The News

Beijing unveiled plans to “vigorously boost consumption,” amid fears that the world’s second largest economy is entering a period of deflation. The announced measures focus on boosting incomes and stabilizing the country’s flagging housing sector.

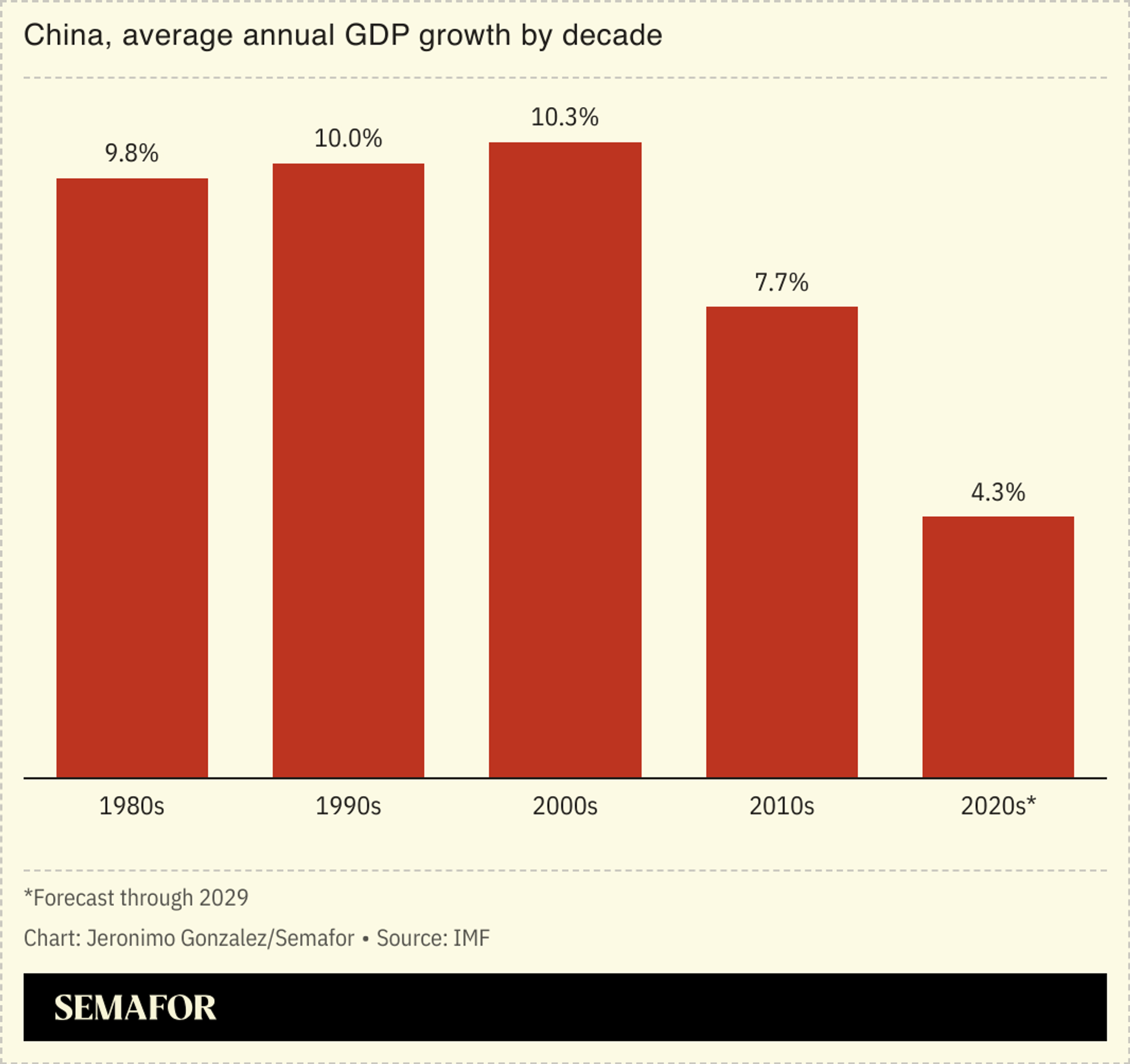

The fresh stimulus push comes as the price of new homes has fallen by 4.8% year on year. Consumer prices have dropped for each of the past two years, with some forecasting the country could experience its worst deflationary cycle since the 1960s. One possible bright spot: Retail sales rose 4% in January and February of 2025 compared to last year.

SIGNALS

China battles against deflationary pressures

Beijing’s stimulus announcement marks “the most comprehensive directive on stimulating consumption since China’s reform and opening-up” in the late 1970s, a Shanghai-based analyst told the South China Morning Post: Unlike previous proposals, Beijing seems to be recognizing the need to boost income through measures like childcare subsidies and property investments. Yet officials failed to clarify “where additional funds for cash-strapped local governments to implement these measures would come from,” The Washington Post noted. One Rhodium Group analyst told the outlet that Beijing’s plan was “very incremental and limited,” and unlikely to solve the country’s deep economic problems, including persistent deflation, unemployment, and low household income.

Beijing seeks to reduce dependence on exports

The announcement comes at a moment when Beijing is attempting to rebalance the economy “away from its dependence on an ever-rising trade surplus,” The New York Times wrote, amid rising tariff threats from the US and elsewhere: “If the tariffs linger, Chinese exports to the US could drop by a quarter to a third,” the head of China economics at Moody’s Analytics told the BBC. Speaking at the country’s parliamentary meeting last week, Chinese Premier Li Qiang admitted that, “Domestically, the foundation for China’s sustained economic recovery and growth is not strong enough.”