The Facts

The economy is starting off 2023 just as strangely as it ended 2022. Big companies continue to announce layoffs, but job openings remain stubbornly high across the world. The dollar is retreating. You can’t turn around on Wall Street without hearing executives talk about how healthy consumers are, while at the same time packing financial sandbags around their own firms.

To help make sense of it all, I called Jason Furman, who spent eight years as a top economic adviser to Barack Obama and now teaches at Harvard’s Kennedy School. Here’s our chat, condensed and edited.

Q: Did the Fed blow it?

A: Given the pandemic and the fiscal response, I’m not sure there’s anything the Fed could have done to prevent inflation. But they certainly didn’t give it their best try. They blew 2021. They blew the first couple of months of 2022.

But for about nine months now, I think they’ve been pretty much right in everything they’re doing. When I looked at [the Fed statement released yesterday], it was the first time in two years when I didn’t want to bang my head against the wall. But I don’t know if it’s going to be sufficient.

There needs to be some serious reflection on why everyone missed the inflation that, in some respects, should have been quite obvious was coming. Some things in the past few years were black-swan events, but some things were not seeing the swan that was sitting there right in front of us.

Q: Are you optimistic or pessimistic? Or can the economist in you make a case for both?

A: We just had two terrific inflation reports. A slowdown in the growth of [housing and rental] costs has yet to show up in the data but almost certainly will this year. Supersized interest rate increases may be behind us, and increases altogether may be behind us pretty soon.

The flip side is that historically, inflation has been very hard to wring out of the system. Labor markets remain extremely tight. Absent a weakening in the economy, the Fed will still be battling inflation over the next year, and even that may not do it.

Q: The market has consistently misjudged the Fed’s intentions, and in the FOMC minutes released yesterday, there was concern that investors would read the smaller rate hike as a sign that the Fed was giving up. The stock market isn’t the economy. So should Powell even care?

A: The Fed should care. You saw it after the September meeting, when the Fed’s statement looked a bit dovish and the market was really relieved. And then it became clear in the press conference that Jay Powell was upset about the market reaction and had wanted the market to move the opposite way. And in his Jackson Hole speech, where he deflated a couple of weeks of market exuberance.

I think the Fed’s communication has been reasonably clear about sticking to [serious rate hikes]. The market’s skepticism has so far worked out badly for those betting against their resolve.

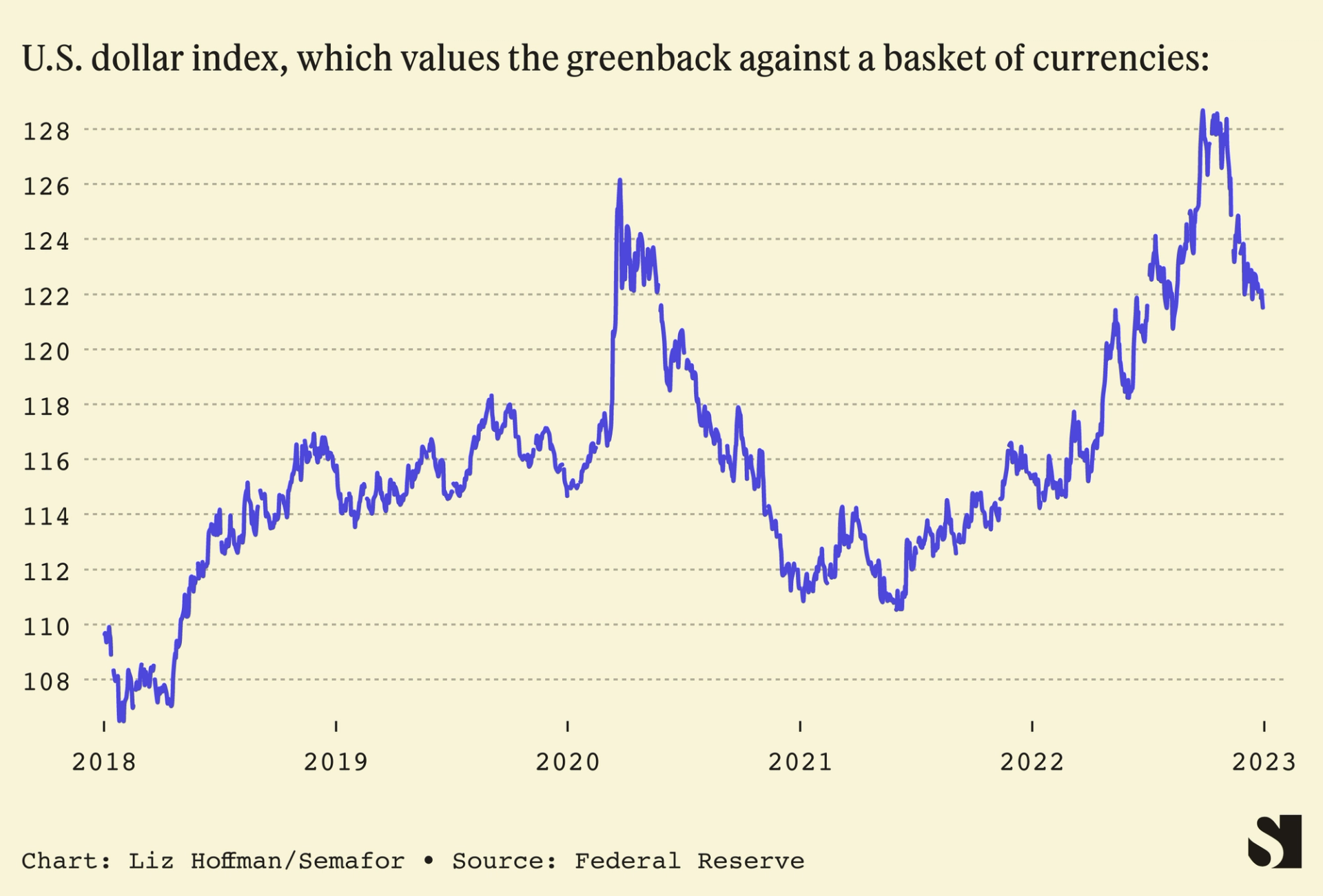

Q: The dollar was incredibly strong for most of 2022 and has fallen in the last six weeks or so. Does that complicate the Fed’s playbook?

A: It makes their job harder. The Fed is trying to slow the economy, and there are three basic ways they can do that. They can slow the housing sector with higher interest rates, they can slow manufacturing and exports with a stronger dollar [which makes it more expensive for foreigners to buy American goods], and they can slow consumer spending by lowering the stock market. The export tool has been a bit blunted lately. And so the Fed may have to go harder at the housing sector.

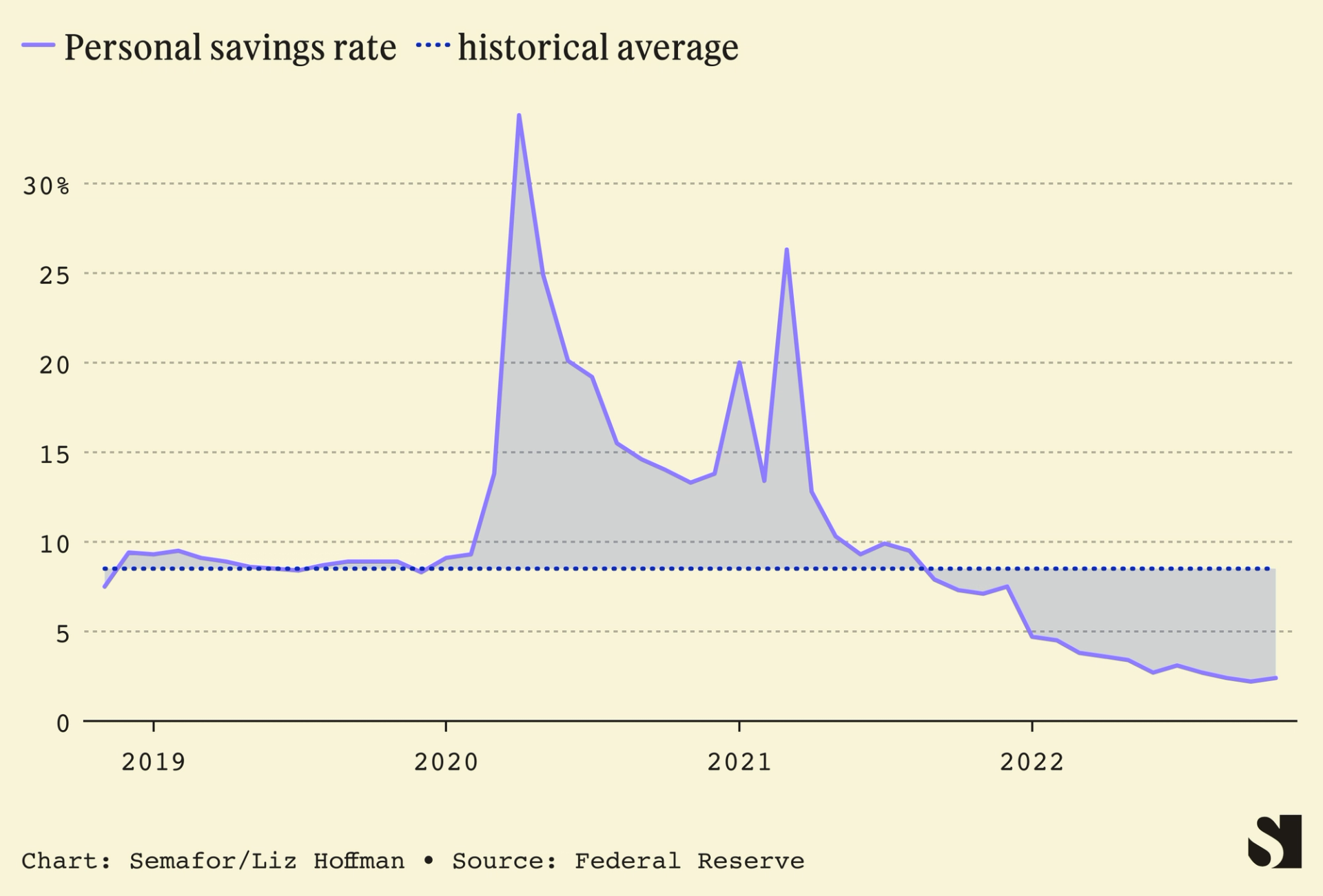

Q: Optimists keep pointing to the resiliency of the American consumer. But with inflation continuing and home prices taking a bite out of household wealth, how long can that last?

A: Consumer spending is 2.5% above what you would have expected, absent the pandemic. Income, adjusted for inflation, is about 1% below. So there’s this huge disconnect. That gap is being bridged by a savings rate that is nearly the lowest it’s ever been in American history, and that is unsustainable. People are going to run through those savings sometimes in the middle of this year, and there’s the risk of a Wile E. Coyote moment.

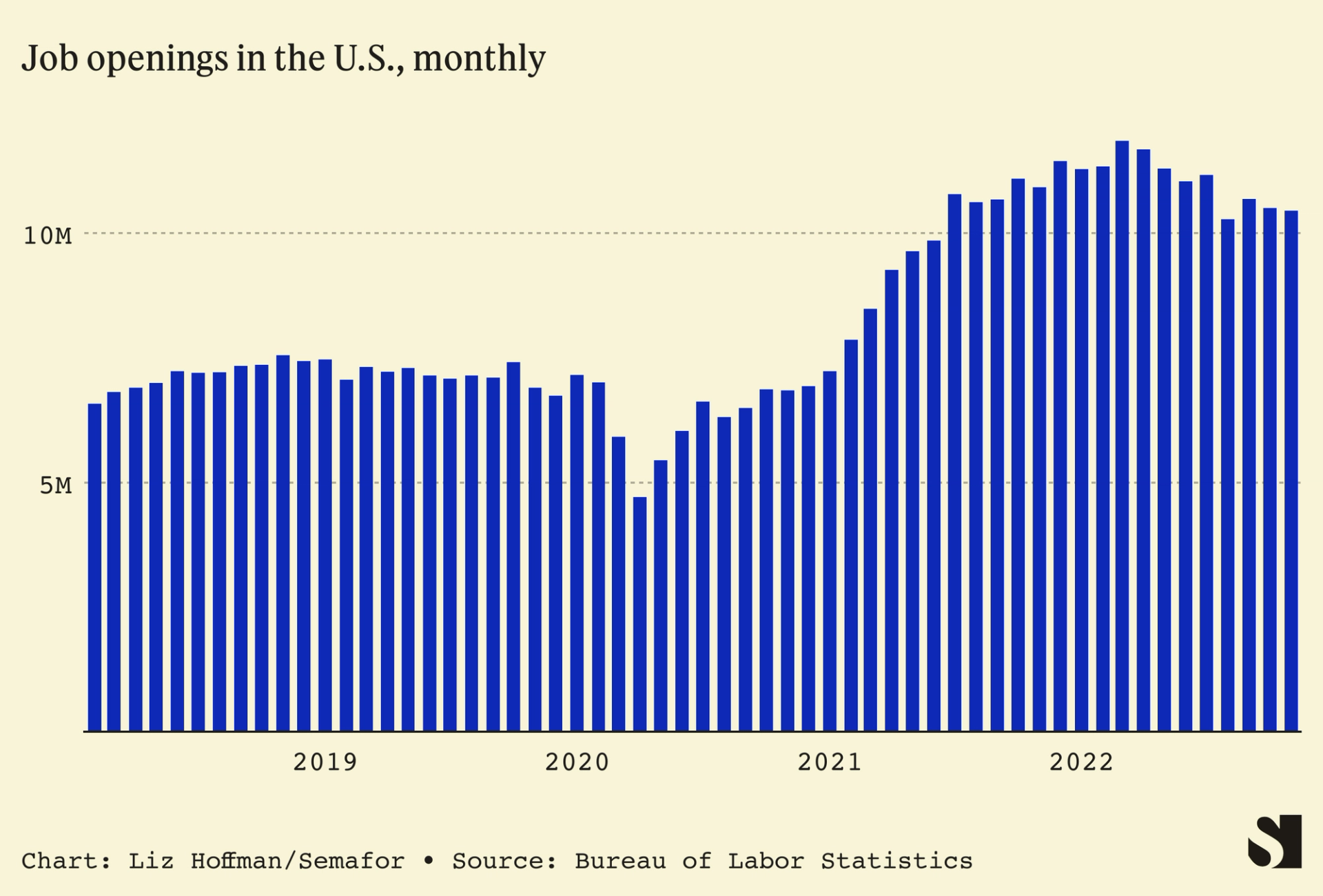

Q: Let’s talk about the job market. Corporate layoffs are making headlines, but job openings have held steady at above 10 million and wages are strong. What’s going on?

A: If you want to predict how tight the labor market is, the two best things to look at are the rate of workers quitting and the number of job openings. Those indicators looked like they were getting looser through the summer, but they’ve flatlined since then.

You can tell all the stories you want about individual companies or sectors. But as long as workers are quitting, businesses have a lot of openings, and wage growth is high, it’s going to be hard to get inflation down to anything resembling the Fed’s target.

Q: Speaking of that target, the Fed spent a decade falling short of its 2% inflation goal and now has massively overshot. When the dust settles, is that even the right number anymore?

A: When the Fed institutionalized its target in 2012, 2% was probably the right number. Since then, the Fed has twice hit the lower zero bound in responding to a recession. So if you were choosing from a blank slate, I think you’d land on something more like 3%.

But getting from here to there is really complicated. You don’t want to say ‘hey our new target is 3%’ and everyone thinks it’s really 4%. There’s a lot of credibility wrapped up in the existing target. I could see the Fed shifting to 3% without telling anyone, and not actively trying to wring inflation out of the system beyond that.

Q: If you were a Western CEO, how would you be thinking about China right now?

A: I would be diversifying out of China as much as I could. There’s still a huge benefit to being there – the Chinese market is huge and there is an enormous pool of talent – but long-term resilience is worth paying some short-run costs for. Aside from issues like the COVID surge and the property bubble, China has real structural issues, in terms of its demography, its political system, its economic slowdown. Be prepared for a world with much slower growth in China, and look to Southeast Asia and India.

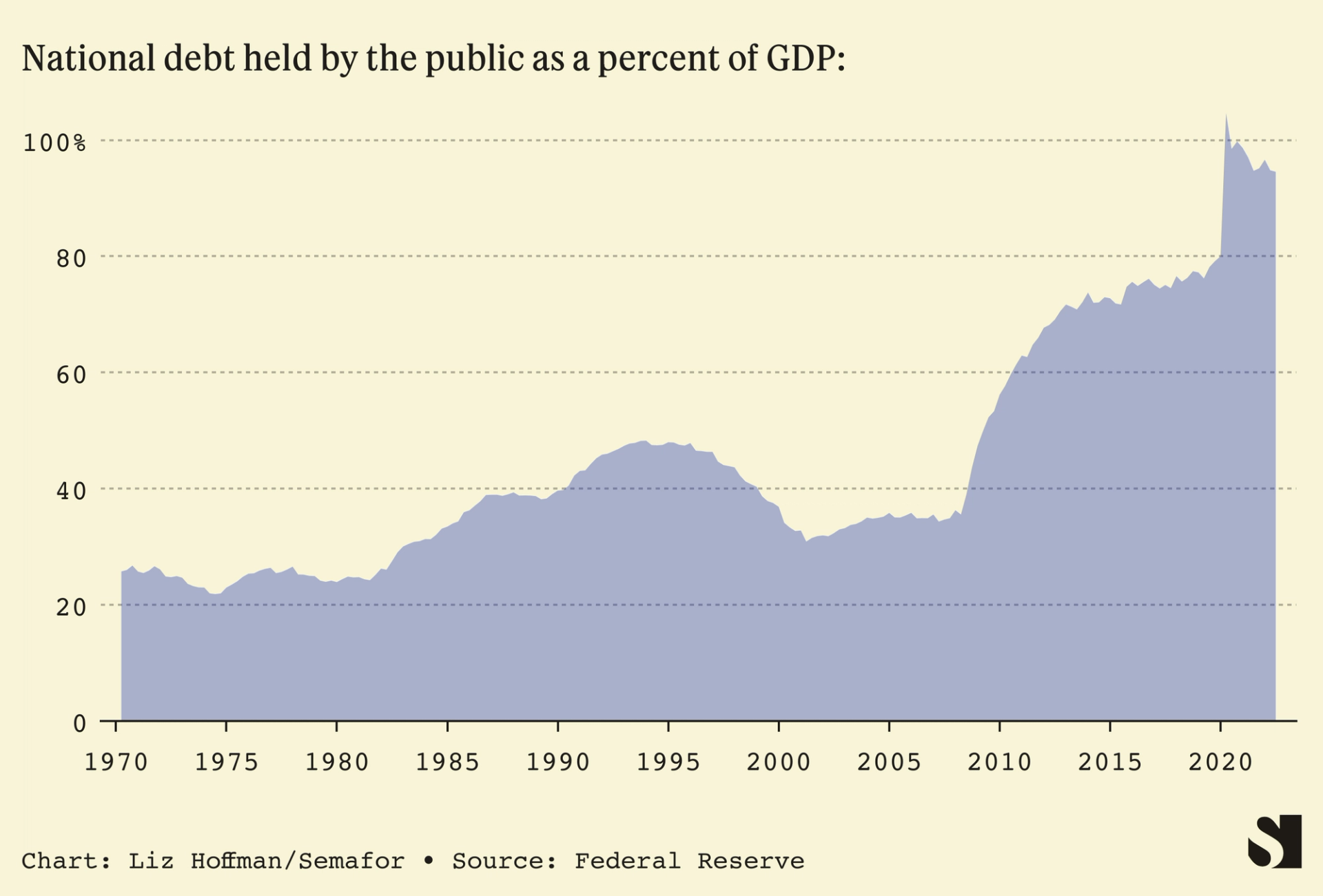

Q: Does the mess in the House this week make you worried about how a Republican majority will handle things like the debt ceiling?

A: Absolutely. That’s a really difficult thing for any Republican speaker to bring to the floor, and it will be an almost impossible thing for an incredibly weakened Kevin McCarthy or whoever else ends up getting the job. So 2011 [the last time Congress failed to raise the debt ceiling] could look like a pleasant diversion compared to what we could end up seeing this year.

Q: Scary enough to trigger another downgrade of U.S. debt?

A: That’s not what worries me. If the United States were to prioritize payments, shifting to paying some bills and not others, our interest rates could go up quite a lot. Look at what happened in the U.K. Just the perception of economic mismanagement can be really costly.