The News

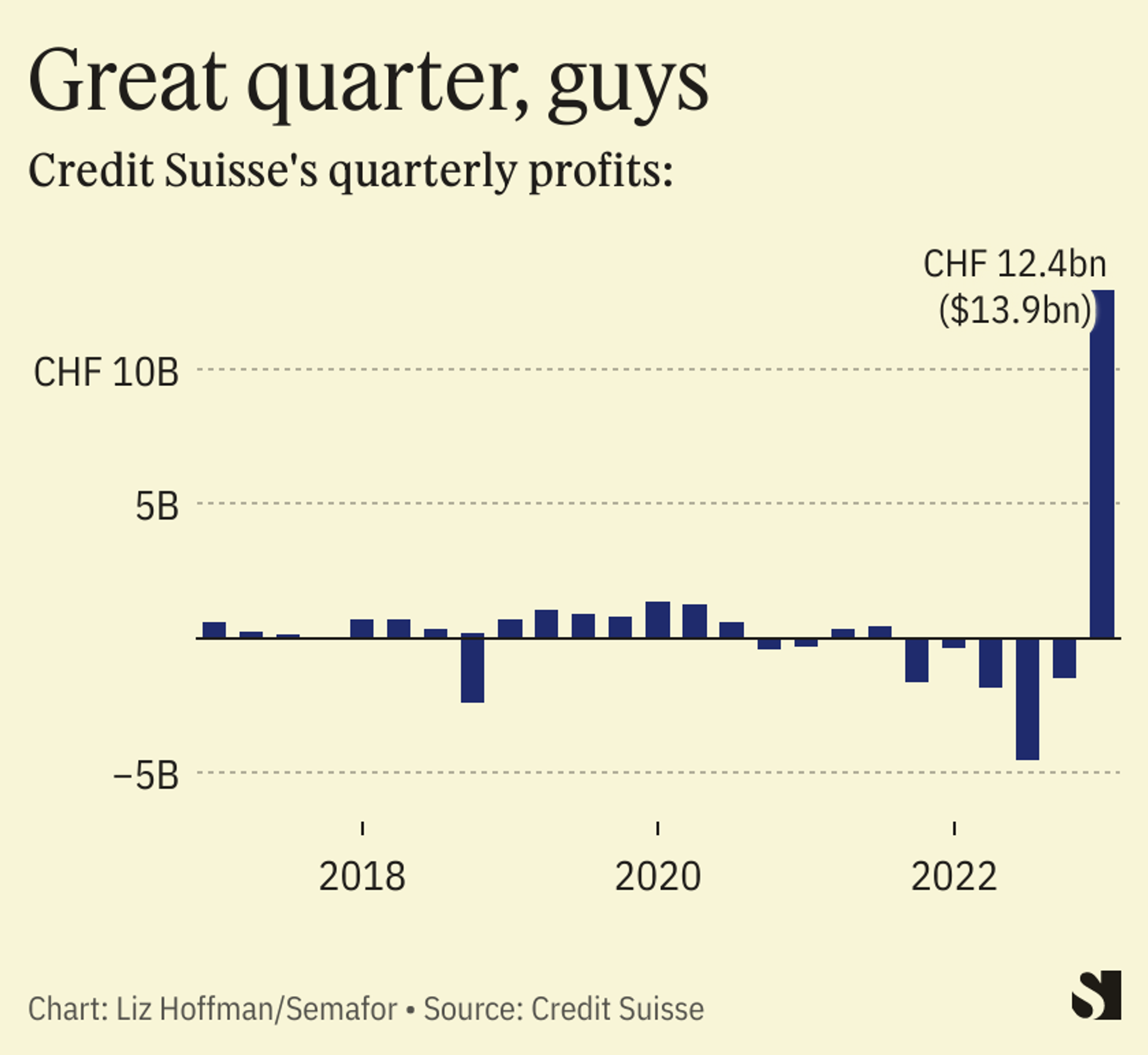

Credit Suisse posted its highest quarterly profit ever — very nearly the biggest haul by any bank in history — as it was dying.

The bank booked $13.9 billion in net income during the three-month stretch in which it nearly failed, saw $75 billion in customer funds whoosh out the door, and was merged by the Swiss government with rival UBS in a firesale.

The boon came from Credit Suisse writing down $17 billion of bonds, which were “bailed in” — maybe legally, maybe not; the bondholders are now suing — to cover losses. It shows the quirks of financial accounting, which, on the heels of the regional-bank turmoil in the U.S. earlier this year, is interesting in a way it hasn’t been since the 2008 financial crisis.

In this article:

Liz’s view

The riskier a company is, the cheaper its bonds trade. That gap between the face value of the debt and the trading value is, by the magic of accounting, a boost to the company because it could in theory buy back those bonds at a discount and zero out a future payment.

Taken to its extreme, that means a company’s most profitable day, at least on paper, is the day before it goes bankrupt.

During the 2008 meltdown, weak banks padded their earnings through this sleight of hand. The reverse happened on the way out of the crisis, when banks that were becoming safer by the day were posting big paper losses. It made no sense, and it made reporters’ lives unpleasant.

That was obviously dumb, and the U.S. body that sets accounting rules essentially got rid of it. Even if they hadn’t, bank debt traded calmly and near 100 cents on the dollar for most of the past decade, so it didn’t really matter.

The Credit Suisse windfall is slightly different and more defensible. It wasn’t that the bank theoretically could have bought back those bonds at a discount; it did buy them back, and for $0, quite the bargain. (Among those stung, we reported last month, were employees, who had been paid partly in those bonds for years.) But it’s a reminder that accounting rules are fine as far as they go, but often that isn’t very far.

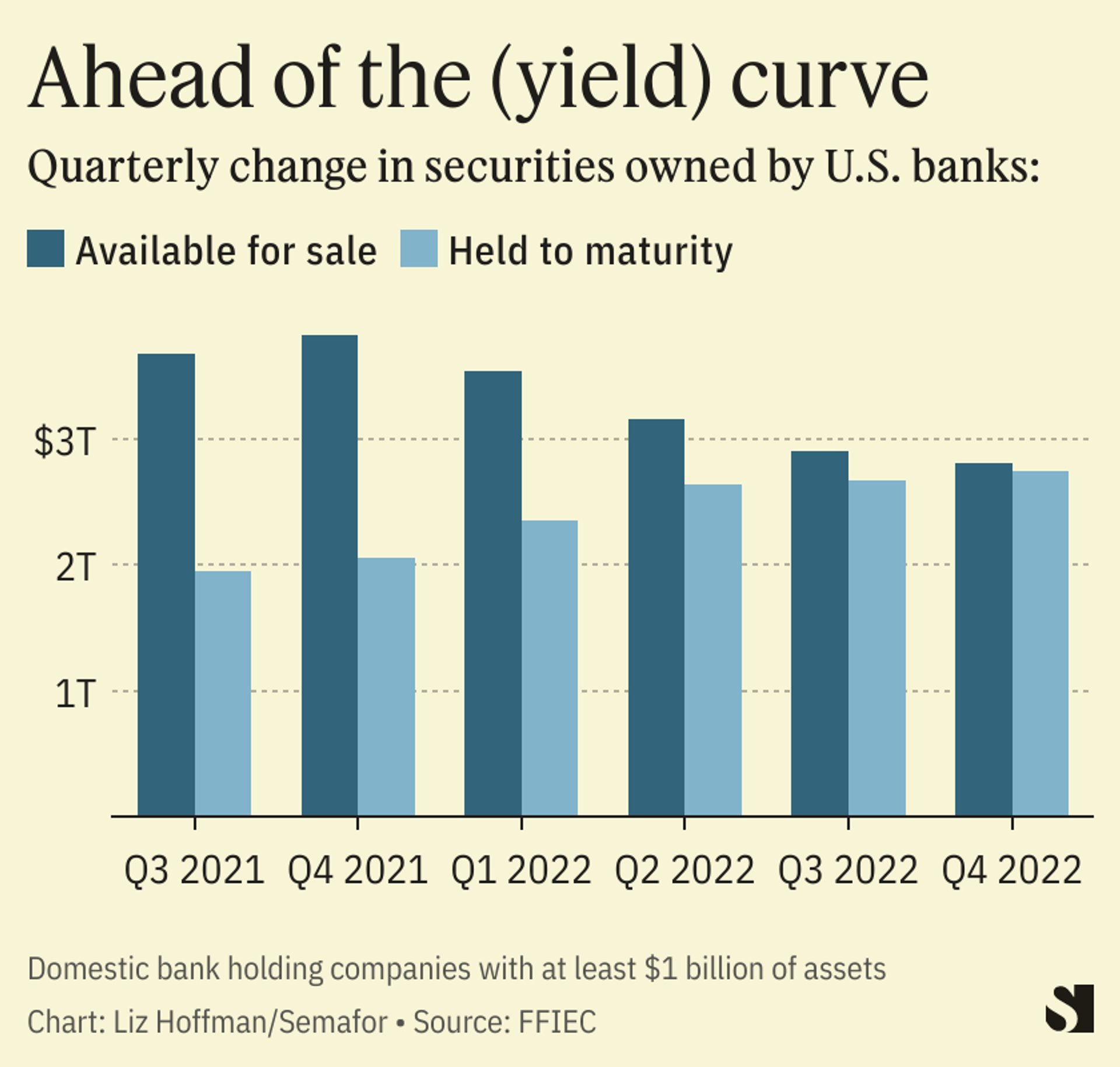

The collapse of Silicon Valley Bank holds the same lesson. SVB labeled most of its loans and investments as “held to maturity,” meaning the bank never intended to sell them and so didn’t have to account for the fact that they were hopelessly underwater and sinking deeper with every interest-rate hike.

In other words, it shoved them into the corporate sock drawer. And it wasn’t alone in doing so: Banks reclassified hundreds of billions of dollars worth of securities as higher interest rates made them unprofitable, as I reported last month.

Accounting rules require banks to have both the intention and, crucially, the ability (read: funding) to hang onto the assets forever. SVB’s auditors at KPMG, which signed off on its soundness two weeks before its collapse, will clearly face some tough questions.

But the rules they were enforcing are far from perfect, too, which is how you get record profits at a failed bank.

Room for Disagreement

You’d get exactly the opposite takeaway from one of the biggest corporate collapses in history.

In the early 1990s, Enron lobbied regulators for the right to ditch traditional accounting methods and instead slap market prices on its investments. When the Securities & Exchange Commission signed off, CEO Jeff Skilling held a champagne toast celebrating the change, which let Enron decide what its investments were worth and record upfront windfalls on future profits that were fuzzy at best.

The particulars of Enron’s business were different, and a lot more wiggle room goes into valuing things like energy contracts than the Treasury and mortgage bonds that got SVB in trouble. But it’s a reminder that no rules are perfect.

Notable

- The Financial Times has a fun rundown of Credit Suisse analysts giving their take on the SVB meltdown and awkwardly omitting their own bank’s predicament.