The News

European and Asian stocks fell, following losses in the US, as part of a selloff analysts say was triggered by fears of a US economic downturn.

Japan’s benchmark index fell 5.8%, its second-biggest single-day decline since 1987’s Black Monday crash.

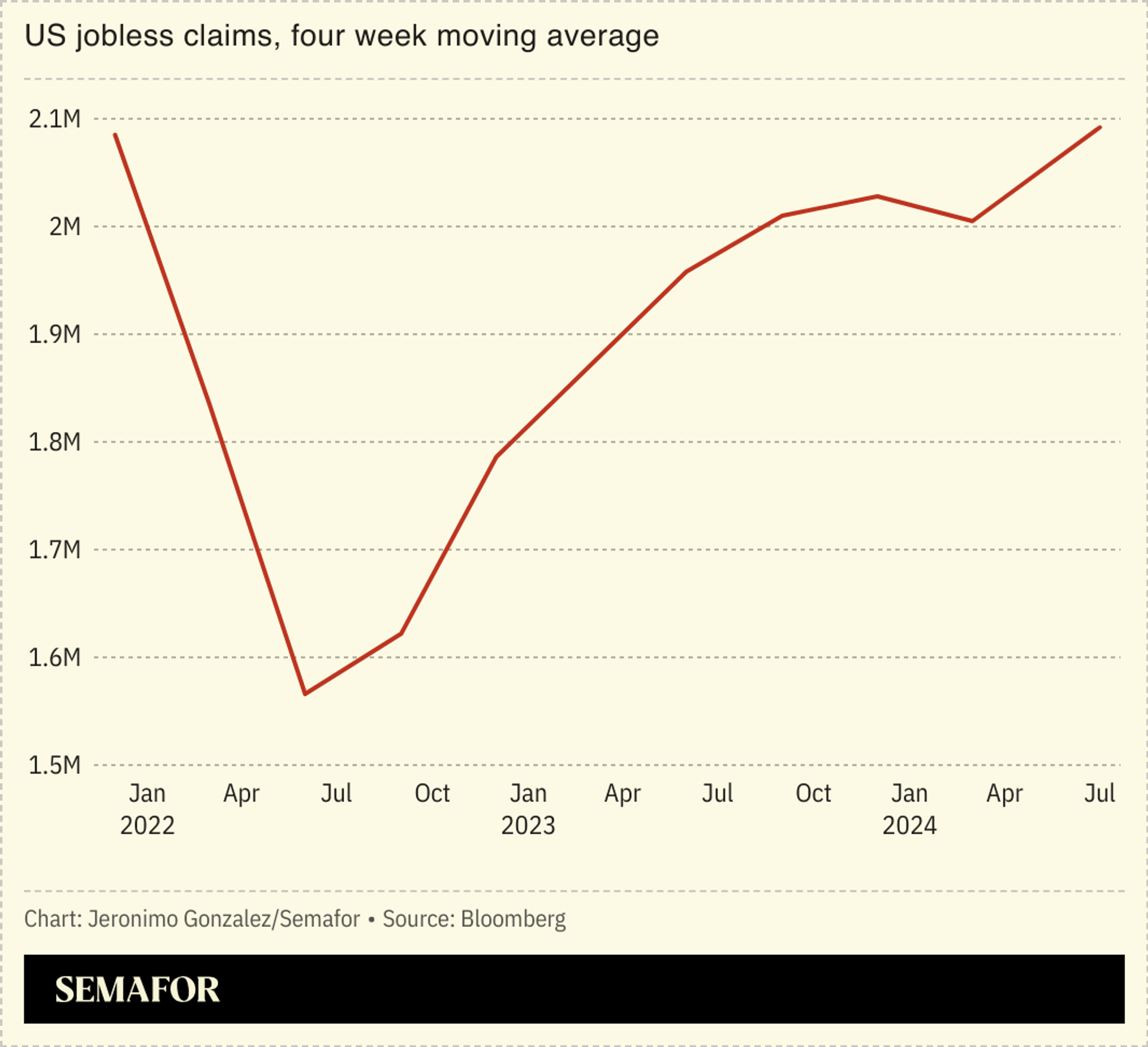

Traders pointed to recent economic data from the world’s biggest economy that showed jobless claims were higher than forecast and that manufacturing shrank. New data on Friday also showed that non-farm payroll numbers were short of expectations, and unemployment rose. Poorer-than-expected second-quarter results from some tech companies added to the bad news.

“It looks like a painful day ahead for Wall Street,” The Guardian wrote.

SIGNALS

Fear of a US recession is impacting markets

The downturn was in large part driven by manufacturing data showing a slowdown, raising fears for a drop in economic growth, while jobless claims were the highest in nearly a year. “We are getting to a point where bad economic news is bad for markets,” one analyst told Barron’s. A number of analysts warned that the Federal Reserve’s decision this week to delay interest-rate cuts could affect the US economy more than expected, and may ultimately come too late. “The economy does not slow in a linear manner,” a Financial Times columnist warned. “The recessionary warnings are flashing, they should not be taken lightly.”

Disappointing tech reports add to the malaise

Bad economic news was compounded by fears over the tech sector, as investors questioned whether a frenzy around artificial intelligence that has driven stock markets to record highs will translate into meaningful profits. The tech-dominated Nasdaq index dropped by 2.3% Thursday. Two tech giants reported disappointing results after markets closed, adding to the malaise: Intel, which announced it would lay off 15,000 employees after failing to capitalize on the AI boom, and Amazon, whose CEO Andy Jassy warned profit would have to take a backseat to investments in in artificial intelligence, Bloomberg analysts said. European tech stocks also reached their lowest point in six months Friday.

US markets could be headed for crash

Some analysts warned that a market crash may be impending, and could come as soon as August, investing-focus website The Motley Fool noted. A prominent investor who made billions in previous trades warned that stocks could lose more than half their value, The Wall Street Journal wrote, and suggested that the US is in the “greatest bubble in human history” caused by high public debt and inflated corporate valuations.