The News

US stocks seesawed Monday, as investors embarked on the first day of trading after US President Donald Trump’s baseline 10% tariffs on imports went into effect.

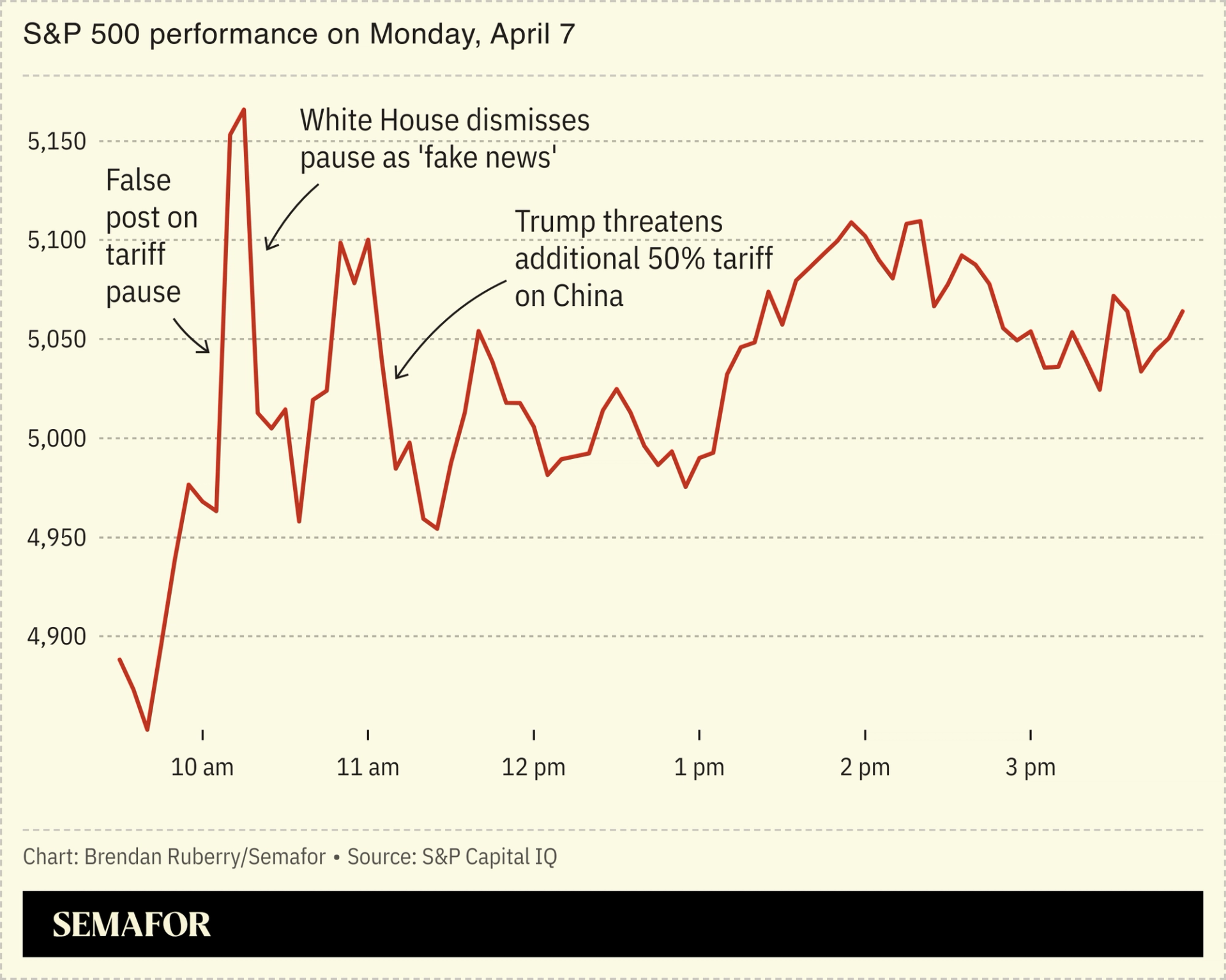

After opening sharply down — the S&P 500 at one point tumbled into bear market territory, a 20% decline from a recent peak — markets were gripped by volatility fueled by social media speculation that Trump was considering a 90-day pause on tariffs for all countries except China.

That rumor, which was briefly reported by CNBC, saw stocks surge. The White House quickly denied that such a pause was under consideration, sending markets back into the red.

SIGNALS

Social media rumors fuel massive market moves

That social media fueled such significant swings in many ways encapsulated the uncertainty and restlessness that has surrounded the entire tariff saga: Before Donald Trump announced the tariffs, investors, analysts, and executives had been desperate for any clarity on the president’s trade policy. Since the “Liberation Day” reveal, many have questioned whether the market rout would spur the president to enact a delay or exemptions, as he has done with past tariff threats. The swift denial from the White House of the rumor despite the chatter’s positive market impact “tells you all what you need to know: for now, Trump isn’t backtracking,” Bloomberg columnist Javier Blas said. The swings, CNN wrote, “underscore just how badly investors want Trump to put a pause on his trade war.”

Business leaders call for ‘time out’ on tariffs as trade war spirals

Wall Street leaders described the global markets fallout over “Liberation Day” tariffs as “a five-alarm fire,” as stocks plummeted globally over the weekend, generating losses in the trillions. Many CEOs compared the turmoil to the 2007-2008 global financial crisis, though a significant difference is that the US Federal Reserve is currently unlikely to swoop in and rescue investors: Central bank chair Jerome Powell on Friday said the tariffs were much “larger than expected,” and that the Fed needs time to assess their possible consequences before taking action. Even billionaire hedge fund manager and ardent Trump supporter Bill Ackman called for a “90-day time out” on X.

Lack of administration guardrails leaves Trump unbound

No one in the Trump administration inner circle seems willing or able to rein in the president: Treasury Secretary Scott Bessent, who had advocated for a more nuanced approach to the duties and was previously seen as “a potential ally” to Wall Street, appears increasingly sidelined in both the tariff announcements and Oval Office discussions, Fortune wrote. Instead, the decisions are increasingly concentrated in “a small group within Trump’s inner circle,” while Bessent has been fielding calls and texts from executives. As one executive close to the White House told CNN: “The problem is, it’s the president’s view and it’s not widely shared,” but, “on this issue, he seems immovable.”