The Scene

Joe Biden and Donald Trump will take the stage in Atlanta with predictable stories about the American economy from 2017 to 2020 (the Trump Boom!) and 2021 to 2024 (the Biden Recovery!).

But the record isn’t as simple as either will portray. History and data show more blotches than either will admit and a narrative that defies either political agenda. Here is what actually happened to the economy on the respective watches of both men.

The Trump Record:

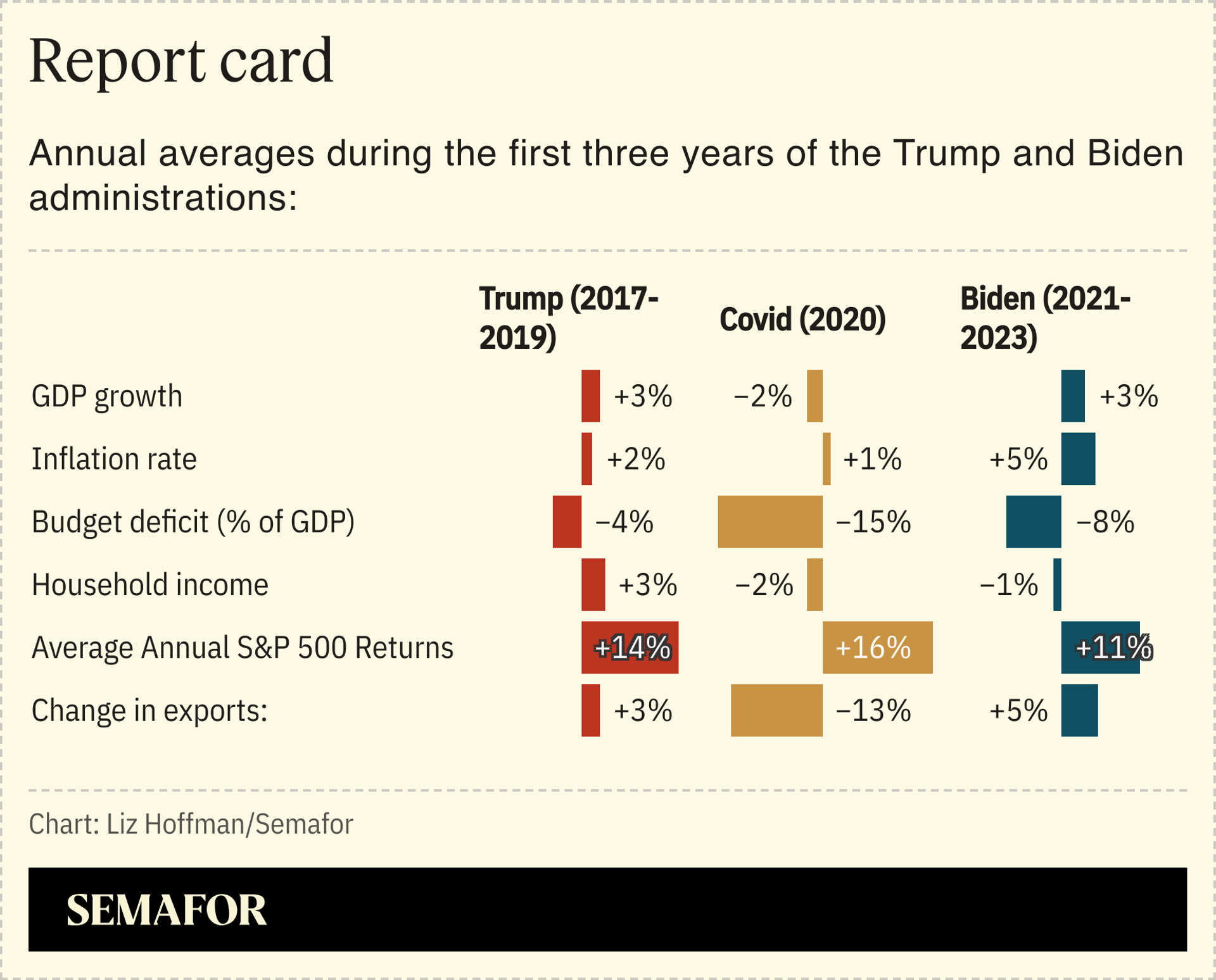

Trump championed deregulation, individual and corporate income tax cuts and tariffs during his first three years in office. The remarkable fact of those years was the economy’s stability, not any profound change in its performance after he advanced that policy agenda.

Economic output, as measured by the gross domestic product, grew on average by 2.7% a year from 2017 through 2019, modestly faster than the 2.4% rate during the three years that preceded Trump’s arrival. Annual increases in employment, at 2.1 million, were robust, but less robust than the yearly gains of 2.7 million during the final three years of the Obama Administration.

In short, Trump’s policies mattered, but likely not as much in the short run as either his allies or adversaries have argued. His tariffs were not the disaster many economists predicted and Biden later took up his approach to China. The U.S. still runs large trade deficits. His tax cuts didn’t start a boom; they carried on an expansion whose most marked characteristic was its longevity, not its pace.

The US was nearly seven years into a recovery from the 2008 financial crisis when Trump took office. Progress had been frustratingly slow, but steady, and the US was finally nearing the sweet spot in an expansion when unemployment gets so low that wages rise for everyone, even low-income workers. It finally hit that point in 2019.

Perhaps the most important thing Trump did early in his tenure was avoid a recession.

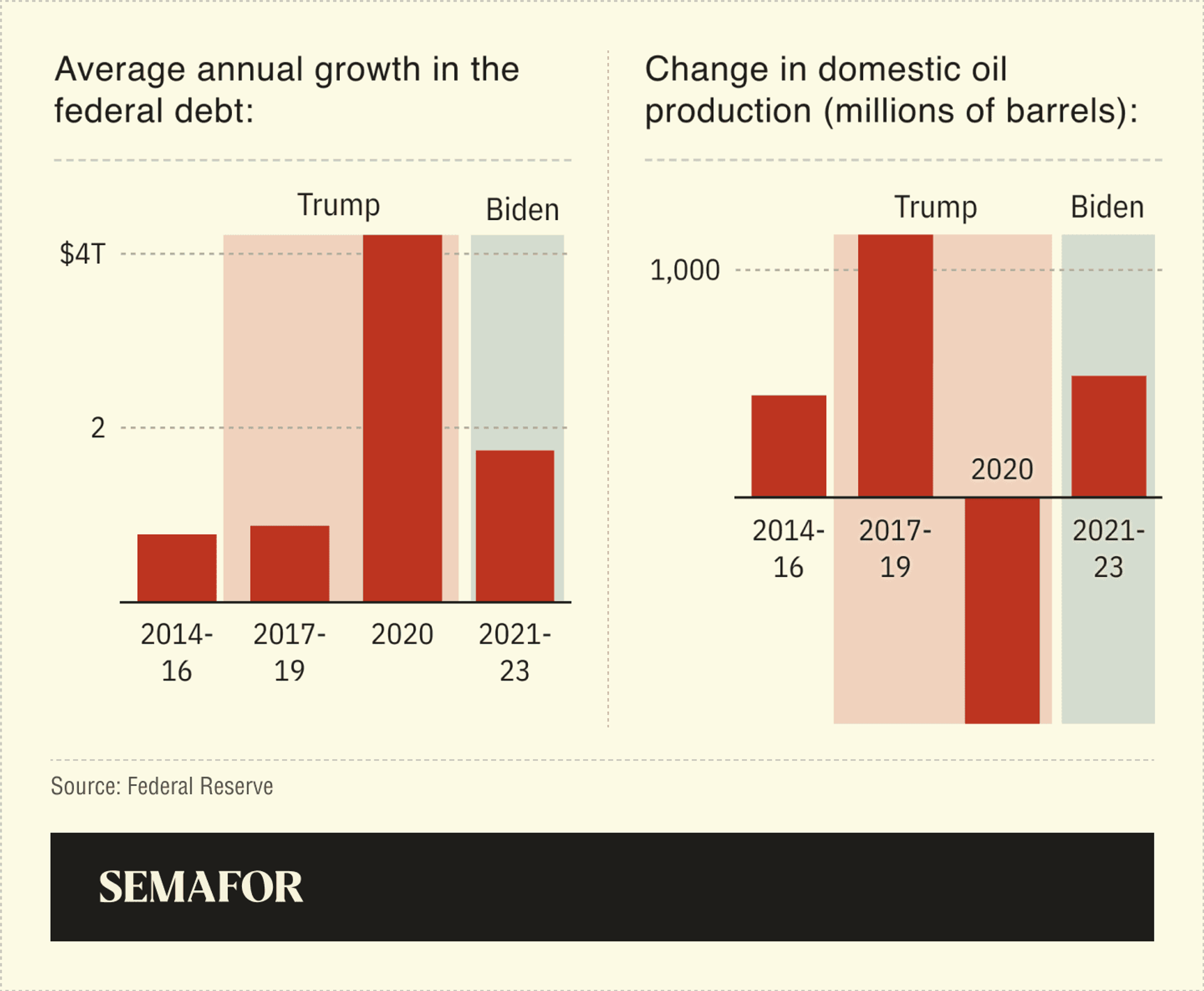

One thing he didn’t do was tame the budget. Normally budget deficits shrink when the economy is growing, as tax revenues rise and households have less need for government programs like unemployment insurance or food stamps. Tax revenues rose 6% while spending rose 15% during Trump’s first three years in office, causing the annual budget deficit to grow from $585 billion in 2016 to $984 billion in 2019. Without the federal borrowing, economic growth rates might not have been any better than Obama’s.

The Covid Response:

Trump’s reaction to the outbreak of COVID-19 was an explosion of government spending and transfers of wealth that drove federal debt up $4 trillion in 2020 and government outlays up 47% in one year, precursors to an inflation outbreak.

The legacy of past crises was on the minds of many US officials when Covid hit. During the 2008 meltdown, banks and auto companies were bailed out while households were left to work out their own problems in bankruptcy. This time, a major feature of bailouts was relief checks to households. Trump presided over the first two rounds of such aid and on his way out of office proposed a third.

The Biden Record:

Biden and congressional Democrats made those relief checks a central feature of the $2 trillion American Rescue Plan that they launched in March 2021.

The US was then about 11 months into an economic recovery. History strongly suggests it didn’t need more federal spending by then. Nor did it need the very low interest rate policies advanced by the Federal Reserve, led by Jerome Powell, who was first nominated by Trump and later backed for a second term by Biden.

The Fed and Biden’s economic team, including Treasury Secretary Janet Yellen, were haunted by the long slow recovery from the 2007-2009 financial crisis, which proved to be costly. They were intent on bringing unemployment down fast. After two decades of exceptionally low inflation, they didn’t think a surge in consumer prices could be a problem.

They were wrong.

During Biden’s first three years in office, growth in economic output was faster than during Trump’s first three years as president and hiring was faster, thanks to the exit velocity from the crisis that was fueled by government spending and low interest rates.

It turns out the recovery’s speed meant little to Americans sizing up Biden’s economic record because of the accompanying inflation surge, which was worsened by global supply chain disruptions also sparked by Covid. Gallup finds that 38% of Americans have confidence in Biden’s economic stewardship, compared to 46% who have confidence in Trump.

Jon’s view

The spending Biden marshaled on climate programs and domestic semiconductor production may reap long-run dividends. At the moment these programs ensure Trump and Biden have one economic fact in common: Both presided over surging government debt and spending and neither has presented a serious plan to change that course. History suggests this debt accumulation won’t be addressed unless it leads to another crisis. History also suggests that few will be prepared for a crisis when it happens.

The two men also are bound by Covid and their responses to it. Perhaps the most important question voters should be asking about the coming election is who they want making decisions when another crisis inevitably hits, in whatever form. Crisis and response to it are the thunderous hands that shape the modern economy. The nation needs leaders who can manage such moments wisely.