The News

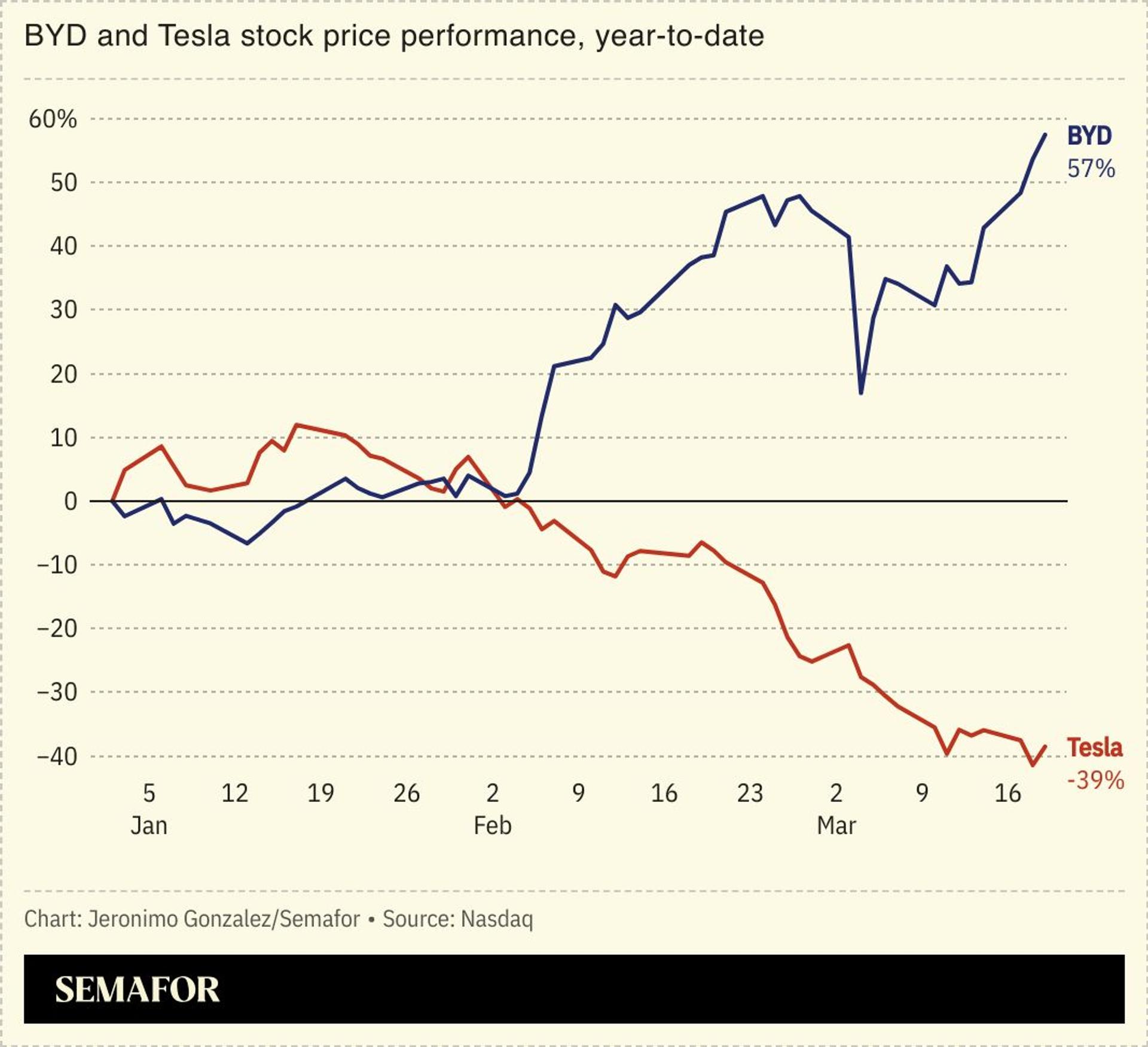

Asian electrical vehicle optimism is in the ascendent: Chinese EV company BYD’s announcement that its chargers can in five minutes give its cars enough juice to run for 250 miles catapulted its market value to more than $160 billion — far above that of established Western automakers like Ford and GM.

US EV darling Tesla, by contrast, has seen its shares fall precipitously since December: Its market value fell by about $700 billion in that period — wiping some $100 billion off CEO Elon Musk’s net worth, the Financial Times noted.

The divergence marks a broader shift in the industry as smaller, global companies push to innovate beyond their bigger, more established Western rivals.

SIGNALS

US EV sector already faced charger challenges

Tesla CEO Elon Musk’s close involvement with the Trump administration could risk not only the company’s own sales, but the country’s entire EV industry: Last month the White House froze $5 billion in federal Biden-era grants to build out EV infrastructure as part of the pivot toward oil and gas. The lack of infrastructure had hamstrung the EV sector as would-be buyers fretted over range anxiety — the grants were aimed to change that, although they had been slow to disburse. Still, cutting the grants is unlikely to help: “BYD’s announcement is a clear signal that the EV race is no longer just about vehicles—it’s about infrastructure,” Satish Jayaram, senior vice president of eMobility at ABM Industries, told Semafor. “The administration’s plan is not to actually impact the deployment of charging infrastructure,” one analyst told CNBC. “It’s to drive the narrative that we’re killing those evil EVs and EV chargers.”

BYD’s success could crowd out global EV makers

BYD’s push for innovation — most recently in its charger, as well as its new “God’s Eye” advanced driver-assistance system — has “significantly ratcheted up pressure on global automakers,” the Financial Times wrote. Unlike many other carmakers, BYD boasts intellectual property across its EV, battery, and charging technology — an edge that will “likely put a few global brands out of business,” Tu Le of Sino Auto Insights said. Smaller, southeast Asian EV makers may also stand to benefit somewhat, The Economist wrote: Thailand and Indonesia have both grown their respective EV sectors — albeit controversially — through Chinese investment and imported production kits, but their dependence on China is also a weakness when it comes to homegrown growth, the outlet noted.

US automakers push innovation outside of EVs

Automakers in the US are increasingly pushing into self-driving technology and other artificial intelligence initiatives to lure consumers, as their balance sheets come under pressure from declining EV sales and uncertainty over Trump’s tariffs. General Motors announced a tie-up with chip company Nvidia Tuesday to roll out AI-powered piloting across its cars. Industry analysts have said that the “race is now on to procure the latest and greatest chips… to solve self-driving,” InsideEVs noted — while the race to make better EVs seems to have stalled.