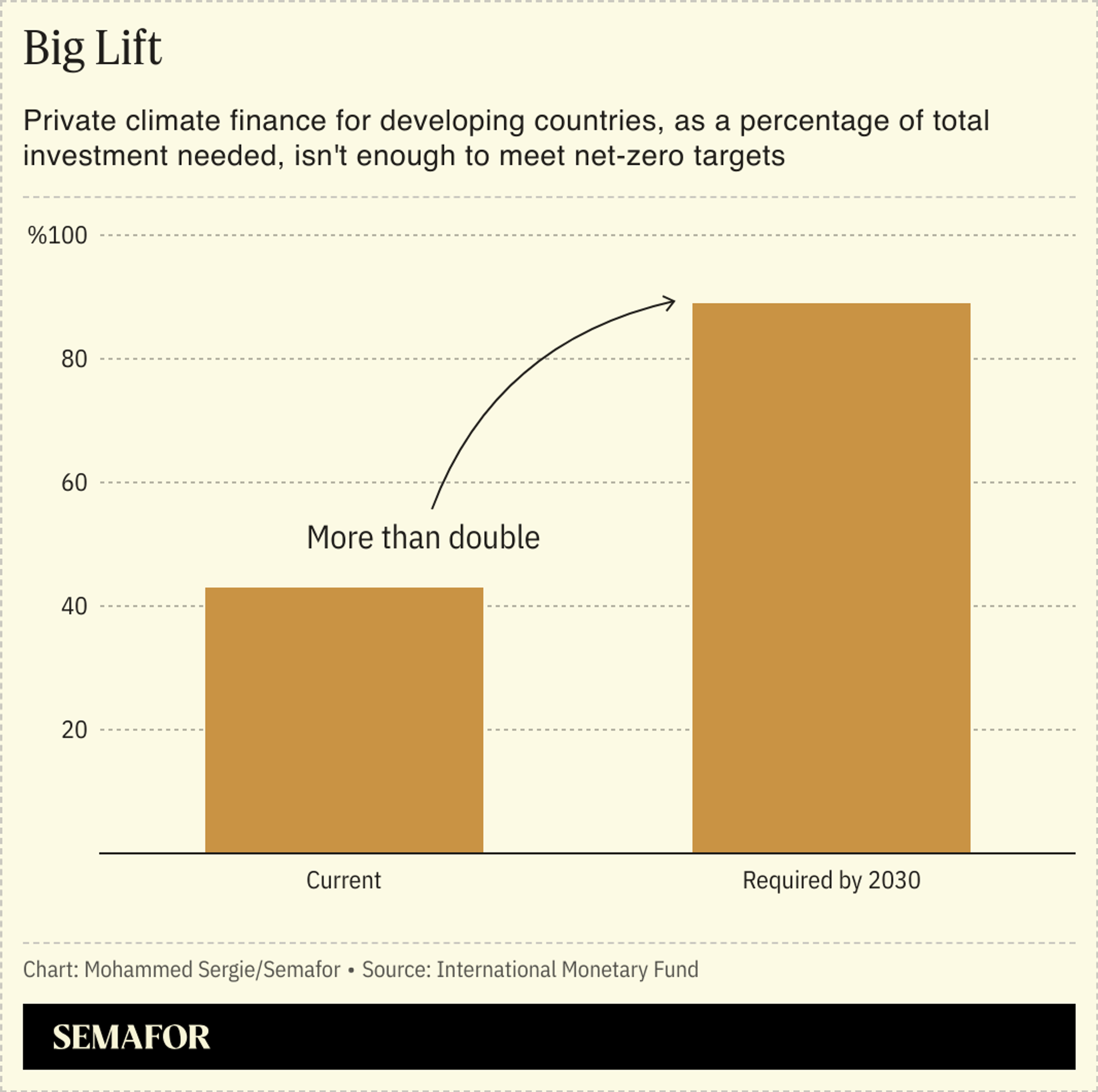

The strategy underlines a mammoth challenge in the world of climate finance: There isn’t enough money, and what little there is stays in the rich world, loath to take on the risks — real or perceived — presented by poorer countries. Capital that’s managed by banks, infrastructure funds, and other private investors covers less than half of the financing needed for climate mitigation projects in developing countries excluding China, according to the IMF. Political and economic risk, low returns (at least in relation to the apparent challenges), and high costs are usually blamed for the shortfall.

But Abu Dhabi is more confident, building on experience providing loans and grants to an array of developing markets and investing through its renewable energy firm Masdar. And now it’s putting its money where its mouth is in apparently riskier places on a bigger scale.

“We are developing an innovative concept,” Majid Al-Suwaidi, CEO of ALTÉRRA and COP28 director-general, said in the interview in his office overlooking the emergent Guggenheim Abu Dhabi. “We have different arrangements, some with strict caps on return and others based on a ‘first in, capped out’ model which is totally new. We’ve seeded some funds using these mechanisms, and they’ve been able to raise capital against it.”

Al-Suwaidi didn’t disclose how much the UAE was willing to give up in terms of returns, or where it had set its cap. Some asset managers who aren’t active in climate finance have held discussions with ALTÉRRA, he said, an encouraging sign that the fund’s efforts may unlock new sources of capital for developing economies which most need the funding.

In this article:

Mohammed’s view

Fund managers flocking to the UAE, which styles itself as the ‘Capital of Capital,’ isn’t news. This hybrid approach — combining a variant of concessional capital with cold, hard returns from the same investor — is. Abu Dhabi usually leverages its wealth to extract concessions from Western asset managers, and doesn’t give up points.

Al-Suwaidi’s strategy reflects a noticeable shift in attitudes toward climate issues over the past 15 years in the UAE, which is increasingly prioritizing investments in clean energy and other sectors vital to the energy transition. Green initiatives are constantly promoted here, and high electricity prices — subsidies were lifted years ago — have even forced a wealthy couple I visited recently who live in a $5 million mansion to use their AC more sparingly.

Critics say Emirati spending on clean tech and the energy transition — exemplified by Dubai’s ostentatious hosting of COP28 last year — amounts to little more than greenwashing, which isn’t a hard accusation to make against a country that built its wealth on fossil fuels. The UAE, and Gulf countries more broadly, have massive per-capita carbon footprints, with indoor ski slopes and multiple gas-guzzling cars for every household. The question is whether the region is responsible only for the emissions in its territory, or the fuel being burned by its customers around the world.

If it’s the latter, then there’s nothing large oil producers can do to escape the label. But the many gigawatts of solar power in the UAE and the country’s billions of dollars of investments in renewable energy — in developed and emerging markets — are tangible contributions to reducing emissions. The plan Al-Suwaidi outlined to us involves giving up actual profits in the hope of raising more capital to fund the energy transition for countries most vulnerable to climate change’s impacts.

It’s not a leap to think that these efforts by Abu Dhabi could hugely juice climate financing needs.

Room for Disagreement

ALTÉRRA’s plan is ambitious, but even if it can elicit a tenfold match of its commitment by 2030 — an enormous success — the $50 billion the fund would have generated pales in comparison to the trillions needed every year for clean energy investments to achieve global net-zero targets. Many other countries will have to step up, and even that still may not be enough. This is why critics of a market solution to climate change, like BlackRock’s former chief investment officer for sustainable investing, argue that governments must change the rules to accelerate the energy transition and implement a global carbon tax.

And though ALTÉRRA’s fund is climate-focused, it is not fossil fuel-free: At least one of its funds managed by BlackRock is invested in a natural gas pipeline, according to Climate Home News: Though natural gas is a fossil fuel and investments in it draw activists’ ire, many businesses and governments have continued to invest in it, particularly in cases where it displaces coal, a far dirtier source of energy.

Know More

ALTÉRRA operates as a fund of funds and committed $6.5 billion — out of an overall portfolio of $30 billion — to BlackRock, TPG, and Brookfield Asset Management during COP28 in Dubai last year. The Emirati firm operates a $25 billion fund that invests in traditional climate funds, and a $5 billion transformation unit, the one Al-Suwaidi referenced, which aims to drive capital to the Global South.

It is also considering direct and co-investments, Al-Suwaidi said, and expects to announce new deals soon. “Our most important goal is to mobilize $250 billion by 2030, so we need to deploy capital at scale,” he said.

Much of its own investment will be directed toward clean energy, one of ALTÉRRA’s focuses. The fund’s other targets are sustainable living — which includes adaptation technologies in agriculture and water management — as well as industrial decarbonization, and other climate technologies. The fund is also exploring opportunities in sectors like artificial intelligence, both to make sure the technology is run on clean energy and to use it to improve efficiency, Al-Suwaidi said. Carbon tracking, smart metering, and the development of new materials and battery technologies are also on his radar.

“We are committed to investing across all of our mandated pillars, but of course there are more projects and opportunities in the clean energy space,” Al-Suwaidi said.