The News

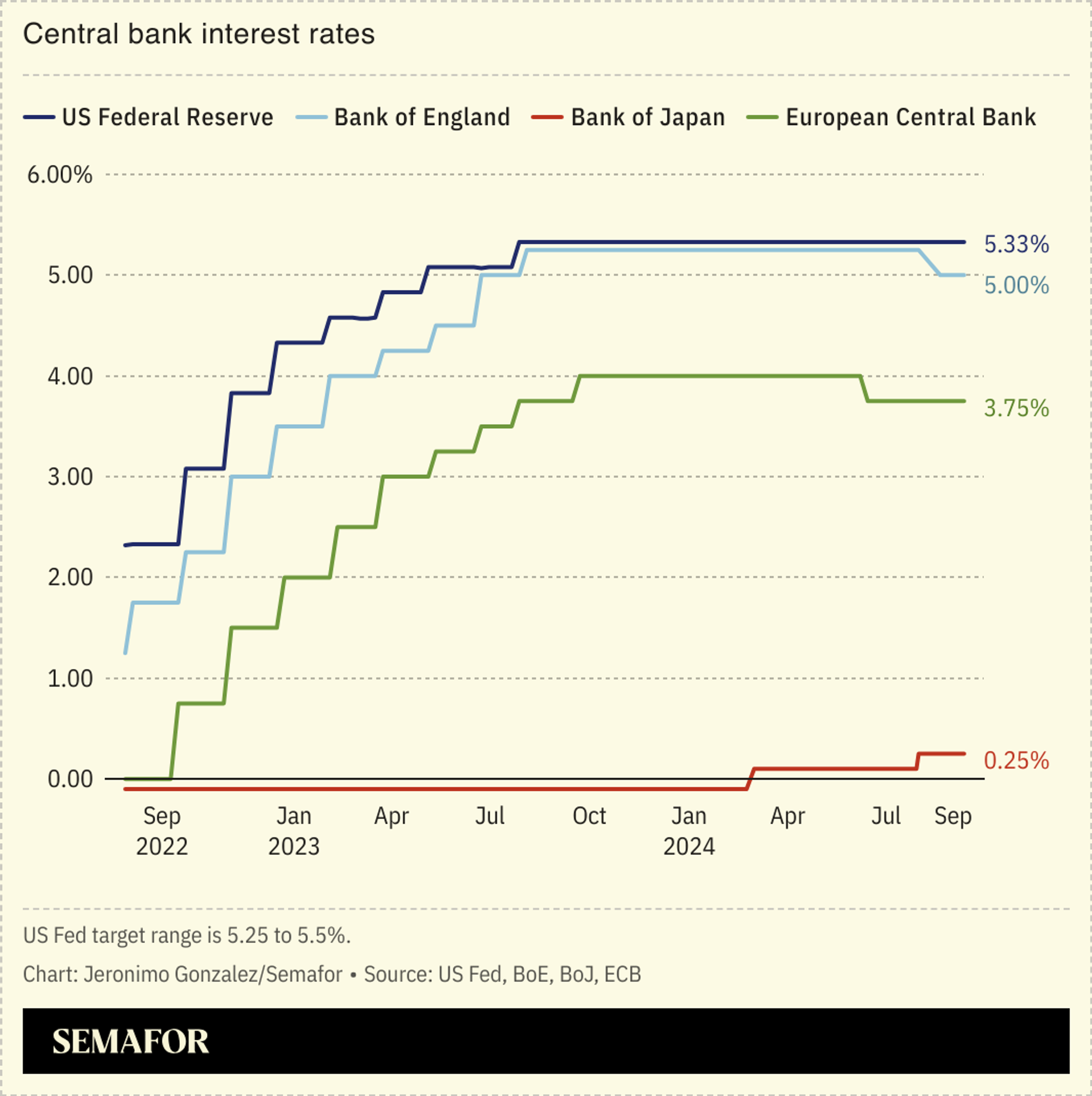

The European Central Bank cut interest rates for the second time in three months Thursday.

Analysts had anticipated the quarter-point cut, which brings baseline borrowing costs to 3.5%, back to their level in the summer of 2023. The ECB declined to commit to any further cuts this year, although most traders bet there will be at least one more cut of similar size before year-end.

The ECB’s move comes ahead of the US Federal Reserve’s widely anticipated meeting next week, at which it is also expected to cut the cost of borrowing by 0.25% as inflation nears its target 2% range. Higher interest rates cool overheating economies, while lower ones spur growth, and central bankers around the world have spent the years since the pandemic trying to strike that balance.

Inflation in Europe peaked higher and later than in the US, but has come down more quickly. That has left policymakers worried about sluggish economic growth.

SIGNALS

Lagarde warns eurozone recovery faces ‘headwinds’

European Central Bank President Christine Lagarde admitted Thursday that the bloc’s economic recovery since the pandemic is facing “headwinds.” The eurozone’s economy has grown only 4% since the end of 2019, about half of the gains in the US, Le Monde noted and is only likely to increase by 2% in 2025. Lagarde pointed to household spending and investment as weak spots, with both struggling to return to pre-pandemic levels even in the bloc’s biggest economies. “We expected consumption to make a contribution to growth in Germany, but this has not happened,” one German economist told Bloomberg. The reason may lie in some national governments’ decision to slash financial support for individuals, as well as waves of layoffs and corporate insolvencies, the outlet noted.

Cuts may be ‘too little too late’

The ECB’s cuts may be “too little too late” to solve the eurozone’s economic sluggishness, Le Monde argued. It’s possible the ECB underestimated how severely individuals and businesses were affected by increased energy prices as a result of the Ukraine war, and didn’t provide enough support to encourage spending. In that, the ECB may have inadvertently led the eurozone to stagnation, Le Monde said, despite Lagarde’s assurance that growth is coming. “There is a high risk that the ECB’s growth forecast for the eurozone is still too optimistic,” bank ING said in a statement after the ECB announcement, “and that it eventually will have to cut rates more aggressively.”