The News

Bill Ackman slashed the $25 billion whisper target he’d set for the IPO of his investment fund and asked big investors to put in their orders, “the sooner the better.”

A letter sent to big investors this week is a sign that demand for shares is lighter than the billionaire had expected. Not expecting the letter to be publicly disclosed — lawyers later disagreed — Ackman disclosed the names of several anchor investors (Texas Teachers is in for at least $60 million) in Pershing Square USA, as the fund is called, and tackled doubters’ concerns about its structured: “We have addressed this issue by analogy by comparing PSUS to Berkshire Hathaway.”

The IPO is a high-stakes moment for the investor and a milestone in his decade-long comeback story. Bravado is a key ingredient in any Ackman endeavor, but he may have overshot here: After privately telling investors for weeks that the IPO could raise as much as $25 billion, he’s now aiming for $10 billion, though even that would be a record sum for this type of investment vehicle.

The disclosure of today’s letter led to a strange caveat: “The Company specifically disclaims the statements made by Mr. Ackman.”

A Pershing Square spokesman declined to comment, citing the upcoming listing.

Liz’s view

Ackman expects PSUS to trade above the value of the stocks it owns, something few such funds have ever done. Legendary investor George Soros’ Quantum Fund pulled it off in the 1980s, as did an early bitcoin ETF, back when it was harder for individuals to own actual tokens. But there’s no real economic reason that a basket of stocks should trade for more than the sum of its parts.

Ackman is betting instead on an uneconomic driver: his growing army of ideologically aligned, extremely online fans. Ackman has become a celebrity on X, where he’s criticized diversity efforts, supported Israel, and, recently, signal-boosted conspiracy theories about Joe Biden and the Trump shooter. He’s hoping that amen corner will provide the same, economically irrational support for his stock that Elon Musk’s acolytes have provided for Tesla and meme-stock legions have given GameStop.

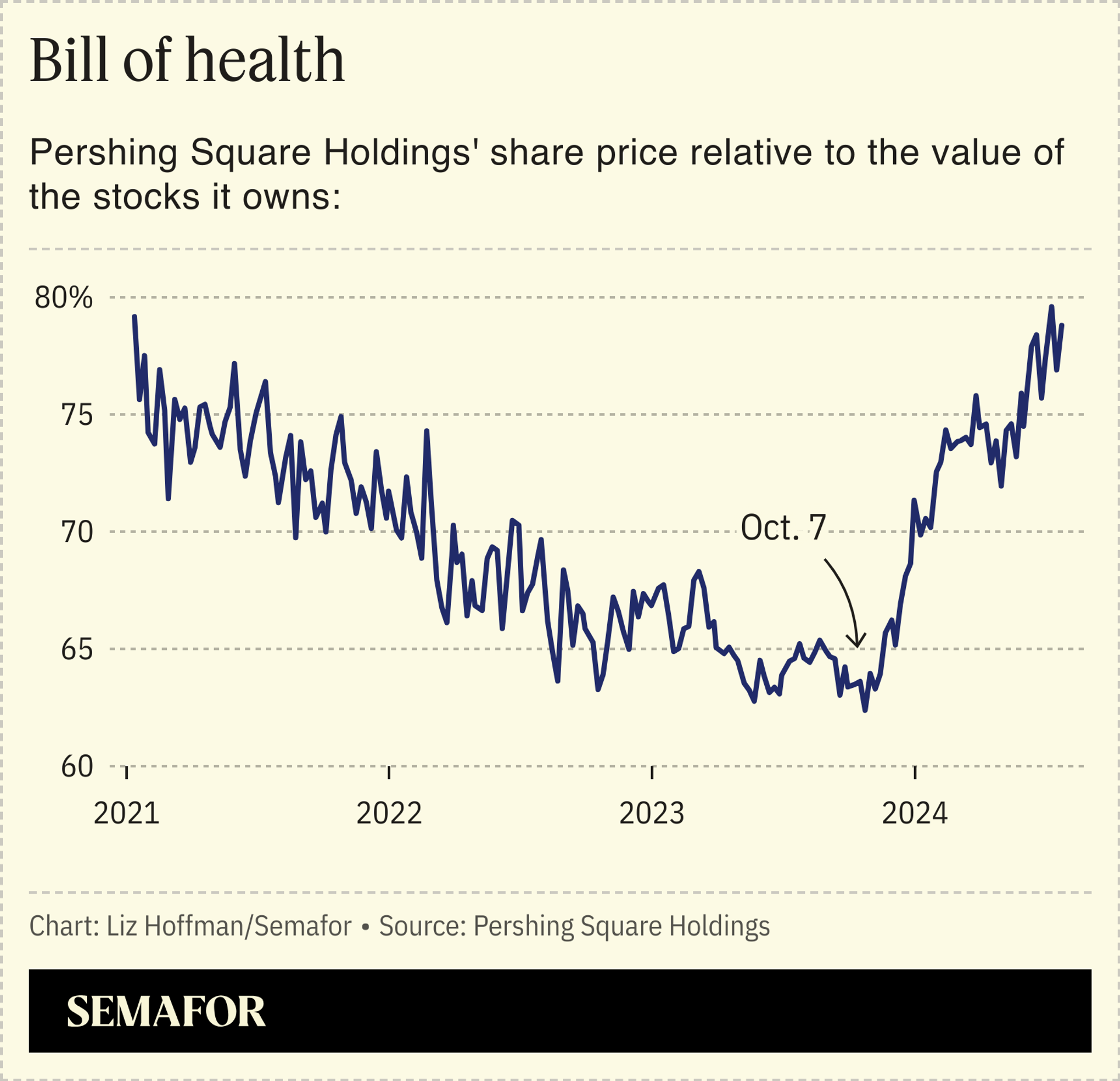

It’s already working in another corner of his investment empire: Shares of his Amsterdam-listed fund, a precursor to the one he’s now taking public in New York, have been on a tear since he started posting, adding more than half a billion dollars to Ackman’s personal wealth in the process.

That rise, which began shortly after the Hamas attack in Israel spurred Ackman to his keyboard, came despite European rules that limit his ability to promote his fund on X. With his US fund, he’s free to do so, and has said he plans to. If Ackman’s turn as right-wing provocateur is worth $2 billion to investors in a little-known, Amsterdam-listed fund, imagine what it could be worth to the madding crowds in America.