The News

BlackRock CEO Larry Fink said US officials should revisit the idea of private investment accounts to supplement — though not replace — Social Security, whose modest returns have been far outpaced by US economic growth and financial markets.

“We have a plan called Social Security that doesn’t grow with the economy,” Fink told Semafor’s Liz Hoffman at BlackRock’s retirement summit. “You’re detached from the economy, and you don’t feel like you’re winning.”

Social Security has long been a sensitive Washington topic, and the White House has emphasized that those benefits will not be cut while Elon Musk’s government efficiency efforts target what he sees as fraud and waste in the program.

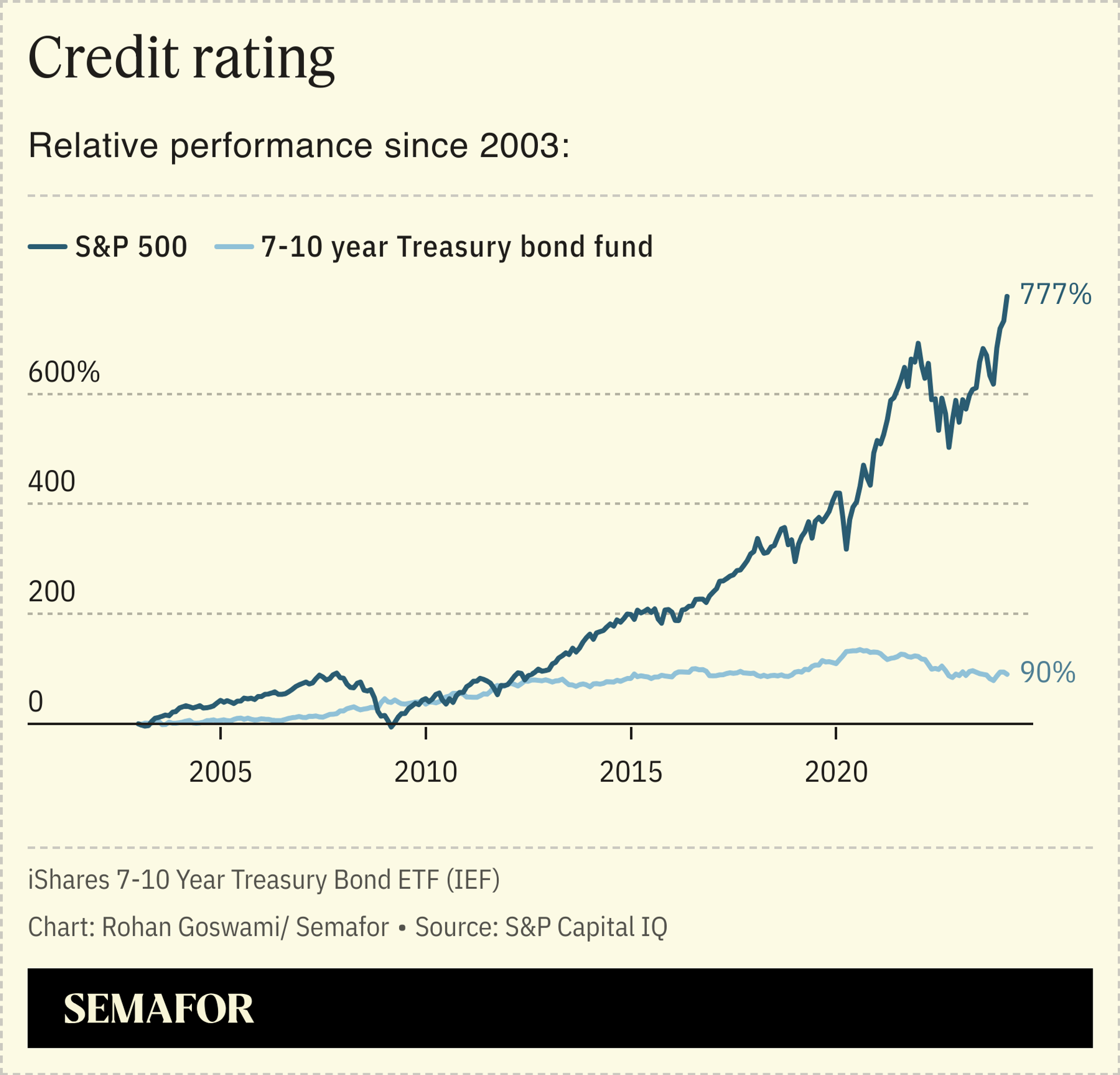

Money in those funds is invested in US Treasury bonds, which have offered paltry returns for much of the past 20 years while the stock market has soared.

“I think more Americans can be a little more hopeful today with their retirement savings than just getting that bond payment,” said Fink, who started his career as a bond trader.

Instead, most Americans get their retirement accounts through their jobs, which are subject to the labor market, career changes, and the quality of financial education that employers choose to offer. Other countries, like Australia, have mandatory contributions that are invested in global markets.

“The beauty of that plan, unlike Social Security — and I know we can’t talk about Social Security in this country — is that you’re investing in real assets,” he said. “You’re growing with your country.”

Congress and White Houses of both parties have shied away from discussing private retirement plans since President George W. Bush proposed allowing Americans to put a portion of their Social Security tax payments into investments. Opposition to that plan, which Democrats called an effort to privatize the entitlement program, helped wreck Bush’s second-term agenda.

In this article:

Liz’s view

A renewed effort might find more support in Trump’s Washington, where a push is underway to move large pieces of the economy into private hands.

DOGE wants to sell the Postal Service and has put hundreds of federal buildings up for sale. Treasury Secretary Scott Bessent, speaking to economists and business executives in New York last week, said Trump is pursuing a “re-privatization of the economy,” in part by reducing regulations on banks and allowing them to finance projects and services currently paid for out of the public purse.

Know More

Fink said he “would not be surprised to see elevated inflation over the next five months” as Trump’s tariffs and other economic policies start to sink in and that he wasn’t, for now, overly concerned by plunging stock prices.

“Having [the market] fall 7% after the dramatic rise for the last 30 years is a blip,” he said. “The question is, is it going to fall another 8%? That’s a possibility.

“Every CEO I talk to, we’re starting to talk about a more fearful economy right now,” he said. “But I do believe this is going to be more short term, once we understand the policies, once we become more accustomed to it.”

That’s the message the Trump administration has been pushing, with the president warning there might be a “period of transition” and declining to rule out an economic recession.

Notable

- “De-leveraging the public sector and re-leveraging the private sector begin and end with smartly reinvigorating our regulated financial institutions,” Treasury Secretary Scott Bessent said in a speech last week.