The News

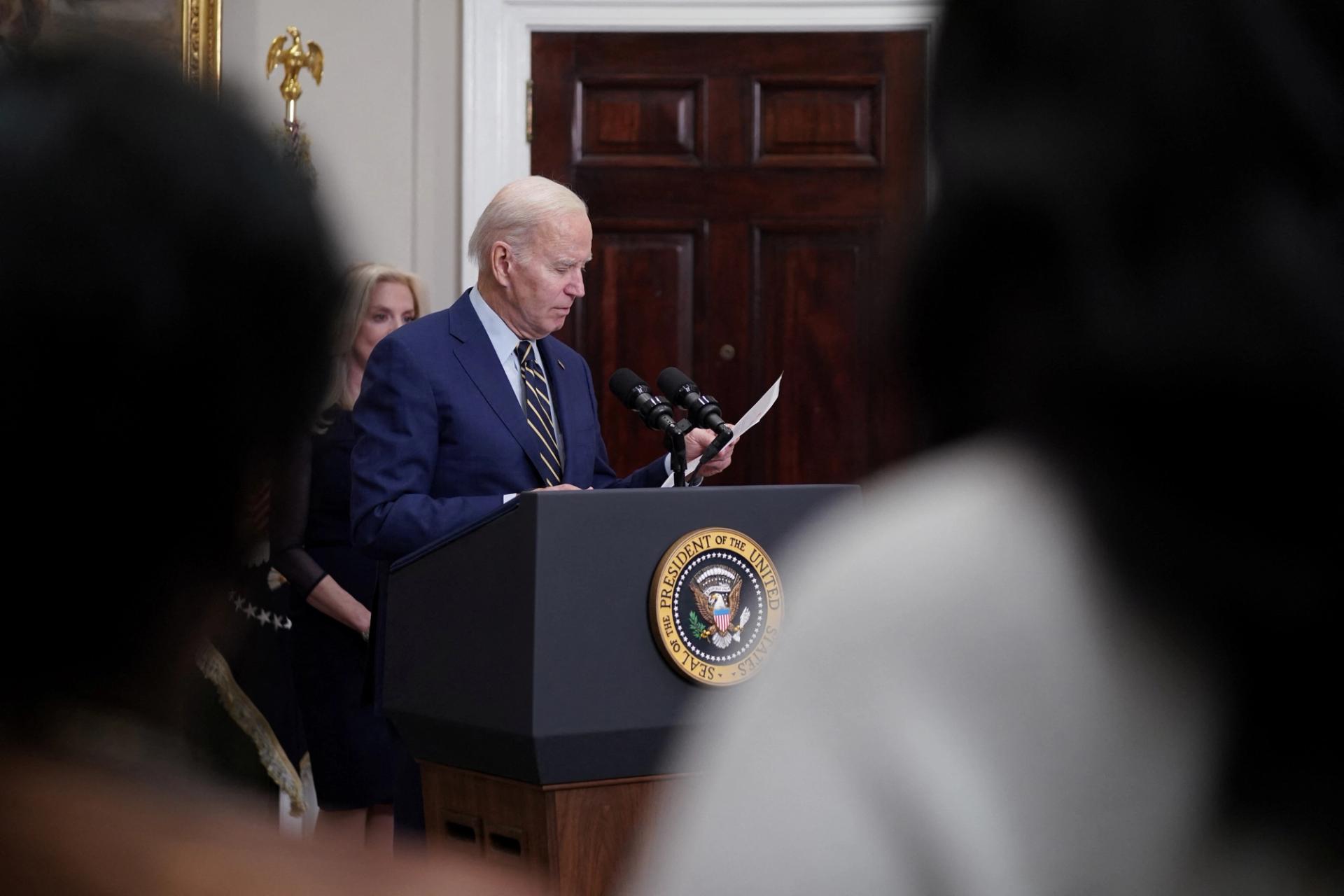

U.S. President Joe Biden vowed to restore faith in the country’s banking system, following the collapse of Silicon Valley Bank and Signature Bank last week.

Speaking to the press on Monday, he said “no losses will be borne by taxpayers” and that managers of banks would be held accountable for lack of oversight and regulation.

In this article:

Know More

“I’m going to ask Congress and the banking regulators to strengthen the rules for banks to make it less likely this kind of bank failure would happen again,” Biden said, adding that “the management of these banks will be fired.”

He said that SVB depositors will get their money from fees that banks pay into the deposit insurance.

Step Back

Biden’s remarks followed a weekend of anxiety for the banking industry after Silicon Valley Bank was shut down by regulators Friday and put under the control of the FDIC. The bank was a pioneer of the startup banking industry, and nearly half of all American venture-backed tech and life-sciences companies used the bank.

The government said people with money in the bank would be paid back in full starting Monday, when their branches reopened under the purview of the federal government.

The bank’s collapse, the second-biggest in U.S. history, began last week after it forecast a high decline in deposits and lost $1.8 billion in bonds. That led many clients to begin pulling their money out of the bank.

Over the weekend, another bank, Signature Bank, failed and was put under the control of the federal government.

The View From Europe

The European Union’s economy commissioner Paolo Gentiloni said the fall of Silicon Valley Bank in the U.S. would not “pose a serious threat” to Europe, as foreign investors worry about potential impact.

“The possibility of indirect impact is something that we have to monitor but, at the moment, we don’t see it as a significant risk,” he told reporters in Brussels on Sunday.

On Monday, HSBC made an agreement to buy SVB’s UK branch for 1 pound — just over $1 — through a deal facilitated by the British government and the Bank of England.

Tech firms in the UK that relied heavily on SVB will be able to access and withdraw their money as normal.

“Deposits will be protected, with no taxpayer support,” U.K. chancellor Jeremy Hunt said.

France’s finance minister Bruno Le Maire also said that French banks were “solid” and there was no “risk of contagion” to the country’s financial system from the collapse of SVB and Signature Bank.