The News

Defluorinated water, mass detentions of immigrants, and DOGE’s cost-cutting crusade are all fodder for the next round of investor Trump trades.

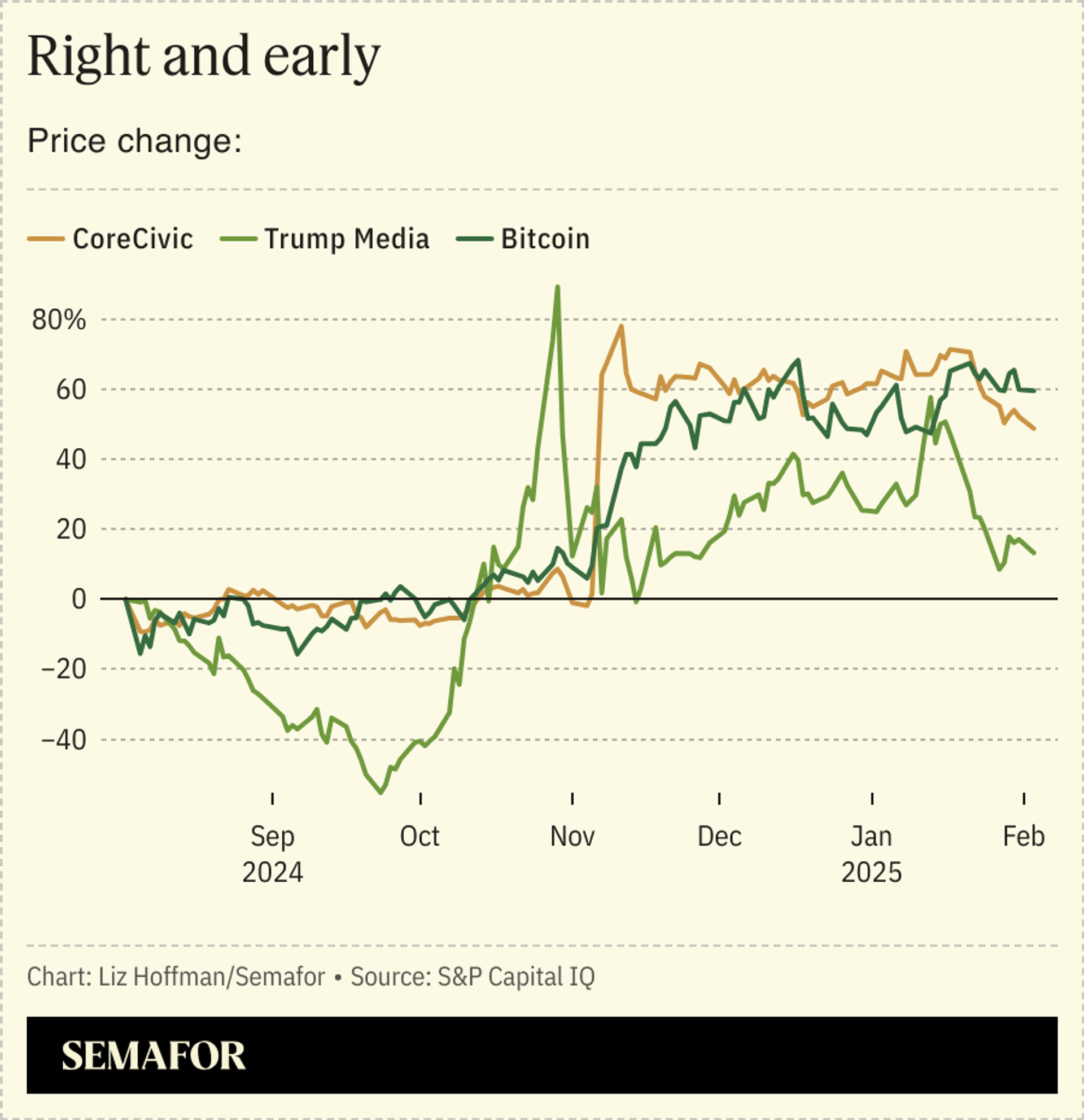

Early MAGA-adjacent bets like buying bitcoin and shares of gun makers are getting crowded, pushing hedge funds toward bank-shot ideas based on their read of the administration’s priorities and personal relationships.

When RFK Jr. said he planned to remove fluoride from drinking water, shares of dental giant Henry Schein fluttered higher. Market bets against shares of H&R Block have risen since Elon Musk posted about simplifying the tax code and reportedly suggested creating a mobile app for filings. Some of the private-equity firms circling Willscot see its mobile structures as potentially key to Trump’s plan to detain 30,000 immigrants at Guantánamo Bay, where the estimated current capacity is 130.

Another idea making the rounds: Trump’s warm relationship with Madison Square Garden owner Jimmy Dolan will break a logjam between MSG, developers, and city officials over a deal that could bring a billion-dollar windfall to the company.

Know More

The early Trump trades were straightforward, and investors piled into stocks of private jails, gold, and the president’s own media company. Those wagers made money early but have since faded: Shares of CoreCivic, one of the country’s largest prison operators, are down nearly 20% since a post-election bump, and Trump Media & Technology Group is down by a third since its late October peaks. A directionally vague pivot into financial services announced last week failed to juice the stock.