The News

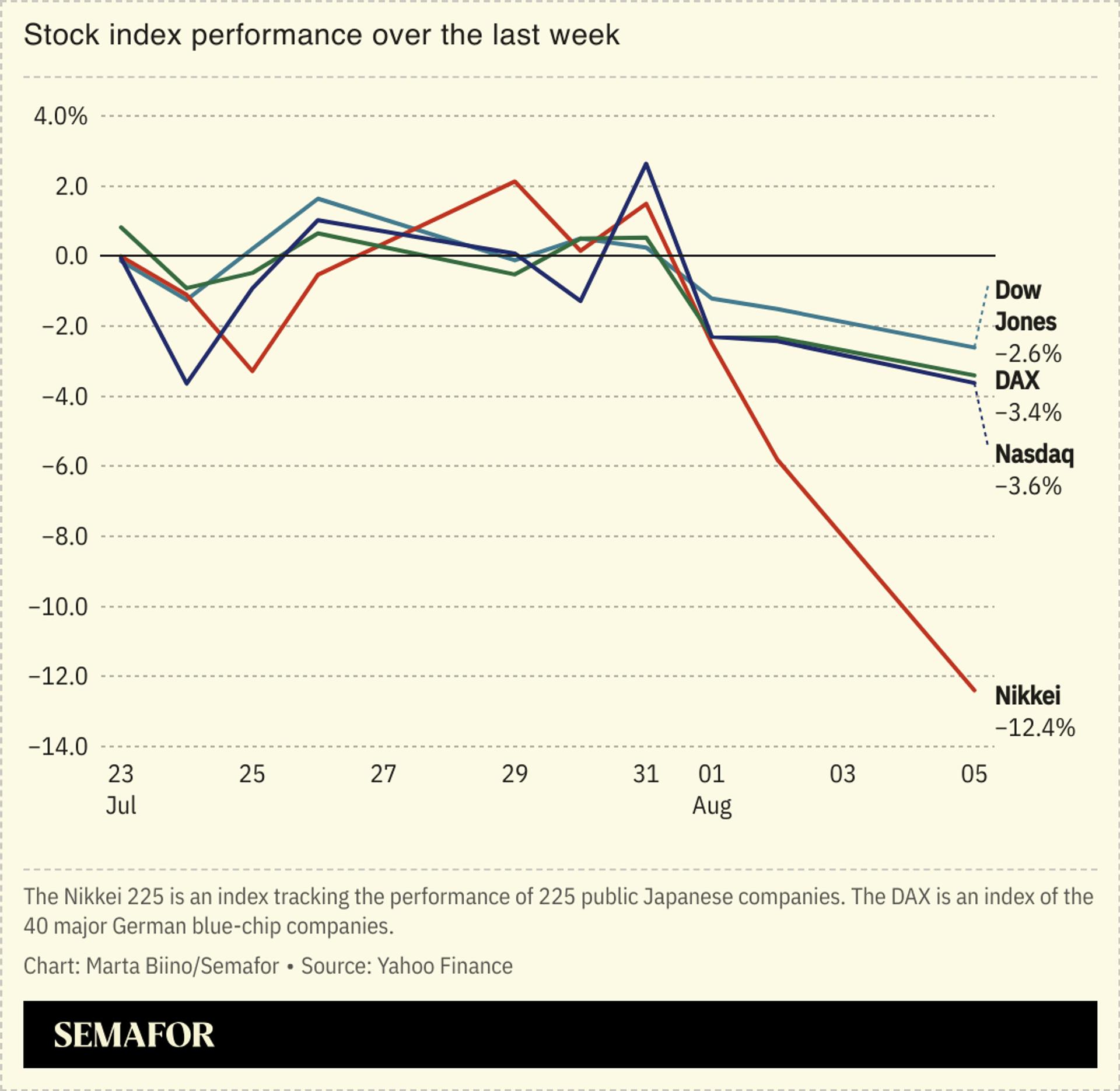

Japan’s stock market tanked on Monday, wiping out nearly $800 billion of market value in its largest single-day selloff ever and setting off a wave of selling on global exchanges.

European and US stocks fell, too, on a mix of investor fears about slowing economic growth, AI hype, and when central banks will start lowering interest rates. A Friday report showed a hiring slowdown in the US and increased unemployment, leading investors to worry that the Federal Reserve has been too slow to act.

SIGNALS

Do we need an emergency rate cut?

Some traders are betting the Federal Reserve will make a snap interest rate cut — lowering borrowing costs before its regularly scheduled meeting next month — as the sell-off continues, Politico wrote. The Fed might have “screwed up” in deciding at its meeting last week not to lower rates, CNN wrote, and could have to scramble now to catch up to an economy that is cooling faster than expected. A snap cut is considered a last-resort measure, the outlet added: The last one came at the onset of the COVID-19 pandemic in 2020. But it’s possible if the fallout starts to threaten important institutions or global stability.

‘Soft landing’ may no longer be possible

For months now, the US economy seemed poised for a “soft landing,” with cooled inflation and no significant rise in unemployment or slowdown in growth. But some doubt is creeping in. Friday’s jobs report showed its highest unemployment levels since 2021 and, according to a measure known as the Sahm rule, which has been historically accurate in predicting recessions, the US may be in for one. Goldman Sachs economists upped the risk of a recession from 15% to 25% in a note to clients, Bloomberg reported. Markets have suddenly moved “from a warm, summer’s day straight into autumn,” an executive at one of Europe’s largest asset managers told the Financial Times.

Job numbers might improve if Fed cuts rates, but not immediately

Lower borrowing costs will eventually prompt employers to hire back some of the jobs they trimmed over the past two years, but not yet, an analyst told Business Insider. “This is not medicine that hits the bloodstream immediately,” he said. That means people who are looking to change jobs may be wiser to stick it out a bit longer.