The News

The four fires raging across Los Angeles could cost insurers as much as $20 billion in losses, JPMorgan said this morning, more than double an earlier estimate.

That comes as those companies are still rebuilding their reserves from the 2017 and 2018 wildfire seasons, which included the deadly Camp Fire in California.

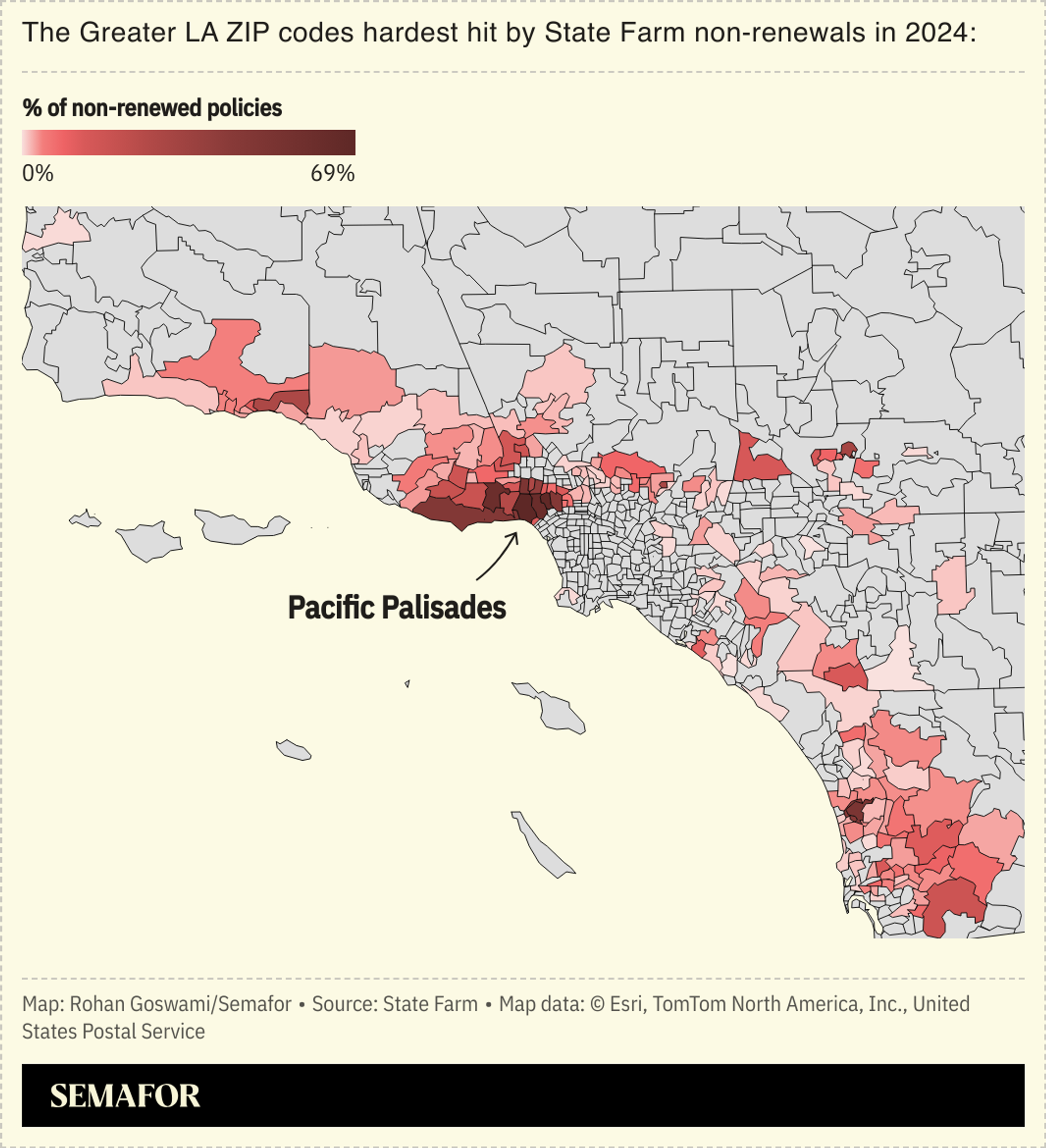

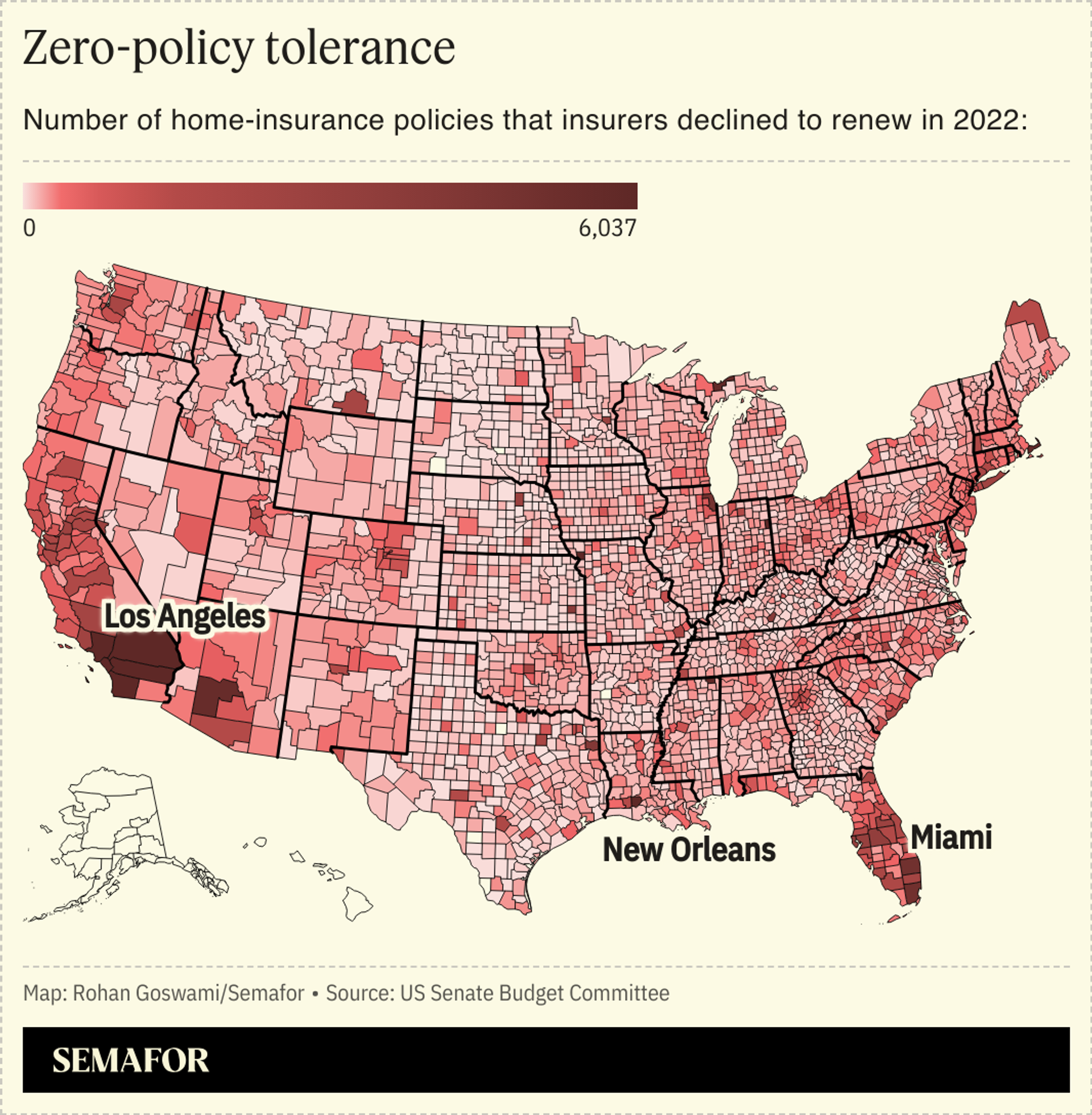

Insurers have been fleeing California in recent years as weather-related catastrophes become more common, pushing more homeowners to a state-backed insurer of last resort.

Know More

A state law requires the commissioner’s approval on annual rate increases above 7% for homeowners’ insurance, which isn’t enough to cover risk that continues to skyrocket, said Tim Zawacki, an industry analyst at S&P Global Intelligence.

Allstate pulled out of California in 2022. State Farm stopped issuing new homeowners policies in 2023 and has been dropping existing customers. Insurers have also stepped up their non-renewals in high-risk zones like Miami and New Orleans, where the threat of hurricanes can be just as expensive as wildfires.