The News

The eurozone economy grew by 0.3% in the second quarter, slightly exceeding economists’ predictions, but Germany revealed it is tipping toward a recession.

Growing gross domestic product — the total value of goods and services — in Spain, France, and Ireland helped offset a 0.1% decline in Germany, Europe’s biggest economy but lately its problem child.

The eurozone entered a technical recession in the second half of 2023, and while analysts said that the latest figures suggest it is healing, it’s still unclear how long the recovery will last.

“The question remains where the economy will head from here and recent data do not provide much confidence that the eurozone economy is further accelerating,” wrote one economist.

SIGNALS

Germany is ‘the weak link’ of the eurozone

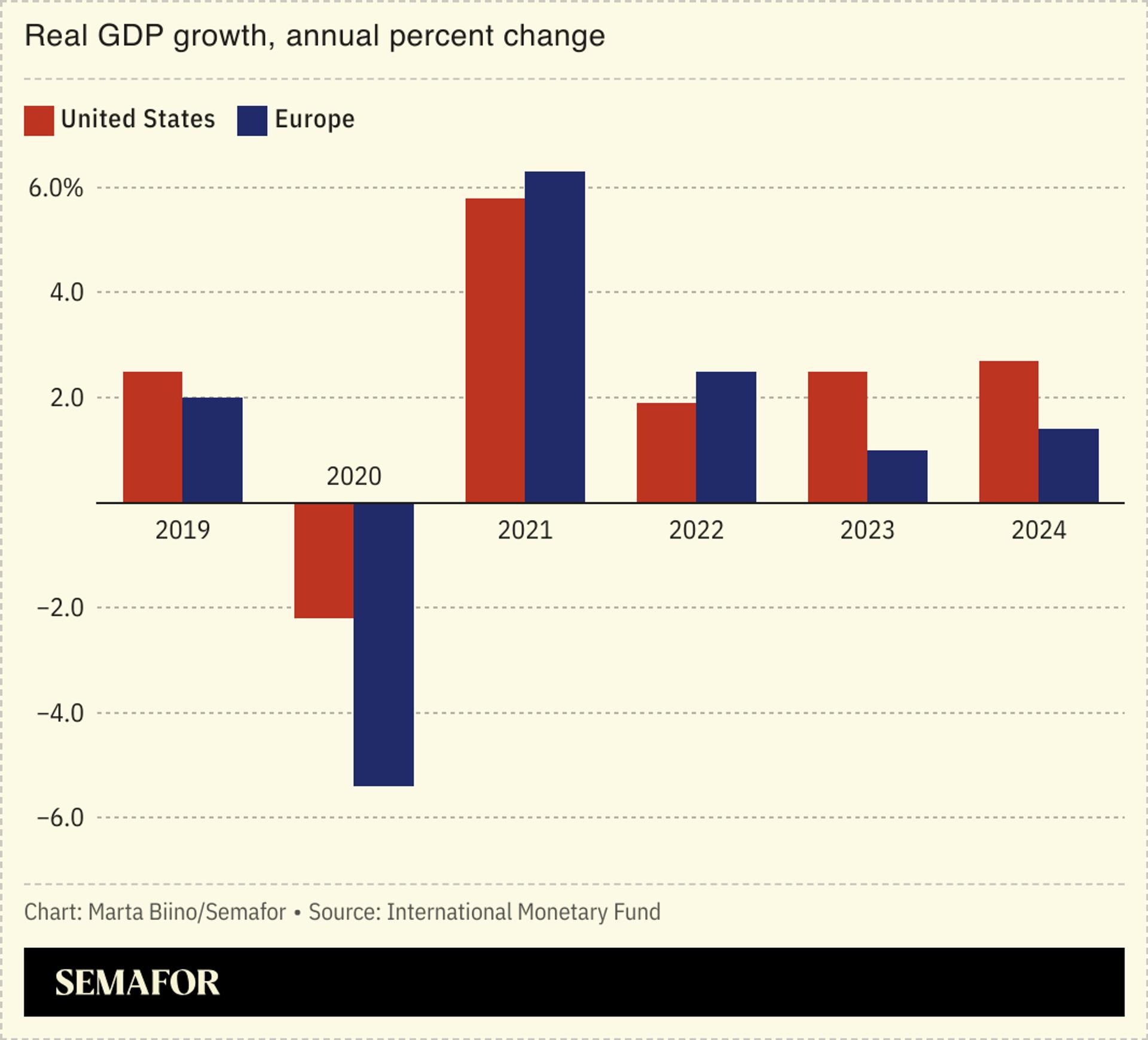

Economic growth in Europe has lagged far behind the US and even some developing economies, an economist told The Guardian: “Leave out Spain and you just have an economy that moves along at a lacklustre growth pace.” The Spanish economy continued to grow at a strong pace in the second quarter, largely driven by tourism, the Financial Times noted. But Germany has become “the weak link,” and it could turn out to be a more significant drag for other countries, too. It has hardly grown at all since the start of the pandemic, prices are still almost 20% higher than pre-pandemic levels, and industrial orders are slowing down.

Uneven growth could influence interest rate decisions

The region’s uneven growth complicates the decision-making process for the European Central Bank, which, like most other central banks around the world, is waiting for the right moment to cut interest rates and ease up on measures meant to tamp down inflation, Bloomberg noted. More crucial data for that calculation will emerge on Wednesday, when Europe’s inflation report comes out. The ECB is likely to “move cautiously,” an economist told the outlet, “as it worries about strong services inflation.” Lower borrowing costs are “very much needed for consumers to start buying goods again,” the CEO of a Swiss chemical company added.

ECB interest rate decision may push US and EU to diverge

The US economy has far outpaced Europe’s going back to the 2008 recovery, a gap that widened when America bounced back from COVID-19 lockdowns faster than the continent. Consumers are spending more and benefiting from huge government programs in the US, like infrastructure spending and student-debt suspensions, The Associated Press noted; in Europe, governments and consumers are more conservative. As central banks move to cut interest rates, the descent will be difficult, Bloomberg markets editor John Auther wrote. “As with scaling mountains, coordination is vital in monetary policy. Mountaineers find safety in roping themselves together. As the Fed has yet to begin its descent, peers that have commenced theirs cannot move too far ahead.”