The News

US Treasury bonds — typically among the world’s safest assets — have fallen in recent days, raising fears that a deeper financial crisis may be brewing.

Typically when stocks plummet, as they have over US President Donald Trump’s “Liberation Day” tariffs, fixed-income assets rise as investors seek the relative safety of American government bonds. Yet Treasurys “are not behaving as a safe haven,” ING economists said.

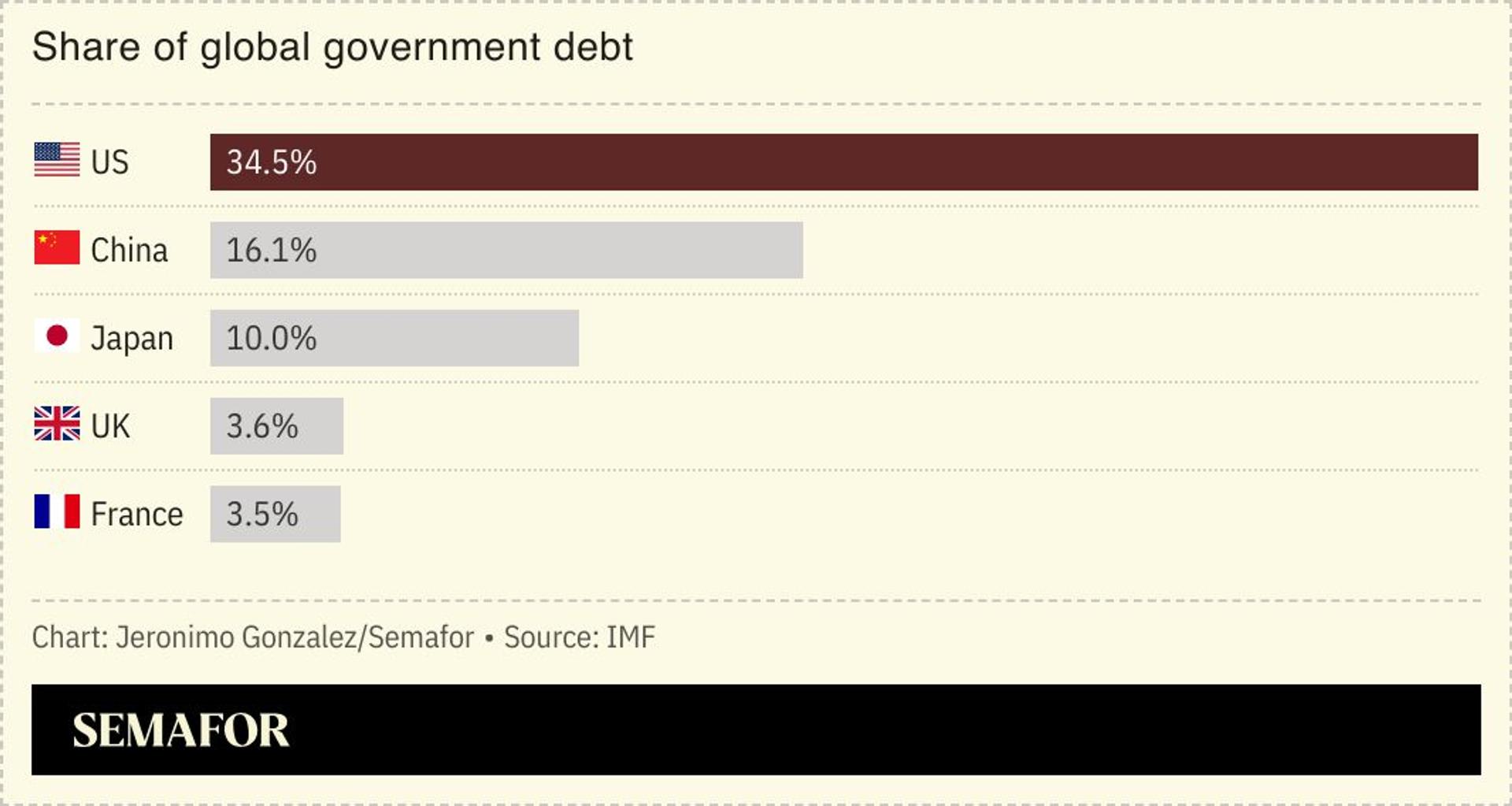

The reasons are manifold: Investors are holding cash, a trade favored by hedge funds is being unwound en masse, and foreign holders of Treasurys may be dumping them.

Perhaps most troublingly, an auction yesterday drew the least interest in years, suggesting plunging demand for American debt, and traders are nervous ahead of another bond sale today.