The News

Chicago Fed President Austan Goolsbee said he isn’t worried about the economy overheating, despite some market concerns, and sees the labor market stabilizing, which could allow the central bank to resume its rate cuts.

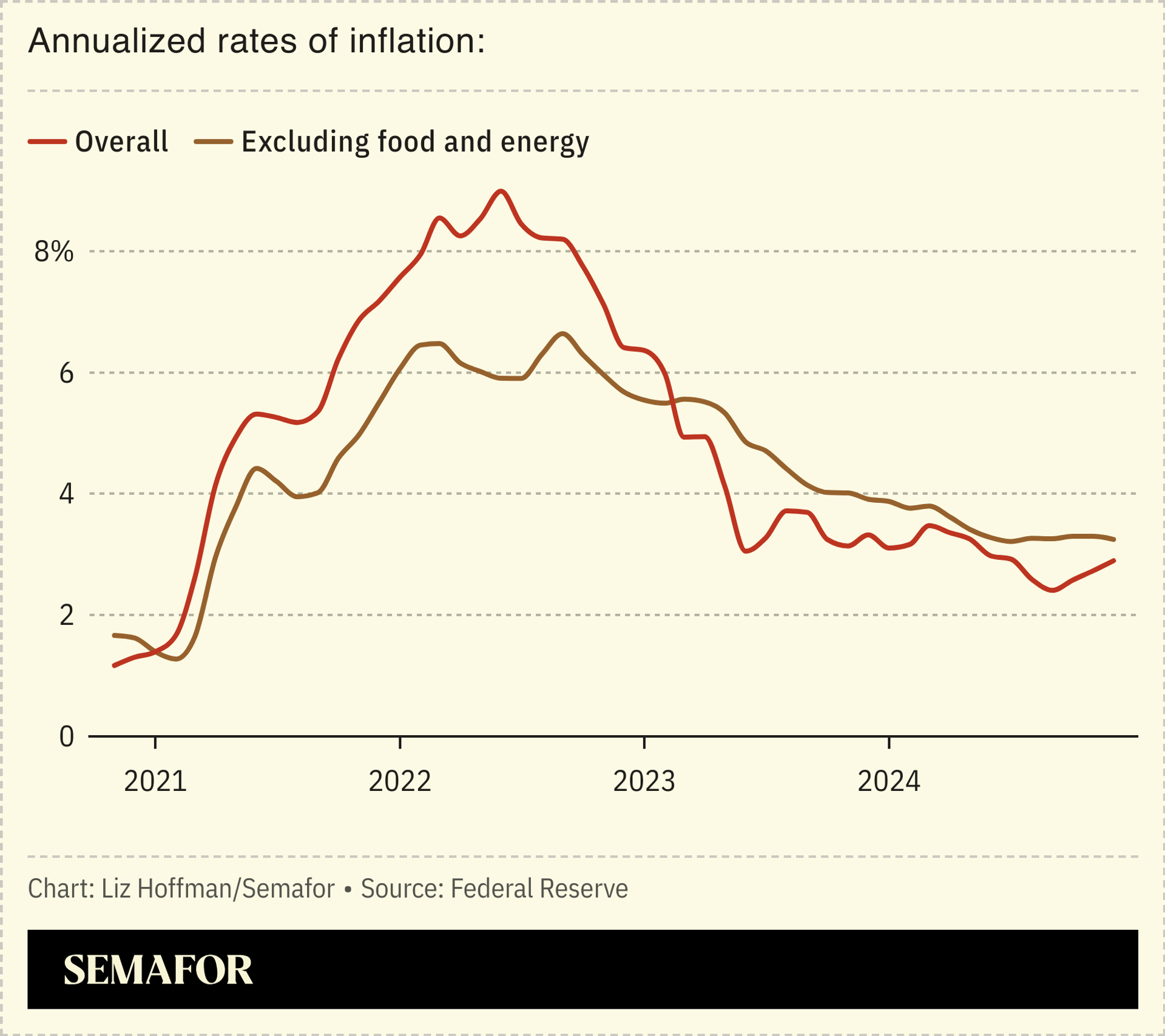

Four months into the Federal Reserve’s easing, recent data has some analysts and investors worried that a too-hot economy could force the central bank to rethink its path down from high borrowing costs, or even reverse course.

“Everything is always on the table,” Goolsbee said in a sitdown with Semafor Friday. But for the Fed to raise interest rates, “you’d have to see convincing evidence that the economy is overheating and that we’re not on the path to get to 2% inflation,” which he said he doesn’t see.

Now What?

December data released this week showed a jump in energy costs, but underlying inflation slowed for the first time since the summer. The Fed lowered interest rates for a third consecutive meeting last month, but have signaled they are likely to slow the pace of cuts going forward.

Altogether, data on jobs, inflation, productivity, and growth “have been saying [the economy is] stabilizing at something like full employment,” Goolsbee said. That, along with low inflation, is the Fed’s main job.

One of the Fed’s more accessible and plain-spoken officials, Goolsbee this year rotates in as a voting member of the panel that sets interest rates, which gives his comments extra economic weight.

Time-tested economic datasets have guided the Fed in its cuts so far, but Goolsbee said he is concerned that these critical indicators will “start to become more muddled.” New tariffs promised by President-elect Donald Trump or geopolitical instability could cause, for example, energy or steel prices to spike — a temporary inflation shock that wouldn’t necessarily require a response from the Fed.

“We’re going to be in the business of trying to figure out which part of the inflation number we should respond to,” he said. “So I do feel like the job in the near term is going to be a little foggier.”

Know More

Semafor spoke with Goolsbee ahead of Trump’s inauguration on Monday, who has threatened to meddle in the Fed’s process of setting rates. Trump, who used debt to build his real-estate empire, has often expressed his preference for lower interest rates. He said last week that borrowing rates remained “far too high,” and his advisers criticized the central bank’s decision in September to lower them — not because it was the wrong call, but because it happened on President Joe Biden’s watch.

Central bank independence is “critically important,” Goolsbee said. “There hasn’t been a lot of public discussion about trying to take that away lately, and I think that’s good.”

Trump’s nominee for Treasury Secretary, Scott Bessent, said at his confirmation hearing this week that he supported leaving the Fed alone to make its own decisions on rates.