The News

The August jobs report brought mixed news. Unemployment fell, but hiring wasn’t as strong as expected.

The US economy added fewer jobs than economists estimated last month: 142,000 nonfarm payroll jobs compared with expectations of 161,000, according to fresh data released Friday by the Bureau of Labor Statistics. Even so, the US unemployment rate declined, falling to 4.2% from 4.3% in July, in line with Wall Street estimates.

The report represents the final piece of economic data the US Federal Reserve will consider at its meeting later this month, when it is widely expected to cut interest rates by at least a quarter of a percentage point. The only question now is whether the Fed will go bigger.

Banks had eagerly awaited Friday’s report, hoping it would show a weaker jobs market to support a larger cut of 0.5%, which should encourage more borrowing and boost Wall Street dealmaking.

If the Fed does decide to trim rates at its Sept. 17-18 meeting, as Chair Jerome Powell has indicated, it would be the first cut since March 2020, when pandemic-era lockdowns tanked the global economy. About 60% of economists expect the central bank will make the more modest quarter-point trim, while the rest anticipate a half-point cut.

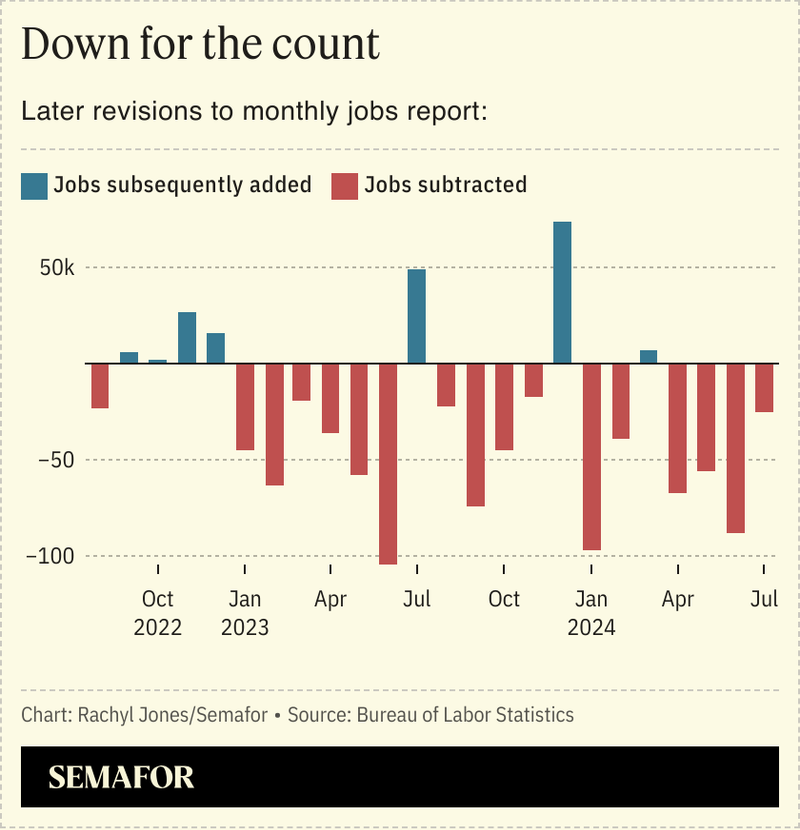

In the report, the Labor Department revised July’s hiring data down from the previously reported 114,000 new jobs to 89,000. It also revised June’s figure down from 179,000 new jobs to 118,000. The movements align with other revisions in the last year but indicate the jobs market is consistently worse than the BLS’s initial data.

SIGNALS

Traders are still unsure how the Fed will move after report

The mixed results did little to clarify how big of a cut the Fed could make later this month, The Wall Street Journal reported. The number of traders betting on a half-point cut has increased, but they are still divided. “Many investors thought the jobs report would be indicative as to the size of this month’s rate cut,” the Journal wrote. “But the data is neither good nor terrible, showing a clear slowdown in job growth but little change in unemployment.” After the report was published, the Dow, S&P 500, and Nasdaq all fell, with the tech-heavy Nasdaq down by the most at more than 2%.

Washington’s takeaway: The economy is strong

The report is one of the final indicators of the US economy’s health under the Biden-Harris Administration ahead of the presidential election in November. “It’s a solid report with decent job gains, wage growth beating price growth, and an important tick down in the unemployment rate,” Jared Bernstein, chair of the White House’s Council of Economic Advisers, told The Washington Post. “Simply put, we’ve got jobs and wages up, and inflation and unemployment down.” Economic issues have been a key talking point in both campaigns. The report comes shortly after both Trump and Harris released their economic plans, and Trump accused the Biden administration of manipulating economic data due to downward revisions in the numbers.

Jobs report tapers some recession fears

Market volatility in recent weeks can be partly attributed to fears that the Fed waited too long to begin cutting interest rates, tipping the US into a recession. But according to some economists, those concerns are overblown. The August jobs report is “still consistent with an economy experiencing a soft landing rather than plummeting into recession,” Capital Economics’ Paul Ashworth wrote in a note to clients Friday, according to Yahoo Finance. Oxford Economics’ Michael Pearce agreed. “The economy appears to be slowing, albeit at only a gradual pace,” he told Reuters. “There are still no signs of a recession emerging.”