The News

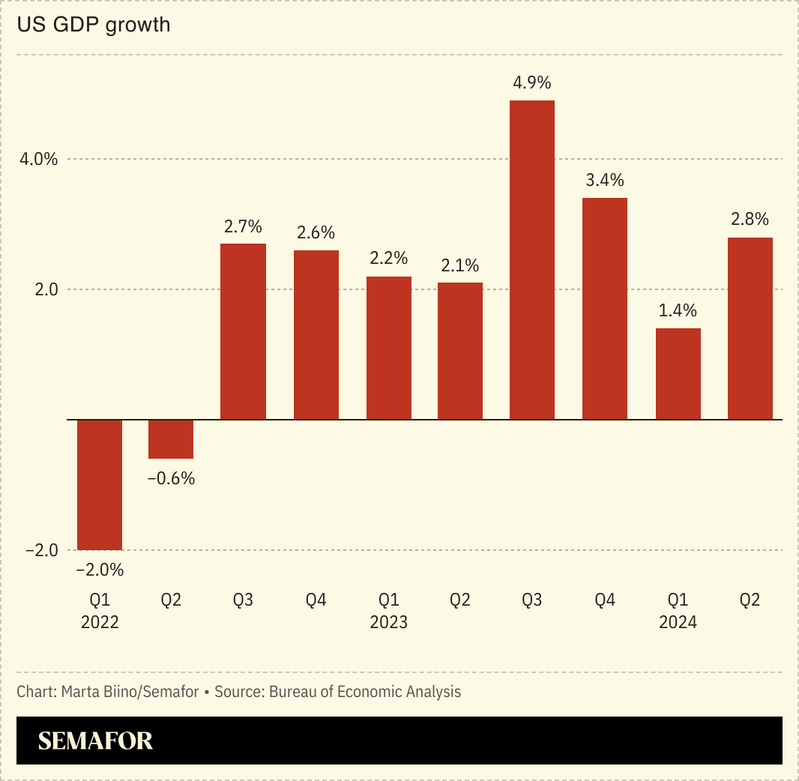

The US economy grew 2.8% in the second quarter, faster than expected.

Contributions to the growth, which exceeded consensus forecasts of around 2%, came from both consumers, who kept spending as inflation eased, and businesses, which are buying equipment and restocking inventories to keep up. Overall, there are signs that the economy is returning to more normal operations after the 2020 slump and post-pandemic boom.

“The economy has been growing gangbusters over the last several years but now it’s settling back into a more normal pattern,” Ryan Sweet, chief US economist at Oxford Economics, told The Washington Post. “We are in a period of transition.”

But the news complicates the outlook for the Federal Reserve, which is trying to find the right moment to start cutting interest rates. Too soon and it risks reigniting an economy that is finally cooling, but is shooting off some conflicting data signals. Even as the economy is growing at a sustainable clip, unemployment is ticking up and there are signs that consumers are having trouble paying their bills.

SIGNALS

September rate cut still looks promising

Thursday’s report comes ahead of the Fed’s scheduled meeting next week, when it is expected to discuss interest rates and could signal a timeline for a rate cut. “The report shouldn’t change the outlook for the Federal Reserve’s next moves,” however, the Wall Street Journal reported. “Officials have signaled that they expect to hold interest rates steady at their meeting next week but could cut at their subsequent meeting, in September, if inflation continues to cool.” One thing likely weighing on officials’ minds is that, while growth beat expectations, it shows an overall cooling. And “even though predictions of a recession have faded, there are signs of weakness,” the Journal noted. For example, unemployment remains low, but employers opened roles at a slower pace than last quarter, signaling the hot jobs market has plateaued.

Report could boost Harris campaign

Danielle Deiseroth, executive director of left-wing think tank Data for Progress, told the BBC there’s an “upside” for the prospective Democratic candidate Kamala Harris beyond that the economy is strong, as she can “put distance between herself and President Biden” on inflation. The economy is a prime talking point in this year’s US presidential election, with Trump accusing the Biden administration of weakening it and causing inflation, while Biden claims the US has the strongest economy in the world. “The country’s steady growth — far outstripping its international peers — would usually typically favour Democrats as the incumbent party. But the current mix of conditions has made for a puzzle,” the BBC said, nodding to the fact inflation woes mean many voters don’t agree with Biden’s assessment, despite the numbers.

The numbers aren’t bad, but try telling consumers that

Consumers tend to perceive the economy based on what’s coming out of their pockets, The Roosevelt Institute’s Elizabeth Pancotti told the Missouri Independent. While GDP numbers are improving, overall grocery bills are still high, so voters don’t have much confidence that the economy is getting better. “When egg prices finally come down and chicken prices finally come down, but orange juice is high because of some random citrus greening disease or some other shocking food item, your total grocery bill doesn’t come down and that really highlights it,” Pancotti said. While inflation has fallen, there are other factors outside the control of the Fed and the Biden administration keeping prices high, including a post-COVID labor shortage, supply chain disruptions, extreme weather, and even the avian flu, The Washington Post noted.