The News

The US Federal Reserve slashed interest rates by half of a percentage point on Wednesday, signaling that the central bank wanted to act more boldly to keep the labor market from slowing too much. Recent jobs data has rattled investors and had some economists questioning whether the Fed waited too long to begin cutting rates and overshot its hoped-for soft landing.

Traders had anticipated the bigger half-point cut ahead of the meeting, according to CME’s FedWatch. Sentiment shifted among economists from a more modest quarter-point trim through the beginning of this month to a half-point cut after weaker-than-expected jobs data raised concerns about an economic slowdown.

“We don’t think we’re behind,” Fed chair Jerome Powell said at a press conference following the announcement. “We think this is timely, but I think you can take this as a sign not to get behind.”

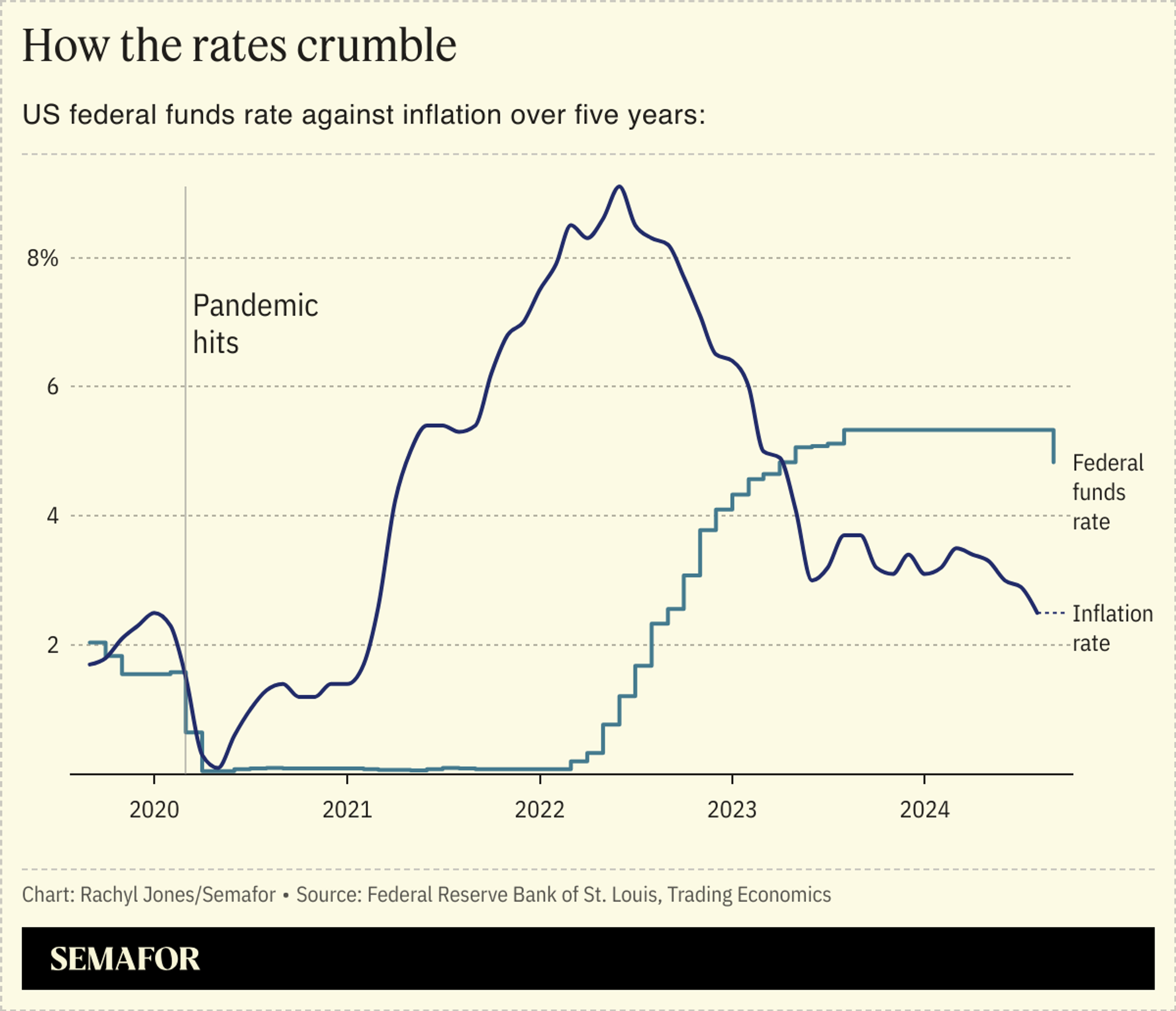

The Fed has raised rates 11 times since March 2022, holding the federal funds rate steady at between 5.25% and 5.5% since August 2023, in an effort to tame rising inflation — which has dropped from a recent high of 9.1% in June 2022 to 2.5% last month, nearing the central bank’s 2% target.

SIGNALS

US cut may inspire action from other central banks

The Fed’s cut follows the lead of other major economies — including Europe, the UK, and Canada — and could set other world central banks up to move. India, South Korea, and South Africa have waited to cut rates. “For many central banks, lowering rates ahead of the Fed risks a weakening of their national currencies. When their rates are lowered relative to U.S. rates, their currencies become less valuable. That in turn can raise prices on their imports, creating a fresh wave of inflationary pressures,” The Wall Street Journal wrote. It’s possible the US cut “will reassure officials that the currency will not suffer renewed falls, at least from their actions alone,” an economist told the Journal.

Powell cautions ‘no preset course’ for future cuts

The majority of the Fed’s committee members said Wednesday they expect to cut another 50 basis points by the end of the year. By the end of 2025, members anticipate the federal funds rate will be closer to 3%. “We are not on any preset course,” Jerome Powell said at the press conference. “We will continue to make our decisions meeting by meeting.” An analyst at wealth management firm Baird told the Journal, “I view it as a very, very positive first cut and not one that should imply some sort of worry or dramatic weakening of the economy.”

Stock indexes close down on fears of economic weakness

Traders initially cheered the news, sending stock indexes briefly up before closing down on fears the Fed may have instituted a larger rate cut to get ahead of a weakening economy, CNBC reported. All three major indexes, the S&P 500, Nasdaq, and Dow, fell by less than 1%. An initial half-point cut has historically “preceded some awful returns in equity markets,” including in 2007 ahead of the financial crisis, an analyst told the outlet. “In essence, the need for a larger cut points toward growth concerns and economic trouble ahead.”