The News

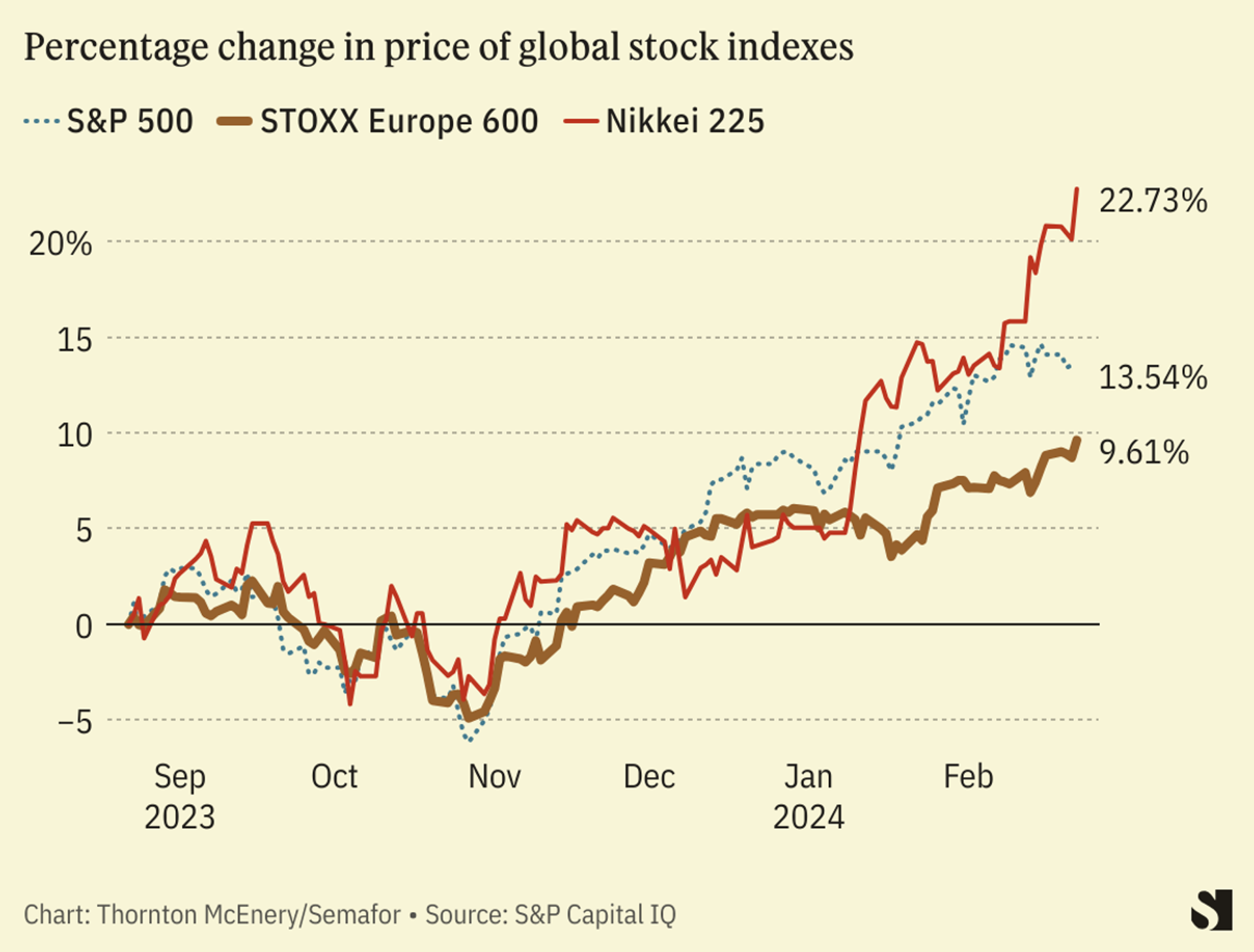

Wall Street had a great day Thursday after chipmaker Nvidia reported a 265% revenue jump driven by sales to artificial intelligence companies, with the S&P 500 and the Dow Jones Industrial Average both marking new record closes. The tech-heavy Nasdaq Composite also closed just shy of a record high.

Other nations’ stock markets had blockbuster days too, with Japan’s Nikkei Stock Average closing at a high not recorded since 1989 and the Stoxx Europe 600 also closing at record levels.

Nvidia shares surged more than 16% after its latest earnings report beat expectations, sparking other tech stocks to rally. The chipmaker’s CEO said generative AI has “hit the tipping point.”

SIGNALS

This is just the beginning of the AI boom

“Nvidia’s results act as a bellwether for the strength of the AI boom,” The Wall Street Journal reported, noting that tech companies are continuing to bet the technology will improve their products and lead to the development of new ones. “The AI revolution is just starting and not peaked,” one financial analyst told the outlet.

Nvidia’s CEO echoed the sentiment. “We are one year into generative AI,” Jensen Huang told The New York Times. “My guess is we are literally into the first year of a 10-year cycle of spreading this technology into every single industry.”

Some investors are concerned about Nvidia’s rapid gains

Some investors and analysts have cautioned that some stocks and indexes may be “approaching ‘bubble’ territory,’” the Financial Times reported. One wealth adviser and market strategist told Reuters that “we’ve gotten well ahead of expectations and baked in a lot for the next three years.”

But industry-wide trends are fueling Nvidia’s growth, and analysts don’t expect them to change any time soon. “AI is a really big deal,” one analyst told The Wall Street Journal. “I don’t think it’s a hype cycle like with the metaverse a couple years ago. I think it could completely transform the way people interact with computers and the way a lot of people do their jobs.”