The News

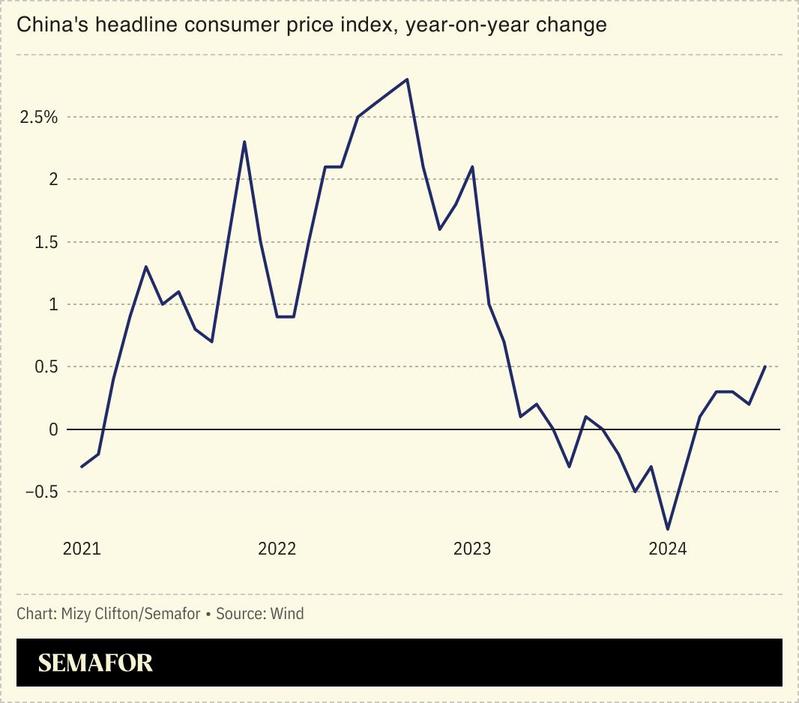

China’s inflation rate was lower than forecast, intensifying fears of deflation in the world’s second-largest economy.

Whereas much of the globe has been struggling to slow price increases, China could face the rarer problem of falling prices, as consumers continue to hold off on purchases in the expectation that goods will be cheaper in the future.

It could have a knock-on effect globally as China “exports” deflation, with its low-cost goods cutting prices around the world, the Financial Times noted. Policymakers in Beijing “are getting uncomfortable,” Goldman Sachs’ chief China economist told Bloomberg, with the country’s former central bank chief making a rare acknowledgment for a public figure last week that falling prices are a problem.

SIGNALS

Beijing is struggling to spark consumer confidence

China’s consumer price index rose by only 0.6% in August, less than most economists’ expectations, Bloomberg reported. The change in prices over time has remained near flat for the last 16 months, well below the country’s target annual inflation rate of 3%. Beijing’s attempts to stimulate spending, like promising trade-ins for some consumer goods, have had minimal effect, with consumers seemingly preferring to pay off debt or invest rather than spend on new goods, Reuters noted. That spells trouble for the world’s largest exporter, as overproduction and a slowing domestic economy could prompt Chinese exporters to slash prices, potentially hurting emerging markets elsewhere.

How Chinese deflation could impact global prices unclear

The potential for deflation in China is unlikely to have a large impact on global prices, particularly in advanced economies, economists told the Financial Times. While they estimated Chinese imports account for less than 5% of total US consumer spending, some economists have argued that imports from China are undercounted in the US, which could be hiding a greater ability to impact prices. It could also intensify policymakers’ and Western businesses’ concerns that Chinese competition hurts domestic and emerging markets. “China spent twenty years destroying emerging-market competitors in the manufacturing space,” one investment strategist told the Financial Times. “Now it’s threatening to do the same to advanced economies’ manufacturers.”