| | Diverting more corn to make airline fuel could have climate consequences.͏ ͏ ͏ ͏ ͏ ͏ |

- Corn takes flight

- Tesla swerves

- Newest oil exporter

- Kicking coal

- Cattle crusade

Kids take on Wall Street, and California retirees take on their carbon footprint. |

|

Biden’s clean aviation rules are really a gamble on EVs |

| |  | Tim McDonnell |

| |

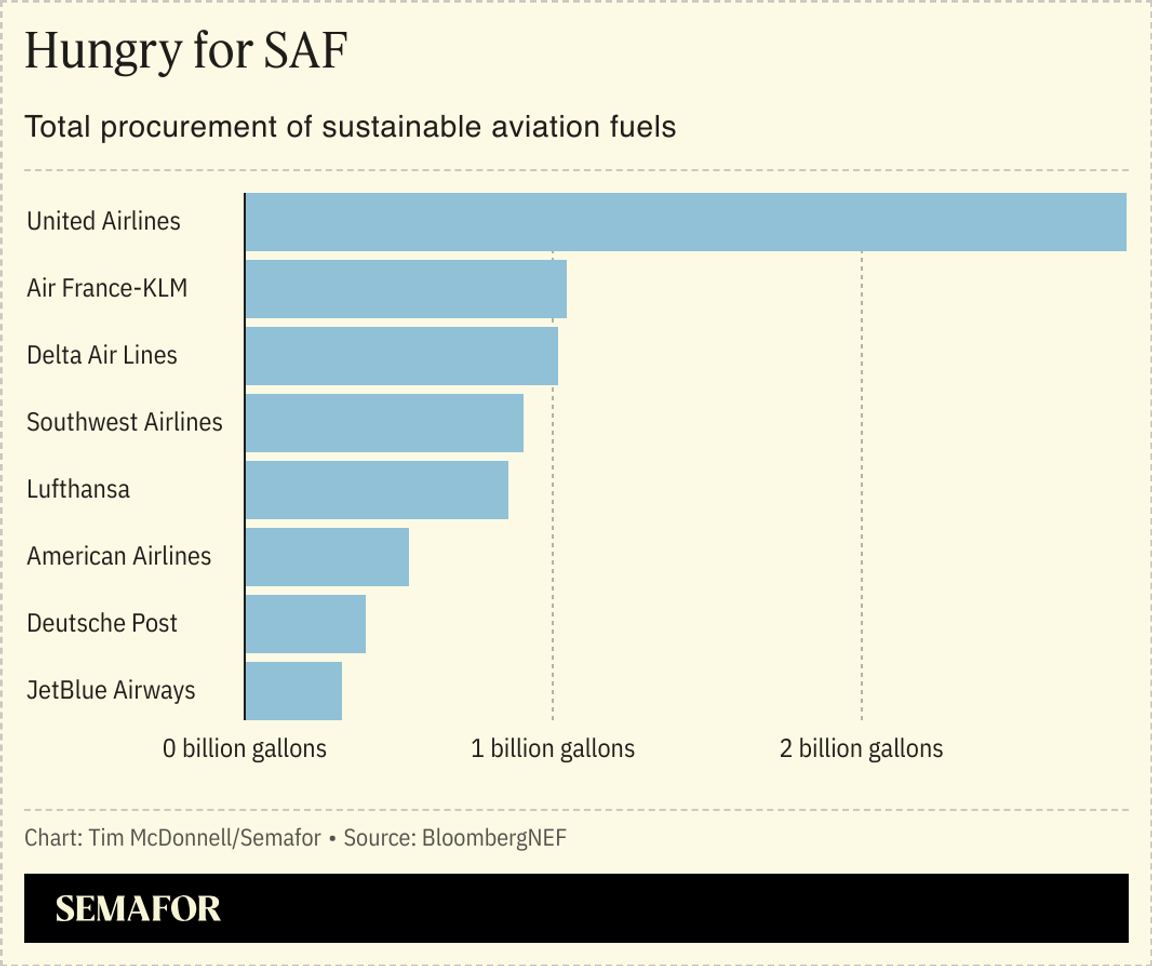

The Biden administration released new guidelines Tuesday on Inflation Reduction Act tax credits for the production of low-carbon aviation fuel, handing a win to the farming and airline industries but opening a rift with environmental groups.  The new rules effectively allow much more corn-based ethanol to qualify as a sustainable aviation fuel (SAF), which the European Union, for example, does not allow. They could help spark investment into SAF production facilities that have been stalled up to now. The Biden administration’s goal is to increase SAF output 20-fold by 2030 to an equivalent of 10% of current US aviation fuel demand. Corn will have to be a major contributor to the SAF supply — alongside waste oil, captured CO2, and other feedstocks — if the airline industry is to have any hope of reaching that goal, United Airlines’ chief sustainability officer Lauren Riley told Semafor. “It will be hard to get to those volumes based on the pace of change that we’re seeing,” Riley said. “That’s why clear guidance on [the SAF tax credit] is really important, so that we can determine what to do in the few years we have left.” It’s not too surprising that the US would take a relatively permissive approach to SAF carbon accounting, given the powerful political influence of Big Corn. But with these rules, the administration has set a challenge to the ethanol industry: to pivot to a new, sorely needed role in the energy transition without actually increasing its environmental impact. At the same time, by agreeing to subsidize corn for SAF, Biden is essentially doubling down his bet on electric vehicles, since the extent to which corn-based SAF becomes a climate hazard is closely linked to how quickly EVs can displace demand for gasoline. |

|

Estimated profits from Tesla’s global EV charging network, the world’s largest, by 2030, before the company let go of its entire Supercharger division on Tuesday. The fresh round of layoffs came as a surprise to many Tesla-watchers, given how successful the division had been. Tesla’s charging design is now the industry standard, with most of its competitors following suit and essentially ceding competition in the EV charging market. Tesla “still plans to grow the Supercharger network, just at a slower pace for new locations,” CEO Elon Musk tweeted. But the pullback looks like an early sign of the company’s recalibration to focus more on AI and autonomous driving, a change Musk highlighted in the company’s earnings report last week. |

|

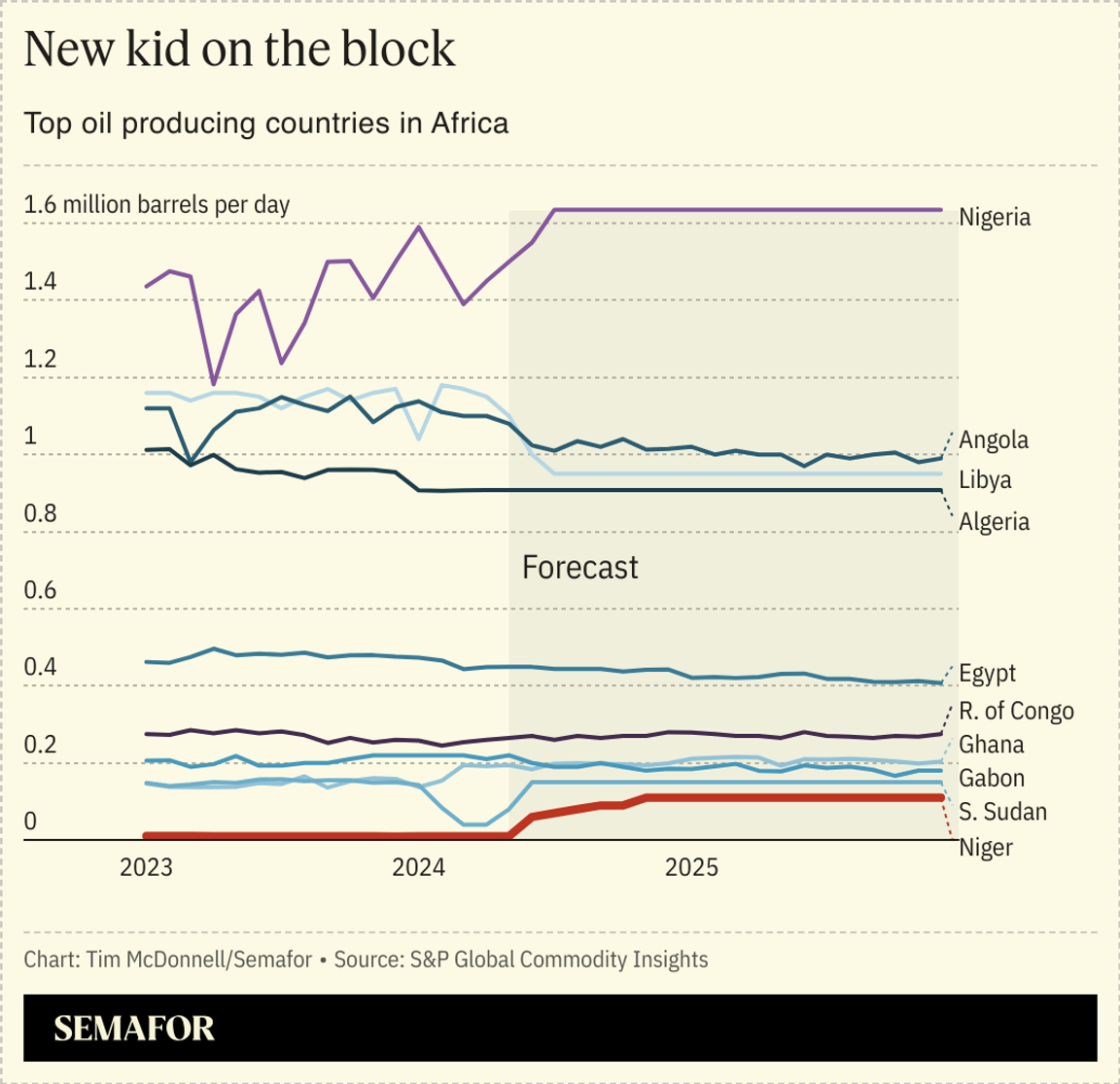

Niger is set to become the world’s newest oil-exporting country.  Oil is flowing through a new 1,200-mile pipeline from drilling fields in Niger to storage tanks on the coast of Benin, with the first offloading into ships expected “any day now,” said Jim Burkhard, vice president and head of oil markets research at S&P Global Commodity Insights. The pipeline was built and will be operated by China’s National Petroleum Corporation, and most of the oil will go to China, in a $400 million prepayment deal that’s a lifeline for Niger’s military regime. Until now, Niger has produced about 20,000 barrels of oil per day for domestic consumption, a pittance next to neighboring Nigeria’s 1.4 million. Once exports commence, Burkhard said they’ll average 80,000 to 100,000 barrels per day, and will cement West Africa as a top emergent oil hub, as Senegal is also expected to begin exports this year. “This is a big prize for a country like Niger,” Burkhard said. |

|

| |  | Helen Li |

| |

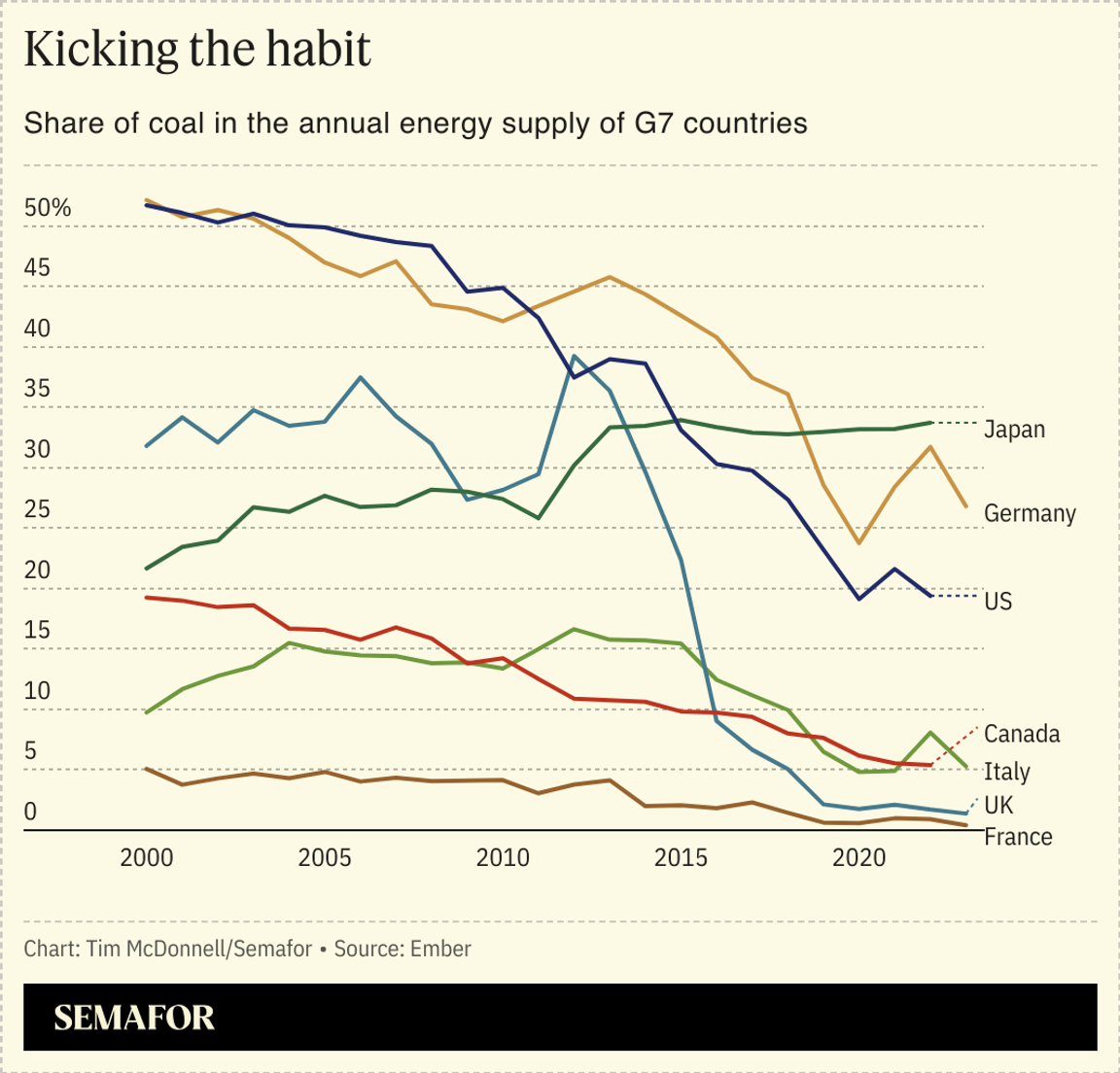

G7 energy ministers reached a tentative agreement to shut down all of their respective coal-powered plants by 2035.  The deal marks a significant step for wealthier nations to transition away from fossil fuels. Italy leads the fossil fuel phaseout, producing about 5% of its electricity from coal, while Japan and Germany use around 25%. The coal target comes on the heels of new US EPA regulations that would force coal plants to cut or capture 90% of carbon emissions, or risk being shut down. However, the G7’s potential “trickle down effect” for other G20 nations could be met with resistance, as developing nations like India argue that carbon emission caps stifle critical infrastructure growth. |

|

Goldman Environmental Prize Goldman Environmental PrizeThe world’s biggest beef companies aren’t doing enough to crack down on Amazon deforestation in their supply chains, the new winner of the top prize for environmental activism told Semafor. Marcel Gomes, a Brazilian investigative journalist and activist, was among seven winners this week of the Goldman Environmental Prize, sometimes called the “green Nobel,” and whose former winners include future Nobel laureates and heads of state. Gomes was recognized for his work tracing illegal deforestation and labor abuses, including slavery, from remote farms in Brazil through to beef processing companies like JBS and to grocery retailers in Europe, some of which suspended their business with JBS as a result. The work involved parsing a mountain of export certifications, environmental citations for ranches, and other public data, with members of his team sometimes detained for days at a time by local police hired by ranchers as private security. “[Livestock] is a super politically powerful industry in Brazil,” he said. Scrutiny of shady business dealings in the Amazon is intensifying ahead of the COP30 summit there next year. Brazil’s environment minister, Marina Silva, is herself a former Goldman Prize winner. But the government needs to intervene more forcefully to curb cattle-related deforestation in overlooked landscapes like the Cerrado and Pantanal, Gomes said. And livestock companies — as well as the garment industry, automakers, and biofuel producers, all of which rely on Amazon-raised cows — need to be more vigilant about their cattle sources. “They’re promising net zero, and there are some improvements, but it’s completely not enough. We need them to do much more.” |

|

New Energy- The US is clawing back control of polysilicon, a key ingredient for solar panels, from the Chinese manufacturers that dominate its global supply chain. REC Silicon is planning its first shipments of polysilicon from a reopened factory in Washington.

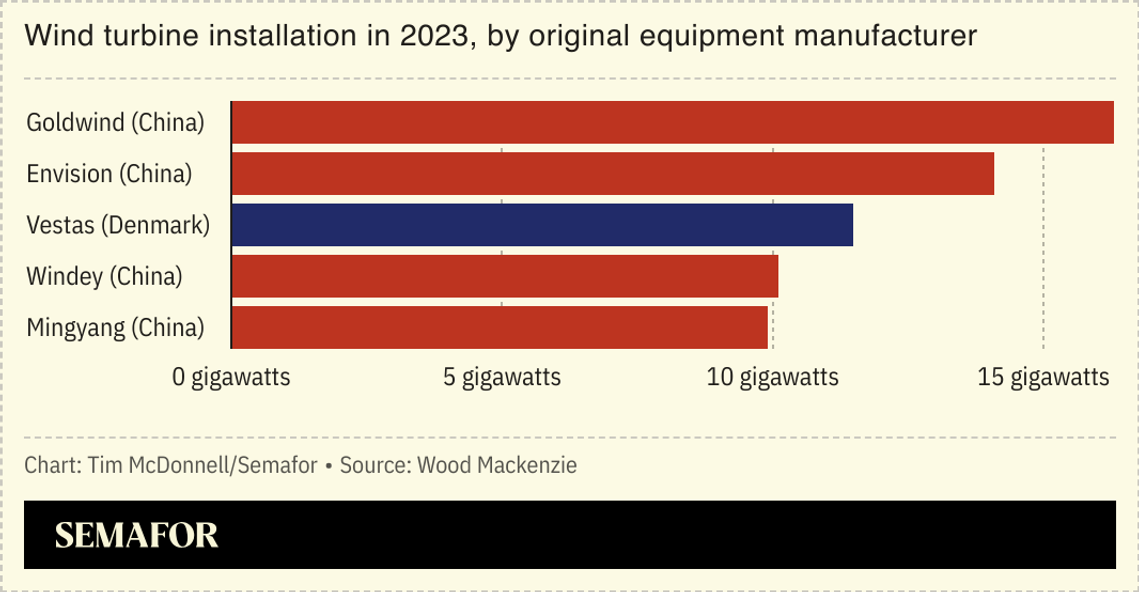

- But China is widening its lead in wind turbine installation, with Chinese manufacturers claiming four of the top five spots in 2023 for the first time.

- The US solar hardware manufacturer Nextracker doubled the capacity of its production line in Pennsylvania, a promising signal for domestic solar companies that have been struggling with intense competition from China.

Fossil FuelsFinanceTech- Frontier, a group of tech and finance companies pooling resources to buy carbon removal credits, signed its biggest deal yet, a commitment to buy $58.3 million for credits from the biomass sequestration startup Vaulted Deep.

- Climate tech investors aren’t sold on AI.

Mining & MineralsPersonnel |

|

Avery, 14, led a climate protest for kids outside Citi’s annual meeting in New York on Tuesday.  |

|

| |