The Scene

Semafor Business’ signature interview series, On The Record, brings you conversations with the people running, shaping, and changing our economy. Read earlier conversations with Mattel CEO Ynon Kreiz and THL CEO Scott Sperling.

“On Wall Street, self-pity, like lunch, is for wimps.” That’s Alok Sama, describing in a memoir out this week his mindset as a Morgan Stanley investment banker approaching mid-career burnout in 2014, when a chance encounter changed his course: At a wedding in Italy, he spotted “an Asian gentleman, elegantly attired in a white lounge suit, standing slightly removed from the others” and with “the wizened appearance of Yoda.”

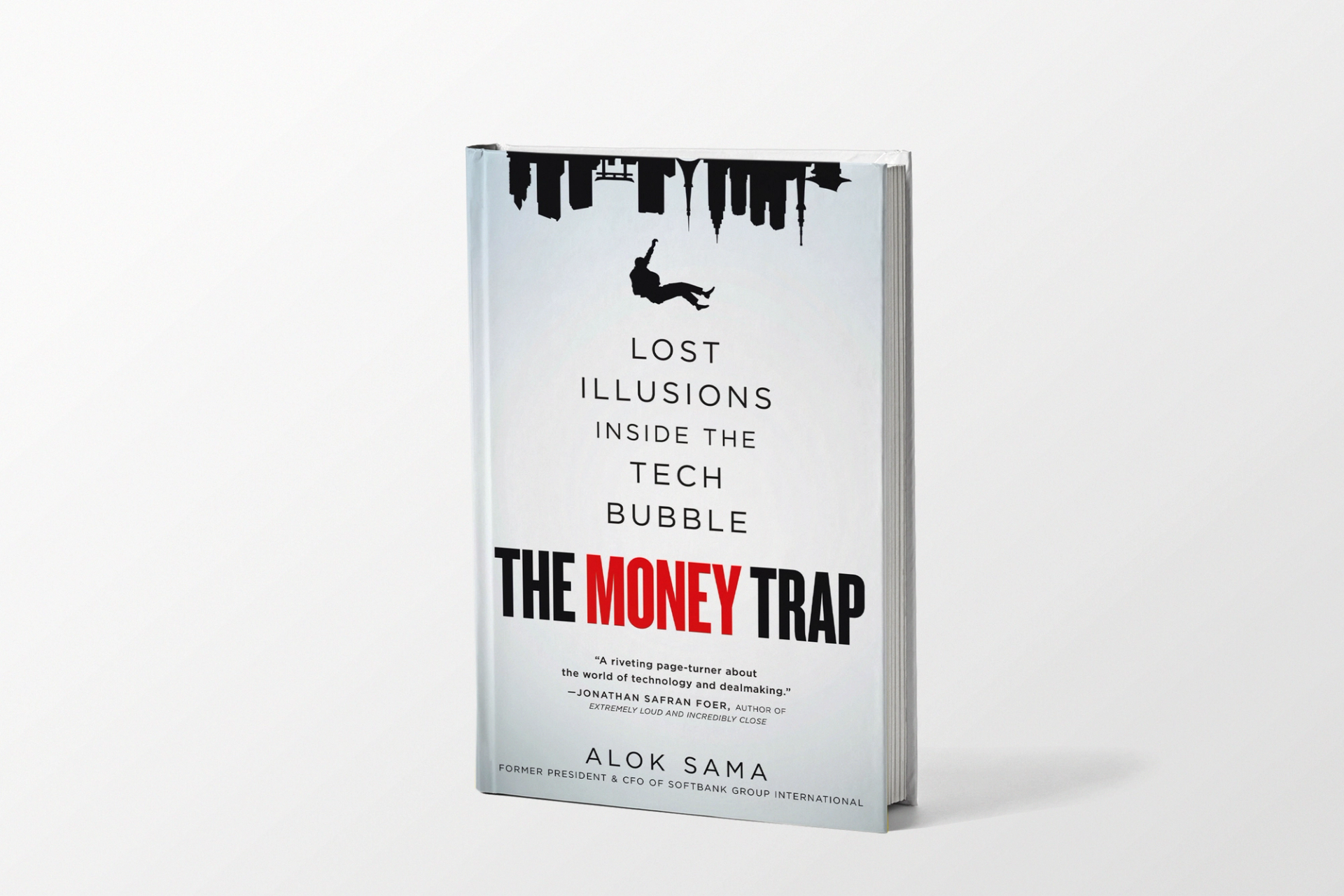

It was Masayoshi Son, the head of SoftBank, and Sama soon joined the firm as its chief financial officer. What follows is the subject of Sama’s The Money Trap: Lost Illusions Inside the Tech Bubble, which tells the story from his seat as Son took SoftBank from a midtier telecom provider to Silicon Valley kingmaker. Its $100 billion Vision Fund — much of it gathered from Gulf governments eager to make their name on the global stage — pumped up startups around the world. Some succeeded because of SoftBank’s largesse, like ByteDance and Coupang. Some succeeded in spite of it, like Uber. Many failed. Losses to date from the Vision Fund and a successor launched in 2019 stand at $2.6 billion, according to Pitchbook.

Sama writes charitably about the cast of characters around Son: Nikesh Arora, the “prince” in Son’s ear; Ron Fisher, the “vizier” and venture-capital veteran; Simon Robey, the London investment banker whom Son called “Sir Suspenders” after his knighting; Rajeev Misra, the barefoot, vaping “alchemist” whose eccentricity Sama, if anything, undersells.

There are some delightful nuggets, like the tale Mark Zuckerberg recounted over a dinner in Tokyo, during his year of living carnivorously, about shooting a bison and having the head stuffed and placed in then-Meta COO Sheryl Sandberg’s office. There are the references, requisite in finance memoirs, to fast cars, expensive wines, and acid trips in Ibiza.

Sama, who is now an advisor to private-equity firm Warburg Pincus, notes — accurately, as I recall from my reporting at the time — his growing unease with the risks SoftBank was taking, in particular its enabling of Adam Neumann, WeWork’s impresario founder. But he doesn’t cast himself as the voice of sanity getting shouted down. He revels in the financial engineering that he brought to the party, and more than once expresses his admiration for “the master of debt,” Michael Milken, whom he first meets as a young MBA student at Wharton and again 30 years later, when the rehabilitated junk-bond king proposes a debt swap to help alleviate Sprint’s financial woes.

“I never learn, and neither will the rock star hedge fund managers,” he writes, “because when it comes to irrational exuberance, we are no better than Uber drivers punting on Tesla stock.”

One of the only times he directly questioned SoftBank’s dealmaking, Son told him: “In every family there are hunters and cooks. We need the cook, he is important. But for me, the hunter is the most important.” In the end, Sama was a cook, and he left SoftBank in 2019. Son is still hunting, returning to his first love: AI.

This conversation has been edited and condensed for length and clarity.

The View From Alok Sama

Liz Hoffman: You write pretty cynically about Silicon Valley and Wall Street. But you’re reverent about Masayoshi Son. How do you square that, given that he’s such a product of both?

Alok Sama: I see Masa as being above that. For him, it’s less about the ‘what’s my bonus? How much money am I making?’ He invests in things he thinks will change the world for the better. I don’t think Zuck is doing anything that’s good for the world. I don’t think social media is good for the world. Musk, I used to be a fan, but him wading into politics … I mean, come on. Masa is not like that. He’s a genuine visionary, and the track record is there. People talk too much about WeWork and not enough about ARM.

Was the Vision Fund a mistake?

It certainly was huge. It was ambitious. It was based on Masa’s vision of how AI might transform the world. And I think he struggled to find, obviously, more bets like Nvidia and ARM. I don’t believe it was a disaster. I think what has followed — you know, Tiger Global and others — I think that’s when people got carried away.

You were there in 2016 when Saudi Arabia and the UAE were pouring money into the tech scene. What’s changed in the region since then?

Their challenge is to get people to really invest in technology in the region. My sense is that most people are still running over there to get capital. That’s going to become a little bit tougher when [Gulf governments] discover that they’re not necessarily getting the inward commitments that they’re looking for.

You were a tech investment banker at Morgan Stanley when the dot-com bubble burst. Is AI overhyped today?

Nvidia is not outrageously valued. You can compare it to Cisco, which provided the plumbing for the internet. Nvidia is doing the plumbing for the hyperscalers bringing up these massive data centers. Cisco, in 2000, was valued at 200 times earnings. Nvidia trades between 35 and 40 times forward earnings, which is just not outrageous for a company with 75% margins and growing as fast as it is. And the big investments that Microsoft and Google and Facebook are making — it’s a monumental number, but if they’re overinvested $15 billion here or there, that’s money they can afford to lose. Investors won’t get hurt in the same fashion.

Where things are a little bit different is the private market. I look at OpenAI being valued at $150 billion and I scratch my head. Look who’s invested; it’s Microsoft and [reportedly] Nvidia. Well, money goes into OpenAI, which buys capacity on Microsoft Cloud, and Microsoft uses capital to buy Nvidia chips. It’s a little bit circular. And I’m not suggesting OpenAI isn’t worth a lot, but they’re losing money. The jury is out as to whether it will be as scalable with the same platform effects as Google once had.

Toward the end of the book, you tell Masa that if he wants to bet on AI, just bet on Google and Microsoft, because they’re going to end up being the big beneficiaries. Is that where we are today?

I actually took that line from [investor] Yuri Milner. Back in 2016, I asked him, ’Why aren’t you thinking about AI as the next big thing? Why are you talking about food delivery?’ which he was really into at the time. His answer was that the big chunk of the value creation from AI is going to be captured by the biggest companies, so why waste time.

Toward the end of your time at SoftBank, you express some concern about the risks and the leverage. Is there anything you’d have done differently?

A lot of people ask me, ’why didn’t you stop him?’ And my response is, ‘if you listen to people like me, do you think he would have done Alibaba?’ And I would have been wrong. The big ones, he gets spectacularly right.