The Scoop

HPE’s board is expected to meet in coming days to discuss whether to replace CEO Antonio Neri, a Hewlett Packard lifer who has run the company since 2018, following a proposal from activist investor Elliott Management to do that, according to people close to the company.

Elliott has a $1.5 billion stake in HPE and wrote in a letter to HPE’s board earlier this week that it would push for Neri’s replacement, some of the people said. If Elliott has its own candidate in mind, it didn’t share them with HPE’s board. The size of its stake was previously reported by Bloomberg.

Elliott declined to comment. “HPE maintains an ongoing dialogue with our shareholders on a range of issues and values their constructive input,” an HPE spokesperson said. “The board and management regularly assess the strategic direction of the company with a focus on driving long-term shareholder value.

Neri is in the middle of the highest-stakes move of his career: Steering a $14 billion acquisition of Juniper Networks past antitrust regulators seeking to block it. Both companies seemed blindsided by the Justice Department’s lawsuit, and have sought to reframe their combination as providing an America-first competitor to Chinese telecom companies.

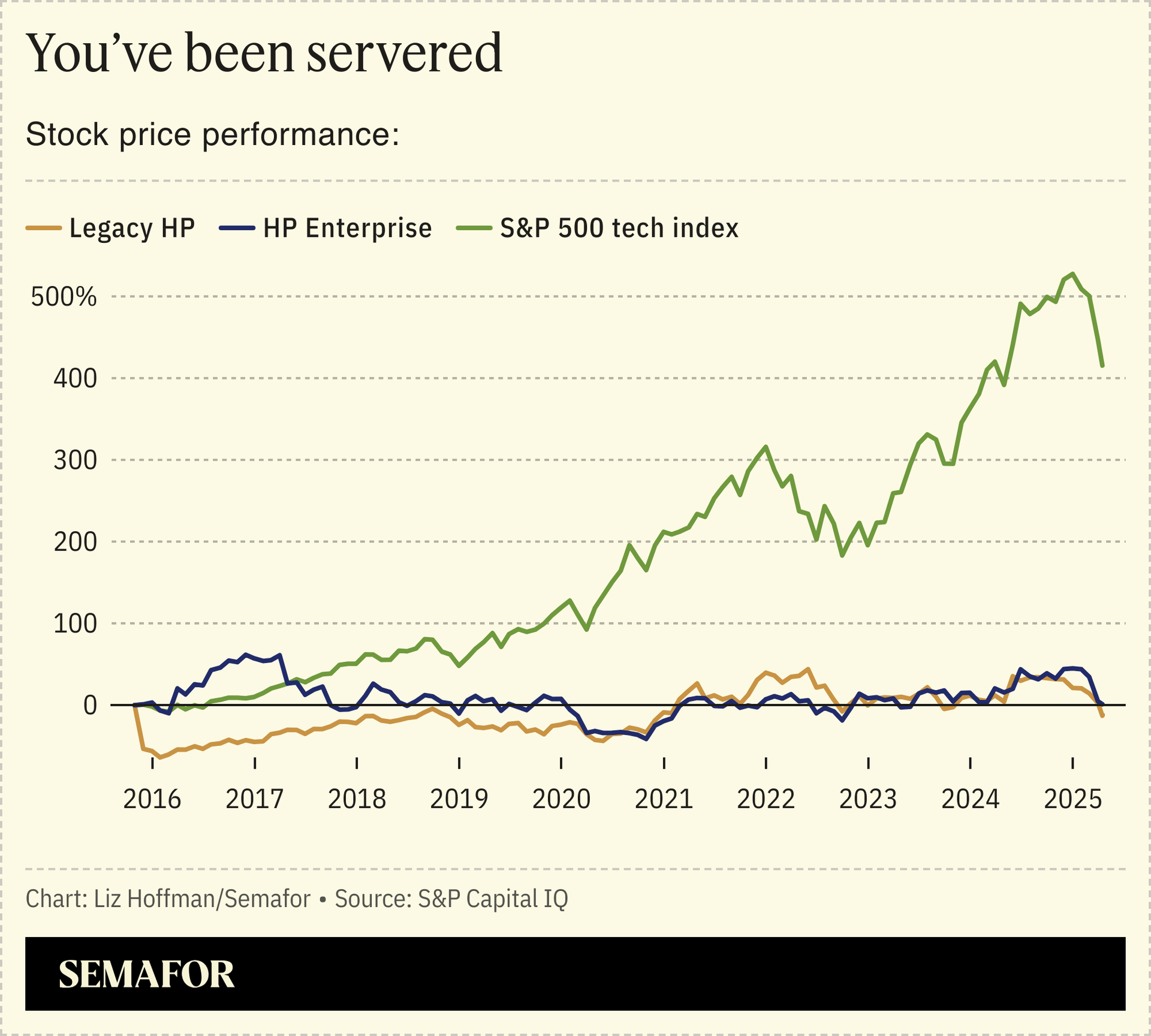

HPE has struggled since its 2015 separation from HP’s legacy PC business. Both companies combined trade today for about what HP was worth on its own before the split, versus a 415% increase in the S&P 500 tech sector.

Elliott in its letter requested discussions with HPE and said it wanted to keep those talks private, especially around a potential CEO change.

HPE’s board, as part of standard succession planning that was ongoing before Elliott arrived on the scene, had identified several internal candidates who could replace Neri, according to people familiar with the matter.

Know More

HPE spun out of Hewlett Packard in 2015 after CEO Meg Whitman split the company’s personal computers from the servers and software it sold to companies. Neither piece has matched the broader market’s surge since then.