The News

US President Donald Trump’s scorched-earth trade policy is driving sharp downgrades in US growth prospects — and upgrades for the country’s rivals.

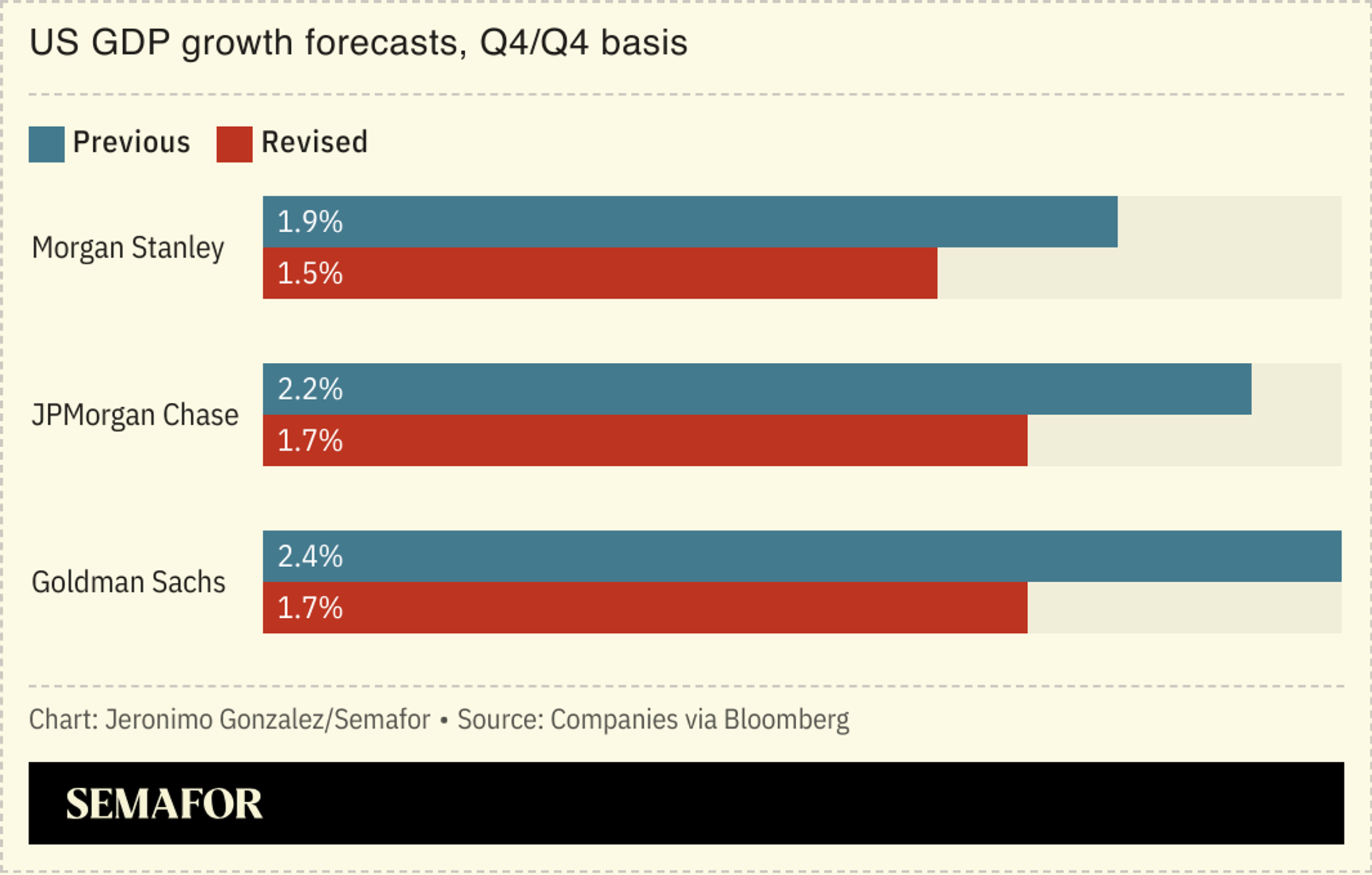

Goldman Sachs drastically cut its growth forecast for US GDP in 2025 from 2.4% to 1.4%, citing “considerably more adverse” trade assumptions, while upgrading the eurozone outlook, thanks to Germany’s unexpectedly aggressive spending plans.

Other investment banks were similarly pessimistic: Morgan Stanley lowered its US growth projections, JP Morgan cut its first-quarter GDP estimate, and Citi downgraded its forecast for American equities and upgraded its China outlook, arguing that “American exceptionalism is at least pausing.”

SIGNALS

Trump’s trade war may do long-term harm to US economic standing

The possibility of a trade war with the US has “ceased to be an economically existential threat” for many of the country’s allies: Many could start to de-risk from the US if they decide that losing cheap access to North America isn’t worth the cost of dealing with Trump or a similarly inclined future president, a sanctions expert wrote in Foreign Affairs. And because Trump has, so far, taken a relatively softer tariff approach to China than he had previously threatened, international efforts to diversify global supply chains away from Beijing could be derailed, an Indo-Pacific expert argued in The Interpreter.

Trump’s reversals could stave off recession — but uncertainty is its own problem

US Commerce Secretary Howard Lutnick has sought to downplay Donald Trump’s refusal to say whether the country is heading into a recession, and many economists think that it remains unlikely, at least in the short-term, The New York Times reported. This is partly because many of Trump’s most eye-catching pledges — tariffs, deportations, and slashing the federal workforce — have been either delayed or rolled back. Uncertainty causes its own problems, however: “Things just stop. Business confidence is muted, employment is muted, and capital spending is put on hold,” one economist said. The challenge for policymakers and investors “is to sift the uncertainty from the noise,” The Spectator argued.