The News

Major global climate finance alliances are increasingly at risk with European lenders reportedly mulling following major US banks in withdrawing from the UN-backed Net Zero Banking Alliance.

The timing of the departures of top US banks including Citigroup, Goldman Sachs, JP Morgan, and Morgan Stanley — as well as four large Canadian counterparts, and potentially top lenders in Europe, too — is significant: US President Donald Trump and other Republicans have led criticism of finance’s role in the energy transition, and the latest departures come months after the COP29 climate summit sought to increase targets for global climate finance.

SIGNALS

Departures coincide with anti-ESG turn

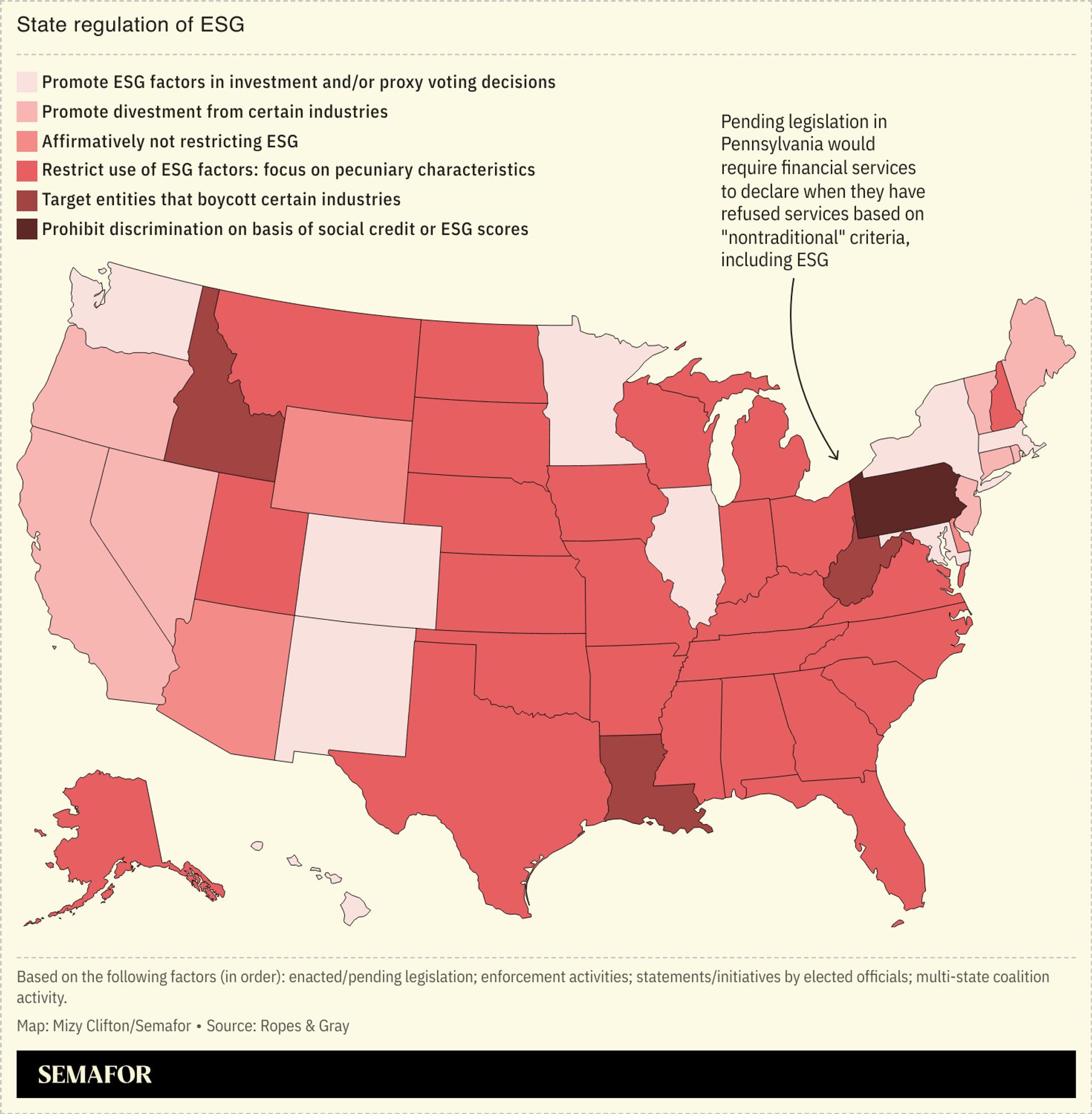

A years-long Republican turn against so-called “woke capitalism” — prioritizing or appearing to prioritize environmental, social, and governance (ESG) factors in investment decisions — has expanded beyond a war of words: BlackRock, Vanguard, and State Street were recently sued by Texas and other Republican-led states for allegedly violating antitrust law through climate activism. The anti-ESG wave seems to be traveling across the Atlantic, The Telegraph reported: Only about 10% of the more than 400 UK funds that claim to be ESG in some way have applied for sustainability labels under the Financial Conduct Authority’s latest “anti-greenwashing” regime.

Other alliances could move to water down climate commitments

With the exception of Morgan Stanley, none of the companies that exited NZBA cited any changes to their net zero targets, but the clout of the alliance will nevertheless be weakened by the loss of significant US members, a sustainable finance expert argued in Corporate Knights. Other alliances that had been part of the broader GFANZ network could move to water down their climate pledges: The Net Zero Asset Managers Initiative (NZAM), for example, has launched a review “to ensure NZAM remains fit for purpose in the new global context.” On the other hand, GFANZ’s loosened membership rules could also open the door to greater participation from financial institutions based in emerging economies, the Financial Times noted.

Mark Carney’s bigwig credentials may not matter in Canadian election

The timing of the crisis “couldn’t be more awkward” for GFANZ co-founder Mark Carney, who launched his bid to become Canada’s next prime minister earlier this week, Net Zero Investor noted. Still, Carney — dubbed a “rockstar central banker” for his time spent at both the Bank of Canada and the Bank of England — is largely unknown to most Canadians: Just 24% are able to recognize him in a picture, according to polling by Abacus Data, though that’s up from 7% in July. And Canadian voters will likely be more persuaded by Carney’s ability to win over a crowd than his credentials, a columnist argued in The Globe and Mail.