The News

Bill Ackman’s decision to cancel the long-awaited launch of his US fund is the latest example of the billionaire’s mouth getting ahead of his wallet.

He pulled the IPO of Pershing Square US, a fund that would let retail investors mirror his stock-picking strategy, after demand dried up. What started as a $10 billion whisper number, then became a $25 billion whisper number, fell last week to $4 billion, then to $2 billion, and then yesterday to zero.

Ackman said he would “reevaluate PSUS’s structure to make the IPO investment decision a straightforward one” and “report back once we are ready to launch a revised transaction.”

Ackman thought he could parlay his newfound internet celebrity, built during his turn over the past year as a very online, increasingly right-wing provocateur, into financial success. His plan was to turn his army of X fans into shareholders, believing that they would buy his fund simply because it was his. “Welcome to the posse,” he posted in a reply to a fan who’d compared the billionaire to Gladiator.

During his roadshow pitching IPO shares to institutional investors, Ackman told them he believed that shares of PSUS would trade at a higher price than the value of the dozen or so stocks it owned, household names like Chipotle, Alphabet, and Hilton.

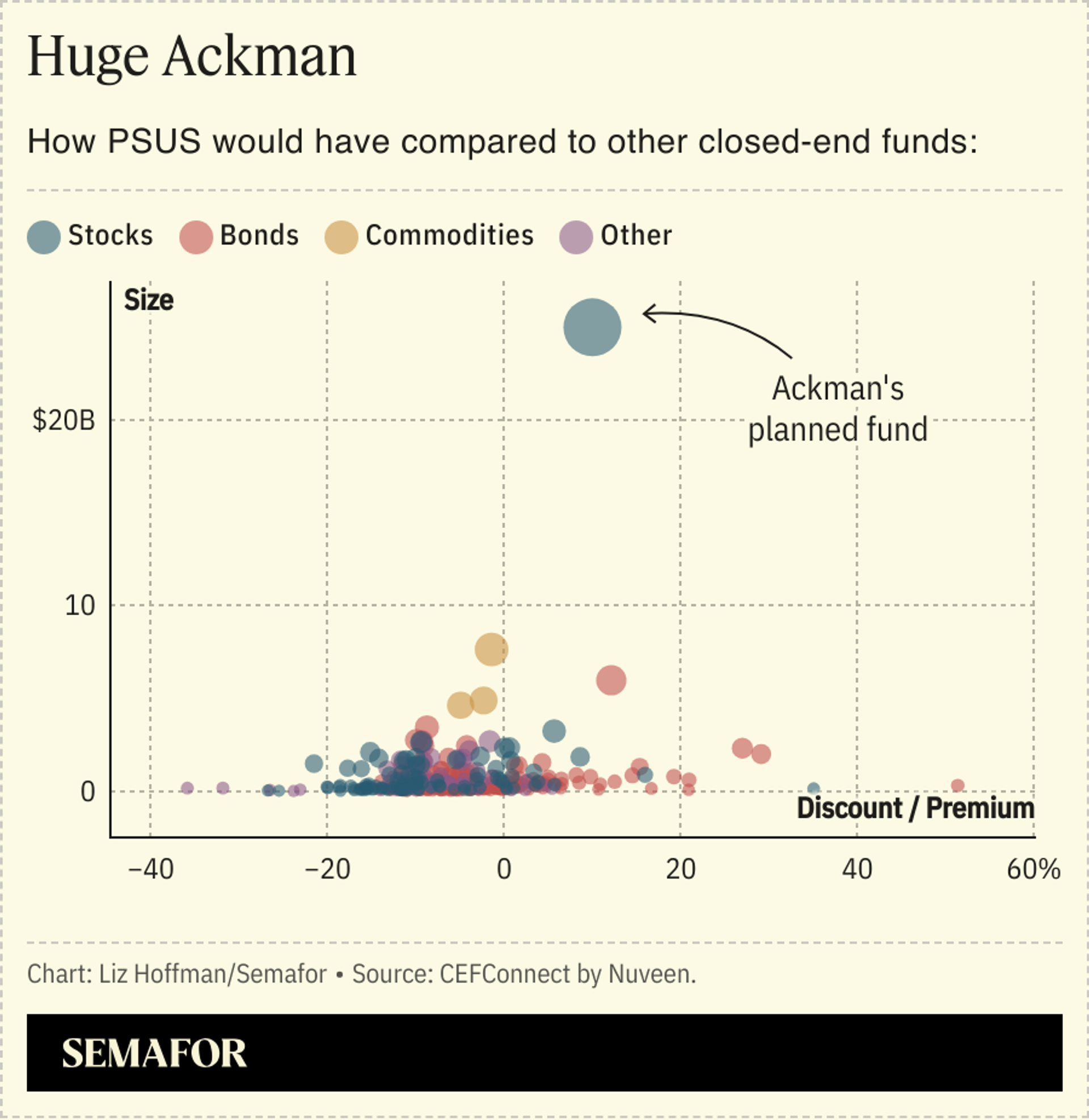

There are about 400 of these funds currently listed, and more than 80% trade at a discount to the value of the securities they own, according to an analysis of data tracked by Nuveen. Those that trade at a premium mostly invest in things that are hard for individual investors to buy, like shares of OpenAI and Discord, or municipal bonds paired with tax-saving strategies. The average closed-end fund has about $600 million.

Liz’s view

The launch of PSUS was a key step in Ackman’s decade-long comeback. It was to be followed by a fund focused on asymmetric macro bets, like his Big Covid Short in 2020 or his inflation wager in 2021, which together turned $200 million into $4 billion. Both were precursors to a listing of Pershing Square itself, Ackman’s main source of personal wealth.

But Ackman’s worst outcomes have always come from his cleverest ideas (tontine, SPARC, hostile tender offers) and his tendency to blend investment theses — many of them perfectly good — with personal missions. The launch of PSUS had both: an obscure investment vehicle, 40 times bigger than the average such fund, built on his newly acquired alt-right fame, and fed by an amen corner of online fans.

Ackman had some reason to think this might work. Shares of his other listed fund, which trades on Amsterdam’s exchange, have soared since he began posting furiously on X last year, spurred on by the Oct. 7 attacks in Israel and the Palestinian sympathizers protesting across college campuses, including his alma mater, Harvard.

Among the investors buying shares in that Amsterdam fund was an Israeli insurance conglomerate called Menora Mivtachim, according to people familiar with the matter. When Ackman saw the firm appear on the fund’s shareholder registry, he reached out to thank them, which is how Menora Mivtachim ended up owning a slice of Ackman’s own management company when the billionaire sold a 10% stake for $1.05 billion in June.

So he’d already seen the virtuous cycle play out once and believed it could work for PSUS.

The difference is that his Amsterdam fund had been trading at a steep discount, around 35%. So there was ample room for Menora Mivtachim and other investors to make money by pushing up the price. At last check, that discount had narrowed to about 22%, which is still sizable.

With PSUS, Ackman was asking investors to buy at 100%, telling them that his celebrity would make the stock trade at 105% or 110%. They decided they’d rather wait and see. “While we have received enormous investor interest in PSUS, one principal question has remained: Would investors be better served waiting to invest in the aftermarket than in the IPO?” Ackman said this week. They decided they would be.

As with a lot of other things, what happens in Amsterdam stays in Amsterdam.