The News

The U.S. government chose efficiency over ideology by allowing JPMorgan, the largest American lender, to purchase First Republic Bank for $10.6 billion, bringing a quick and clean resolution for the ailing California lender.

The hasty sale of First Republic, arranged over the weekend, is a marked difference from the way the Federal Deposit Insurance Corp. handled the failure of Silicon Valley Bank in March. That sales process dragged out for two weeks, partly because the government was reluctant to sell SVB to the largest U.S. banks, some of which were interested, including JPMorgan, Semafor previously reported.

JPMorgan was in one of the strongest positions to buy First Republic, reporting record earnings in the first quarter, aided by an influx of deposits amid the regional banking turmoil and a jump in interest income. PNC also submitted a bid for First Republic while Bank of America was invited to the auction but ultimately declined to participate, people familiar with the matter said.

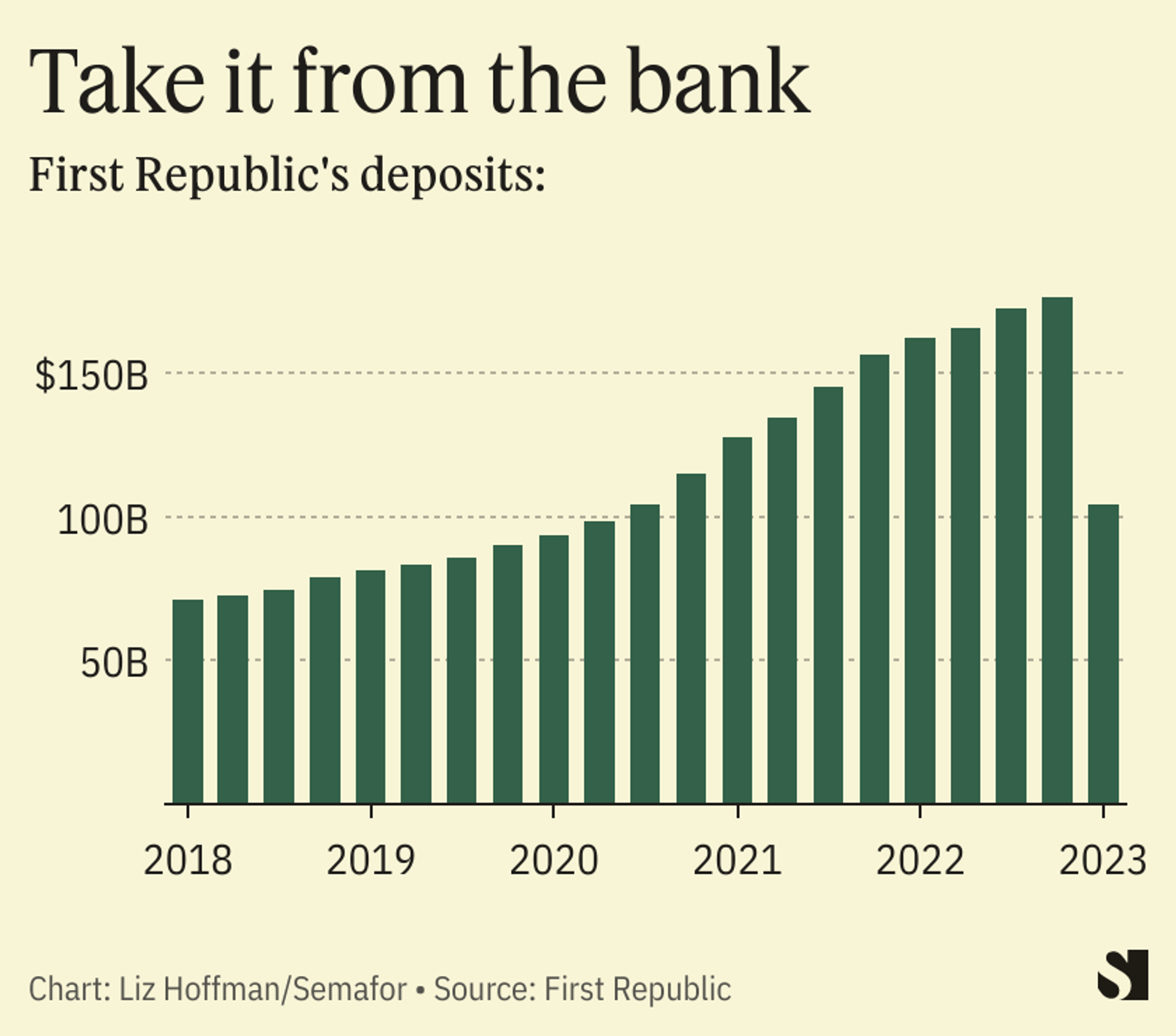

JPMorgan will take over most of First Republic’s $230 billion in assets and some of its liabilities, including almost $100 billion in deposits but not its corporate debt. The government will split future losses on First Republic’s loans, typical for the sale of banks in FDIC receivership, and will provide $50 billion in financing to help sweeten the deal.

The agency said the deal will cost the Deposit Insurance Fund $13 billion. First Republic’s 84 offices reopened on Monday under the JPMorgan banner.

“Our government invited us and others to step up, and we did,” JPMorgan CEO Jamie Dimon said in a statement.

In this article:

Know More

The deal also shows that JPMorgan was comfortable with the legal risks of buying an ailing lender, a sore spot for Dimon. Its acquisitions of Bear Stearns and Washington Mutual during the 2008 financial crisis, which were also orchestrated by the U.S. government, brought years of lawsuits, fines, and operational headaches.

The FDIC and JPMorgan fought for years over who should pay for investor claims against WaMu, and Dimon has said publicly that he regretted the Bear Stearns deal. A key difference here is that First Republic’s assets appear to be higher-quality and cleaner: The bank’s problem was a lack of investor confidence, not mounting losses on a toxic loan book.

“We’re getting a very clean bank in the cleanest way you can get it,” Dimon said of the First Republic deal. “We didn’t have the mortgage crisis sitting on top of Bear Stearns and WaMu.”

Liz’s view

I’ve written before during this slow-moving crisis that I thought Washington’s response was too slow and too politically tinged, but this is a surprisingly good deal for the government and, by extension, taxpayers.

JPMorgan looks to be taking a $13 billion haircut on First Republic’s assets (that’s the cost to the deposit insurance fund). That’s well below the 23% discount First Citizens paid for the SVB assets it bought in March, and less than the average cost to resolve a failed bank. And unlike in the forced sales of SVB and Signature Bank, where buyers left behind the worst loans and investments, JPMorgan is buying mostly the whole bag.

One additional benefit: The FDIC avoided having to invoke a “systemic risk” exception to guarantee First Republic’s uninsured deposits. Government officials have tied themselves in verbal knots to avoid making explicit the promise that depositors are safe, and this deal kicks that decision to another day — potentially permanently if the market holds.

Not to say this isn’t a gift to JPMorgan, already the country’s biggest lender. The government will take 20% of losses on the loans over the next few years, which should be more than enough. It’s also getting $50 billion in government financing to help close the funding gap between the $92 billion in deposits it’s picking up and the $200 billion in assets.

And JPMorgan has been trying to grow its private bank and wealth-management businesses, which are far smaller than those of Morgan Stanley and Bank of America. The failures of SVB and First Republic might ding that business model for a little while, but managing money for rich people is still a very good business, and one prized by shareholders.

(On that note, I’m a little surprised to see Morgan Stanley sit this out. First Republic has been high on its takeover list for years, and CEO James Gorman sounded awfully acquisitive on last month’s earnings call.)

Plus, JPMorgan, by virtue of its size, wouldn’t have been able to buy another bank on a clear day. Now it pads its $500 billion in assets lead over Bank of America.

Dimon may have lasting regrets about his 2008 government-brokered purchases of Bear Stearns and WaMu, but they cemented JPMorgan as the nation’s biggest bank, and the years that followed cemented its reputation as the best-managed. Banking is a scale business, and JPMorgan just bulked up.

Now What?

Keep an eye on other troubled regional banks today. Their stocks, which tanked during the worst of the turmoil this spring, held up well last week. But with First Republic gone, any remaining investor nerves will have to go somewhere.

Shares of Western Alliance were down 1% in premarket trading, and PacWest was down 2.6%.

Room for Disagreement

Democratic U.S. Senator Elizabeth Warren, a vocal critic of Wall Street and mergers that allow bigger banks to grow, slammed the deal on Monday morning. “The failure of First Republic Bank shows how deregulation has made the too big to fail problem even worse,” she tweeted. “A poorly supervised bank was snapped up by an even bigger bank—ultimately taxpayers will be on the hook. Congress needs to make major reforms to fix a broken banking system.”

Notable

- JPMorgan breaks down the First Republic deal and its impact on the biggest U.S. lender’s balance sheet.

- Dimon airs his regrets about his 2008 rescues.