The News

China’s leaders vowed to steady the country’s stumbling housing market with new financial support and controls.

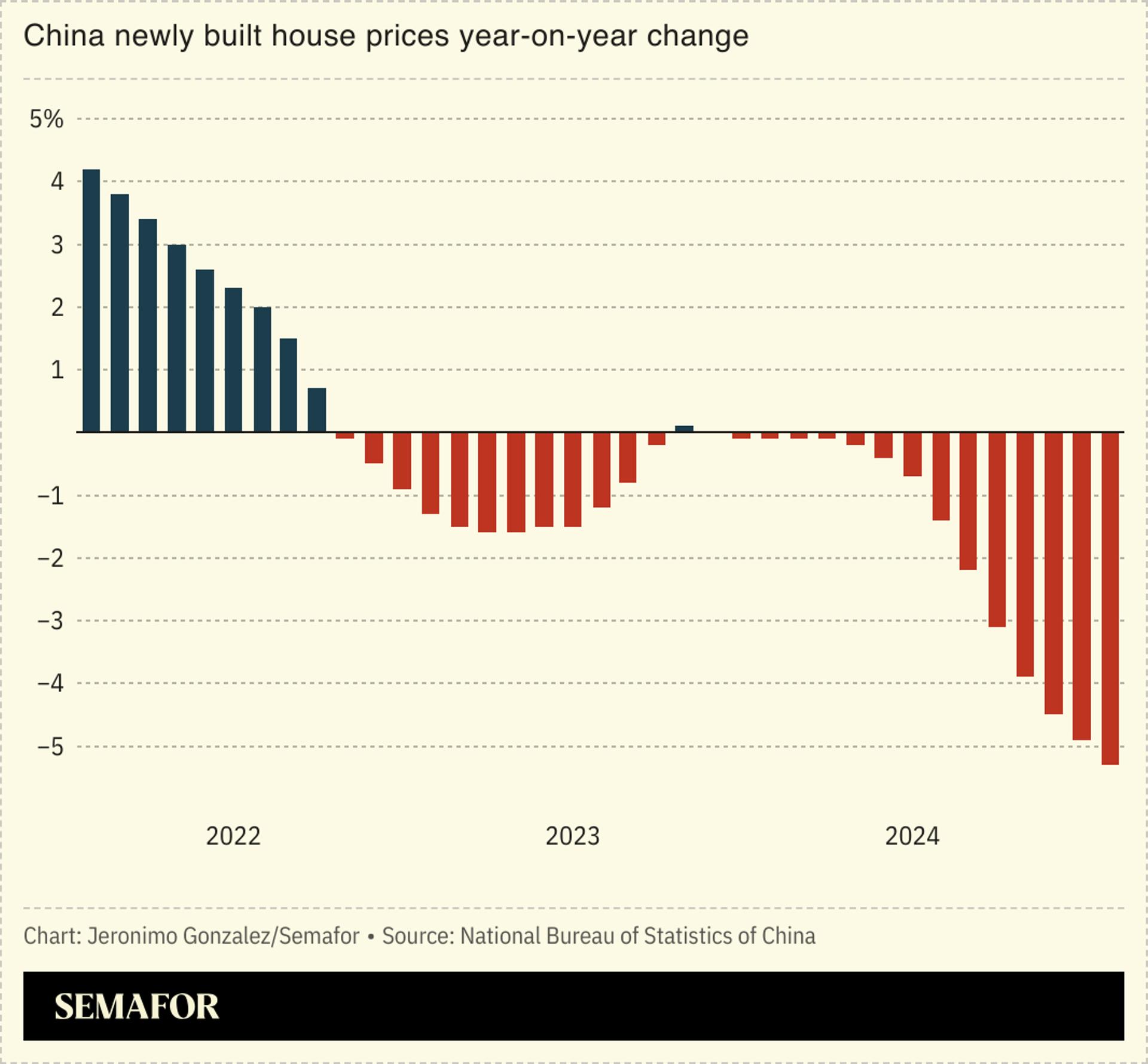

Much of ordinary Chinese people’s investments are tied up in property but a protracted real-estate crisis has reduced household wealth by $18 trillion, leading to a spending collapse and worries of deflation.

Chinese leader Xi Jinping and top officials did not give specifics on the size of the fiscal stimulus but property developers’ stocks went up 9.6% on the news.

Separately, the country plans to issue special sovereign bonds worth $284.43 billion this year, two sources with knowledge of the matter told Reuters.

SIGNALS

The announcement reflects leaders’ urgency, but underlying problems remain

Politburo announcements tend to be vague and sweeping, but this one was notably detailed — which perhaps suggests a “sense of urgency” on the part of policymakers, an expert in Chinese economics told Bloomberg. This is a stopgap measure that won’t fix China’s underlying problems with investment returns and consumer confidence, but implementing more potentially promising steps like wage increases or expanding welfare provisions would “give today’s freewheeling Chinese Communist Party sleepless nights,” another told Time.

There’s likely much more to come

China’s government still hasn’t reached its “whatever it takes” moment, and more intervention is likely to emerge in later months, the Financial Times noted: The announcement amounts to less than the fiscal “bazooka” unleashed during past crises, even as its now much larger GDP demands more resources to reflate, economists said. Turning China’s trajectory around requires more money, a more focused policy response, and unleashing the private sector, the outlet argued in an editorial.