The Signal Interview

Mark Read has pledged that 2025 will be WPP’s “year of execution,” pitching the UK advertising giant he leads as having finally cracked the challenge of balancing the two skills that clients value most in the AI era — creativity and technology.

Read joined WPP in 1989, the year it won a hostile bid for Madison Avenue’s Ogilvy Group, and helped Sir Martin Sorrell build the former shopping-basket manufacturer into the world’s largest marketing services company by revenues. He succeeded Sorrell after the relentless dealmaker exited abruptly in 2018 and set up his own firm, S4 Capital.

Read’s early years in charge were marred by sniping from Sorrell, who claimed in 2020, “He won’t last.” Five years on, Read has done more than prove his former boss wrong. He describes WPP as a more competitive, less indebted and more coherent business now. After “quite a painful process… we’ve taken a lot of the hard decisions” that should start paying off in 2025.

But WPP’s shares are below where they stood in 2018, while those of Parisian rival Publicis have leapt ahead. The $13 billion merger planned by Omnicom and Interpublic threatens to create a more potent US competitor, meanwhile, putting pressure on Read to deliver.

Mark’s Playground

Read’s business is about coming up with new stories for brands, and his execution promise hinges on a technology that will “change the narrative for everybody in our industry.” He says 2025 “is the year where AI moves from being something that’s on the cutting edge and not quite ready, to something that’s really going to start to impact how we deliver work.”

To demonstrate what that shift looks like, he fires up “Mark’s Playground” on WPP Open, the platform through which he’s integrating AI into everything from creative production to media buying, to demonstrate how he would pitch to Semafor if it were a client.

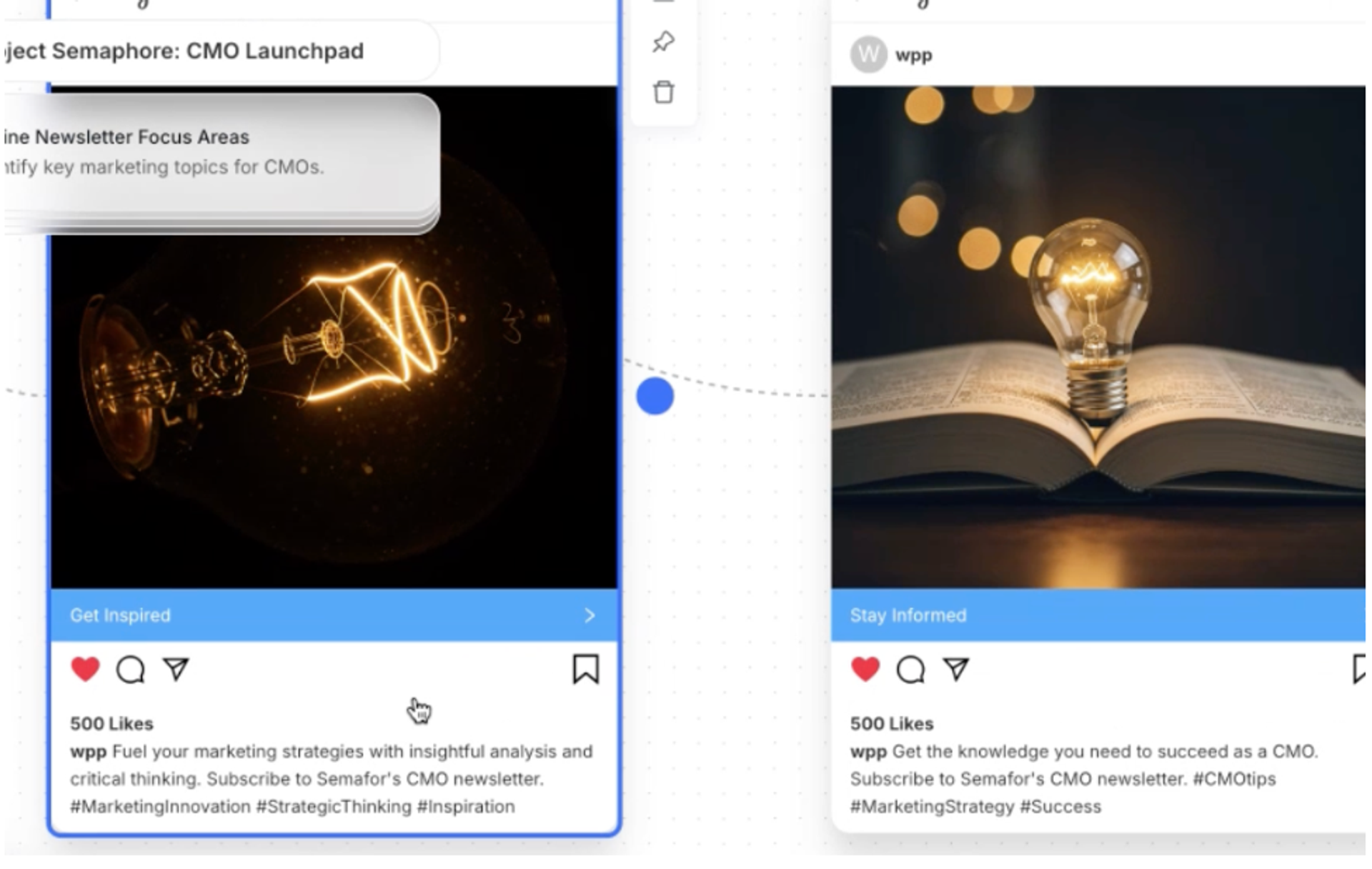

With a few clicks, he drafts several possible ads, featuring smiling commuters and lines like, “Your daily dose of worldly wisdom on the go.” It would have taken a week to come up with those in pre-AI times, he says. Just as fast, he generates five Instagram posts to promote an imagined newsletter for CMOs. The images of light bulbs are not particularly original, but they would serve as a starting point for brainstorming, and “the copy is what amazes me, how good the copy is.”

Then, having fed a recent issue of The CEO Signal newsletter into WPP Open, Read quickly turns it into a podcast. “So, this DeepSeek AI story,” says the AI host to his AI guest: “A trillion dollars in market value vanished practically overnight. What’s the key takeaway for CEOs here?”

Chief AI Officer

WPP Open was built from Read’s acquisition in 2021 of Satalia, an AI company, and his technology investments are now running at about $300 million a year, or about 2% of revenue.

WPP has a chief AI officer, but Read says that has to be his role too. “I annoy lots of my colleagues by doing demos to CEOs like I just did for you. But I think if I’m not using the platform, you can’t expect our people to use the platform.”

The returns on his AI investment will come “through delivering better results to our clients, working more efficiently, and reducing costs in parts of the business,” he predicts, while pushing back on the idea that replicating in minutes a media planning task that once took days will doom the careers of WPP’s media planners. The technology is just a more efficient pencil, he says, “augmenting human creativity” and turning ideas into storyboards faster than before.

He also sees it driving the growth that WPP has sometimes found elusive. “I think as things become cheaper, people will consume a lot more of it, content being a key example,” he says, citing the Jevons Paradox, a Victorian economist’s theory that has become popular among AI optimists. “If we can personalize marketing and make it much more relevant to consumers, I think clients will want to have a much greater degree of personalization.”

Dotcom boomer

Some companies are still not sold on such AI wizardry, though.

“I think clients are probably not adopting it as quickly as I would like or expect,” Read concedes. “We may be a little bit ahead of seeing the potential of what AI can do than our clients.”

To Read, this reticence has strong echoes of the dotcom boom he was part of 25 years ago. He stepped away from WPP for several years, founding a loyalty program operator called WebRewards in which Bertelsmann ended up taking a controlling stake. AI will be every bit as transformative as the internet, he adds.

“Maybe because I was there for the hype [and] the excitement, and then the crash, and then the excitement, my view is the companies that did well on the internet were those that took a long-term view and persisted with their investments over a long period of time.”

FTSE footloose

AI excitement may have propelled the valuations of clients like Alphabet, Amazon, Apple, and Microsoft, but it has done little for the valuation of WPP. The company has been a FTSE 100 staple since 1998, but Read last month admitted that it had looked at moving its primary listing to the US.

“It’s not something we’re actively considering at the moment,” he says, but the idea remains under review, and WPP is far from alone. After companies like ARM Holdings and CRH moved their listings to New York, “it’s a pretty constant topic of conversation” among CEOs of FTSE companies, Read says.

The reason is not just the widening discount at which UK stocks trade: Read highlights the “scale and power” of America’s economy and its capital markets. US investors, too, are more ambitious about funding companies’ growth plans than UK funds that have focused on capital returns, he warns. “For many UK CEOs, [it’s] a question of valuation, but also a question of growth and ambition.”

Sir Keir Starmer’s government is “very aware” of the risk of further exits, Read says, but the policy solutions are not obvious. “The UK stock market no longer has the strong domestic investor base that it once had, and that’s naturally a problem.”

Office holder

Read was speaking from his London office, soon after he told WPP’s staff that he expected them to average four days a week on its premises starting in April. His memo caused a headline-generating backlash, but Read is standing firm.

“I think, because our offices were so deserted, people have forgotten all the positive things about being together [and] the things that make our industry fun and stimulating,” he says, adding that WPP’s busiest offices are its most successful ones, creatively and financially.

Read is sympathetic to staff who say they can be more efficient while working from home. “But I think building a company, managing a company, leading teams, developing people, it’s not just about personal productivity, is it?”