The News

First Republic hasn’t given up hope that its competitors and the U.S. government will bail it out of a financial hole that is getting bigger by the day, people familiar with the matter said.

It’s been more than a month since First Republic, teetering on the edge of failure, was saved by emergency funds from the Federal Reserve and a slug of deposits from 11 U.S. banks.

But that solution was a stopgap at best. It saved First Republic from collapse but doomed it to a financial netherworld, not dead but not healthy. The government money is more expensive than the depositors’ cash it replaced, squeezing First Republic’s margins and leaving the bank a zombie, at least for a while.

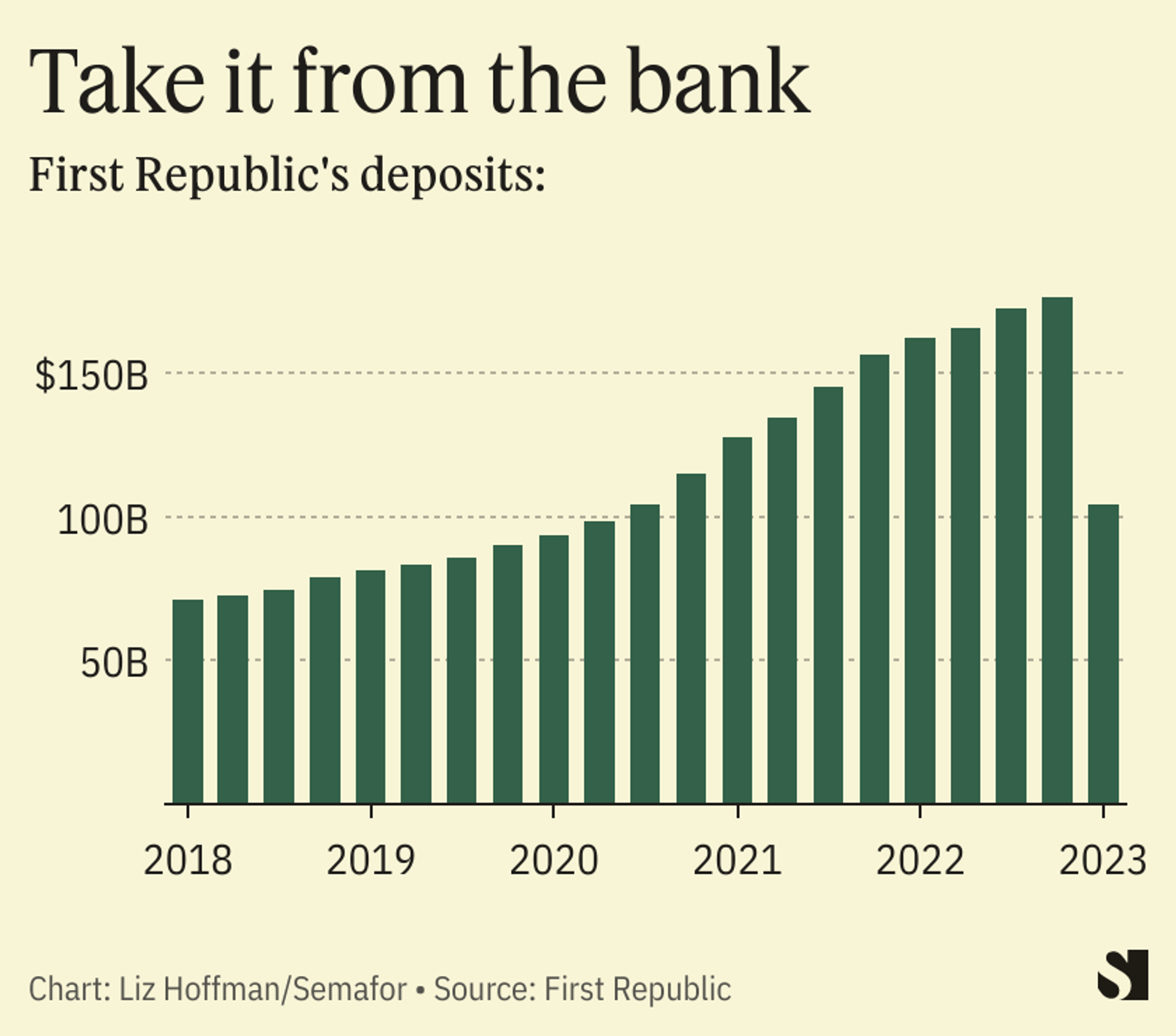

Investors got their first clear picture of that reality yesterday, when the bank reported first-quarter results. Customers yanked more than half of their deposits, about $100 billion in a matter of weeks. The bank borrowed $80 billion from the federal government to fill the gap. The resulting 19% drop in loan profits is a preview of what’s to come. The stock dropped nearly 30% Tuesday morning as shareholders absorbed the news.

Conversations between big-bank executives and government regulators have been quietly happening, people familiar with the matter said. But they’ve stopped short of formal discussions with the biggest banks like JPMorgan, Bank of America, and Citigroup, whose buy-in would be needed to orchestrate a permanent rescue — much less the kind of in-person pressure campaign, involving black cars ferrying executives down to the New York Fed — that will likely be required to get the industry to bail out one of its own.

In this article:

Liz’s view

An industry rescue is the smart move for everyone.

Here are the outlines of a plan being kicked around among First Republic’s camp, according to people familiar with the internal discussions:

The bank’s loans and investments were about $25 billion underwater as of year end. It had $17 billion in shareholders’ equity. That’s an $8 billion hole. (It’s probably smaller: The bank didn’t update those figures yesterday, but the gap is likely narrower now because yields have fallen.)

Creating a “bad bank” backed by private equity could shoulder half those paper losses and see their way to mid-teens returns by holding First Republic’s assets, shielded from the market noise, until they mature. The bank is also feeling out private-equity firms to invest directly into First Republic, people familiar with the matter said, though their ownership would be capped under banking rules at 25%.

If banks shared the other half on the same terms they funded the $30 billion in deposits they gave First Republic last month, it would mean a roughly $500 million loss each for JPMorgan, BofA, Citi, and Wells Fargo; $250 million for Goldman Sachs and Morgan Stanley; and $100 million each from smaller banks like PNC and Truist.

That’s not nothing, about 3% of their 2022 profits. But U.S. banks paid a combined $8.3 billion into the FDIC’s deposit-insurance fund last year, and that figure is heavily weighted toward the biggest banks. They’ll be paying for First Republic’s failure one way or another.

If First Republic is closed by regulators and its assets auctioned off, the move is likely to cost taxpayers something in the neighborhood of $40 billion.

The rough math: First Republic had $144 billion in mortgages and other loans as of Dec. 31, and the FDIC takes an average 28% haircut when it sells off failed banks, according to researchers from MIT and the University of Chicago. (The buyer of Signature, which failed shortly after SVB did, got a 23% discount last month.) Banks pay into the FDIC’s deposit-insurance fund, and those costs will be passed on to them.

Plus, the failure of First Republic would reopen the question — never fully settled — of whether the government is explicitly guaranteeing all retail deposits. So far depositors and stockholders have accepted Fed Chair Jerome Powell’s squishy promise that all deposits “are safe.” Pressure-testing it can only go badly.

The biggest banks have so far been the beneficiaries of customers’ jitters, raking in billions of dollars in fresh deposits. But as JPMorgan CEO Jamie Dimon wrote in his annual letter earlier this month, “any crisis that damages Americans’ trust in their banks damages all banks… The notion that this meltdown was good for [us] in any way is absurd.”

Room for Disagreement

Oligopolies are hard to corral, and some of the biggest banks might prefer an FDIC seizure, hoping to pick up First Republic’s assets and the clients who stuck around at a steep discount.

First Republic could also just limp along, less profitable and trading below its book value. That isn’t fatal — Citi has traded below its book value for years — but it isn’t a recipe for a thriving regional banking sector. First Republic said on Monday it plans to sell off assets, and it could shrink its way to profitability.

Notable

- Read Dimon’s letter for more on his take on the recent banking turmoil.