The News

Nvidia said its chip sales grew quickly in the second quarter and projected robust growth in the coming months, punching back at some critics who worry hype over artificial intelligence has gotten ahead of the business reality.

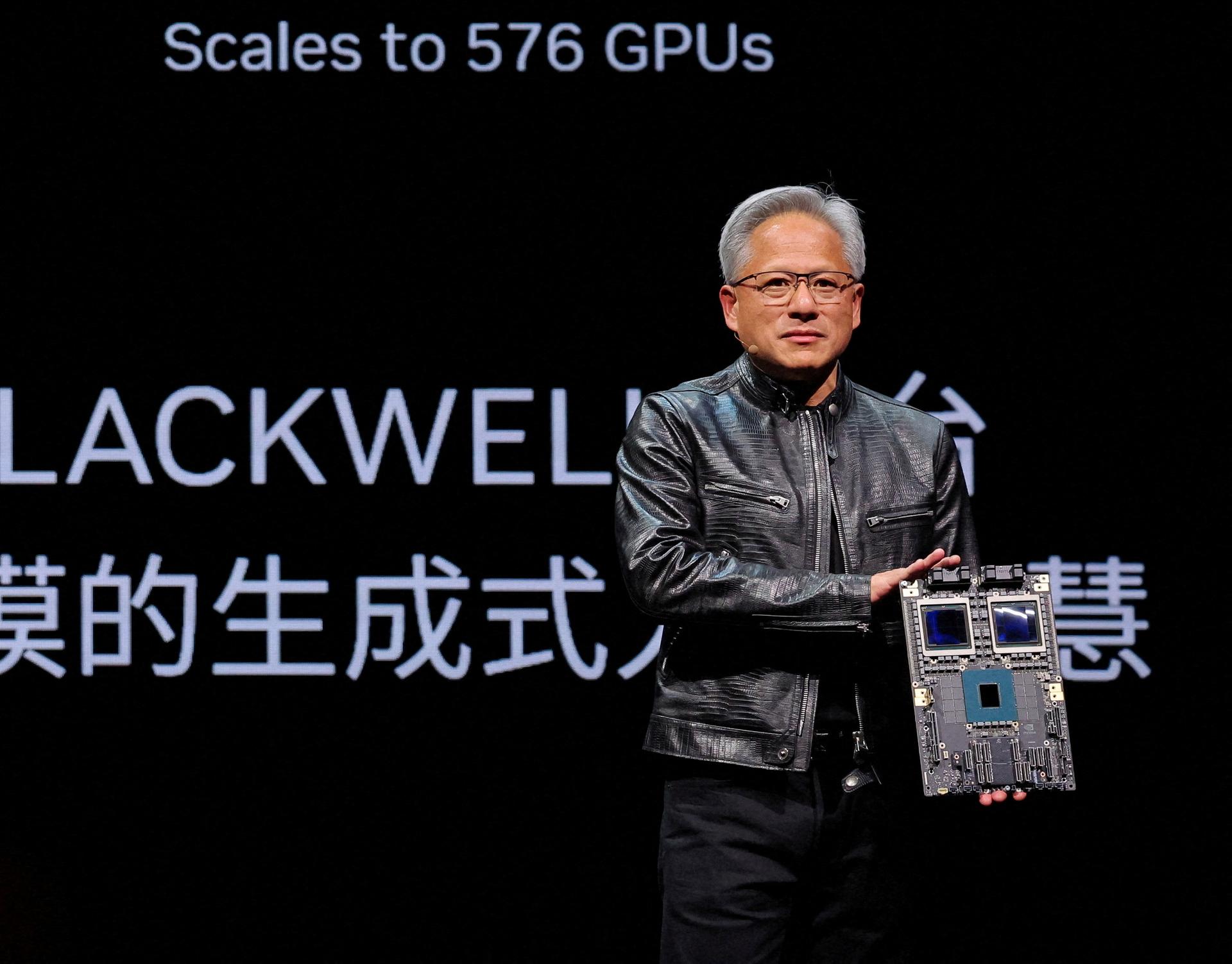

The company — whose hardware has been the backbone of the AI boom, powering everything from large language models to Tesla electric vehicles — said its revenues more than doubled from a year ago to $30 billion, and said it expected $32.5 billion in revenue next quarter, an 80% increase over last year.

The chipmaker’s estimate beat Wall Street’s middle-ground expectations — for the eighth straight quarter — but fell short of some of the most optimistic analyst projections and suggests the huge annual increases that has powered its stock may be slowing.

Investors’ AI enthusiasm has made Nvidia the second-most-valuable company in the world, with a market capitalization of more than $3 trillion. At least one New York bar held a watch party for today’s earnings report, although shares fell 6% to $118 in after-hours trading.

SIGNALS

Nvidia beat expectations. Why is the stock down?

Nvidia’s stock is taking a hit in after-hours trading because some nervous investors want to lock in their gains on technology stocks, the Wall Street Journal reported, citing BCA Research analyst Irene Tunkel. “The reason we have profit taking is lots of people made lots of money,” she told the Journal. “How greedy do you have to be?” And while Nvidia did beat analyst expectations on revenue, it did so by the slimmest margin in a year and a half, which could be pushing the stock down, Bloomberg noted. Even with the slip, Nvidia’s share price is still 150% higher than it was a year ago.

Nvidia is driving the S&P 500

Nvidia accounted for one-third of the S&P 500’s gains over the first half of 2024, which presents a huge risk if the hype fizzles, according to Apollo Global Management’s chief economist, Torsten Sløk. “The top 10 companies in the S&P 500 today are more overvalued than the top 10 companies were during the tech bubble in the mid-1990s,” Sløk said in a February investor note. Other analysts have questioned Nvidia’s pricy valuation and whether the stock can continue to rally, including D.A. Davidson’s Gil Luria, who thinks demand for Nvidia’s chips will decrease as tech giants like Amazon and Meta build their own semiconductors, Yahoo Finance reported.

Rivals try to chip away at Nvidia’s stronghold

Smaller companies including Cerebras, d-Matrix and Groq are creating cheaper, specialized chips that could challenge Nvidia’s hold on the market, the Financial Times reported. “App developers don’t like to be held to one particular tool,” d-Matrix founder Sid Sheth told the newspaper. The companies are investing in “AI inference,” the ability for computer models to draw their own conclusions from new data, which requires chips that are customized for different functions. On Tuesday, Cerebras announced a new inference program, run on its own chips, that it says is 20 times faster than Nvidia’s Hopper chips and a fraction of the cost.