The Scene

Just how dead is the deal market?

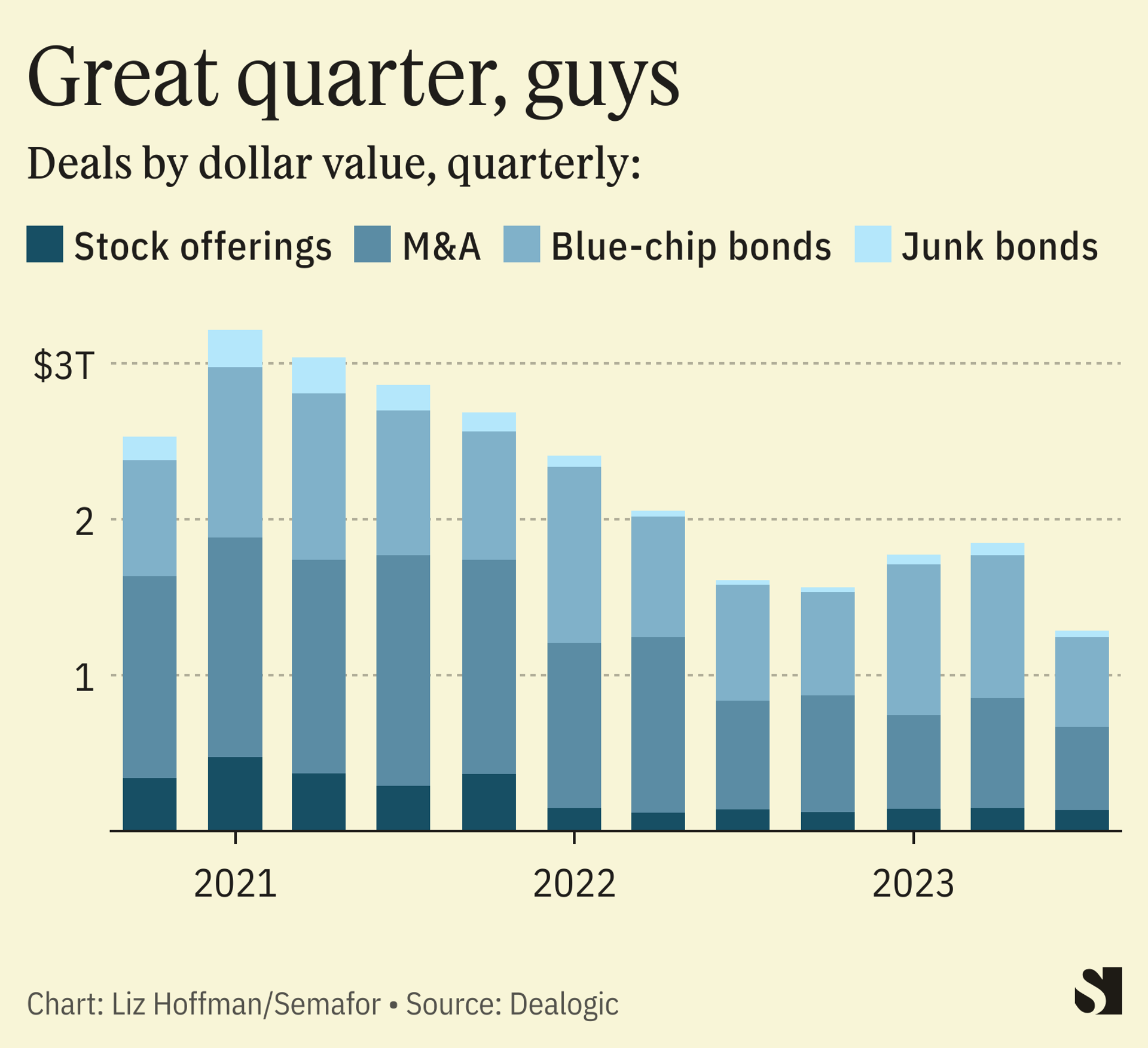

You can see it in the numbers. M&A is down 32% globally from 2022, trailing even the pandemic year; new listings are essentially nonexistent; and syndicated loans are on pace for their slowest quarter since the spring of 2020.

You can see it in the breathless hopes pinned on Arm’s debut today and the IPO of a valuation-leaking Instacart next week. Both are going public with the safety net of big anchor investors — Pepsi is buying $175 million worth of Instacart, and 15% of Arm’s shares were spoken for by Apple, Samsung and other customers — that can put a floor under the stock and attract retail interest.

You can see it in the advisory practices sprouting up on Wall Street peddling not big-money deal advice but the kind that pays a few thousand dollars a month. “Barbarians at the gate this is not,” the Financial Times said of a new “sustainability advisory” offering from one bank.

You can see it in a steady drumbeat of Wall Street layoffs and dour bonus predictions. Headcount at the biggest U.S. banks dropped by more than 20,000 in the first half of the year and more cuts are coming at Goldman Sachs, Barclays, and Citigroup. Alan Johnson, a compensation consultant to big banks whose annual forecasts are closely watched by those anticipating year-end bonuses, expects a 20-25% drop for M&A bankers this year.

You can see it in the press. Deal reporters are profiling bankers, writing up M&A glimmers-in-the-eye, and peppering stories with scenes of bankers staring morosely into berry parfaits.

In this article:

Liz’s view

The reasons are mostly technical. Debt is more expensive. CEOs are dour. The surprisingly strong profits that underpinned the stock-market rally approaching its first birthday look shaky after companies from Target to American Airlines to Thermo Fisher lowered their earnings forecasts.

“That’s the sound of air coming out of the balloon,” said Rich Farley, a lawyer at Kramer Levin who represents banks in capital-markets deals.

But they’re emotional, too. CEOs are pack animals, and nothing good happens to one who strays from the herd.

This may be bad news for bankers and reporters, but dealmaking isn’t an unalloyed good. It tends to reflect a good economy, or at least a feel-good economy, but doesn’t predict one. Studies (most of them years old, though) consistently show that most M&A deals actually destroy value. And there are job losses, of course, by one estimate as high as 30% when two rivals merge.

The bigger they are, the worse they do: Kraft/Heinz. AT&T/DirecTV, and AT&T/Time Warner were colossal failures, and GE’s purchase of Alstom in some ways sparked the unraveling of an American titan. Though smaller in scale, Google’s purchase of Nest was a dud. Even Warren Buffett gets it wrong.

And that’s just M&A. The IPO frenzy of 2021, driven largely by SPACs, did no discernible good for anybody except the sponsors and the bankers who took them public. U.S. companies are carrying twice as much debt as they were in 2012, while earnings before interest and taxes have increased by only a third.

It’s helpful sometimes to think of deals not so much as something companies do, but as products they buy. When stock prices are high or interest rates are low — which conveniently tend to happen together — they buy a lot of money, from shareholders and creditors. When shareholders reward them for it, as they unusually did during much of the last decade, they buy a lot of companies.

Those trends are reversing, so interest is down. Caution now isn’t the worst thing.

One financial product that’s doing very well: fixing troubled companies. Paul Taubman, CEO of boutique PJT, cited “extraordinary performance in our restructuring business” for record revenue last quarter.

The View From Jamie Dimon

Asked on Monday whether JPMorgan was seeing signs of renewed activity, Dimon said: “I never talk about pipelines. You know why? Pipelines open and close…you’re just guessing the weather here.”

Notable

- Sellers still want 2021 prices, and buyers aren’t willing to pay, WSJ reports.