The News

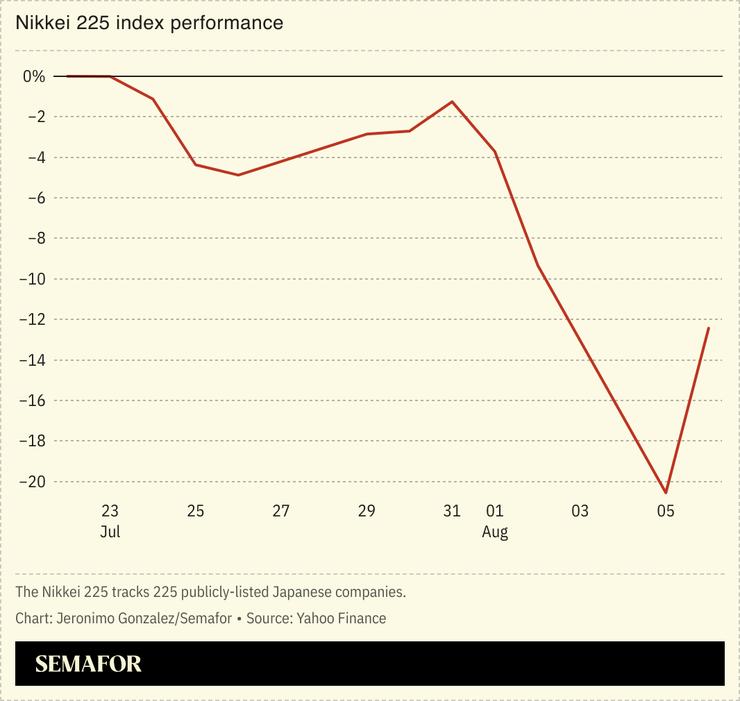

Japan’s stock market rebounded on Tuesday, bringing calm to global markets after shares plunged Monday on fears of an impending recession in the US.

The Nikkei index, which had its worst day since 1987 on Monday, gained 10%, while S&P 500 futures rose about 1% ahead of the opening bell in New York. European stocks mostly continued falling after a positive start to the day.

The reprieve suggests that Monday’s sharp declines were a brief panic, made worse by some technical factors. But analysts still predict more volatility ahead, as AI hype is replaced by growing skepticism about its costs, geopolitics continue to flare, and the dollar stabilizes against the surging yen.

SIGNALS

Volatility will be ‘the name of the game’

A volatility barometer known as Wall Street’s “fear gauge” reached a four-year high Monday. Unrest will be “the name of the game” over the next few weeks, Bloomberg News anchor Kriti Gupta said: “When you see an extreme reaction on either side, whether it’s to the upside or the downside, you are due for some sort of reversal.” A rebound was to be expected given the lack of an immediate obvious trigger to the crash, Bloomberg reporter Garfield Reynolds added.

Traders are bracing for a ‘black swan’ event

While a number of analysts argued that Monday’s selloff was overdone, traders are rushing to protect themselves against a “black swan” event, a rare but severe incident that would cause a market crash, Bloomberg reported. Financial wagers that pay out if the S&P 500 falls by 30% or more are more popular than at any time since the beginning of the COVID-19 pandemic. The number of funds that offer protection against calamities has shrunk over the past decade as stock markets kept rising, so investors looking for insurance policies are having to pay more.

Japan crash could signal broader fragility

Monday’s declines show just how interconnected and fragile the global economy is, a Japan-based professor wrote on UnHerd. That disappointing economic news in the US impacted Japan so strongly, and that moves by the Japanese central bank ricocheted to the West just as quickly, could be a harbinger of future difficulty if the long-feared US recession ever arrives. “If merely worrying, rather than disastrous, economic news from the US can spark a conflagration in Japan, what will happen to global markets, currencies, and even the Western security alliance, if something truly calamitous transpires — such as a dollar collapse?” he wrote.