The Scene

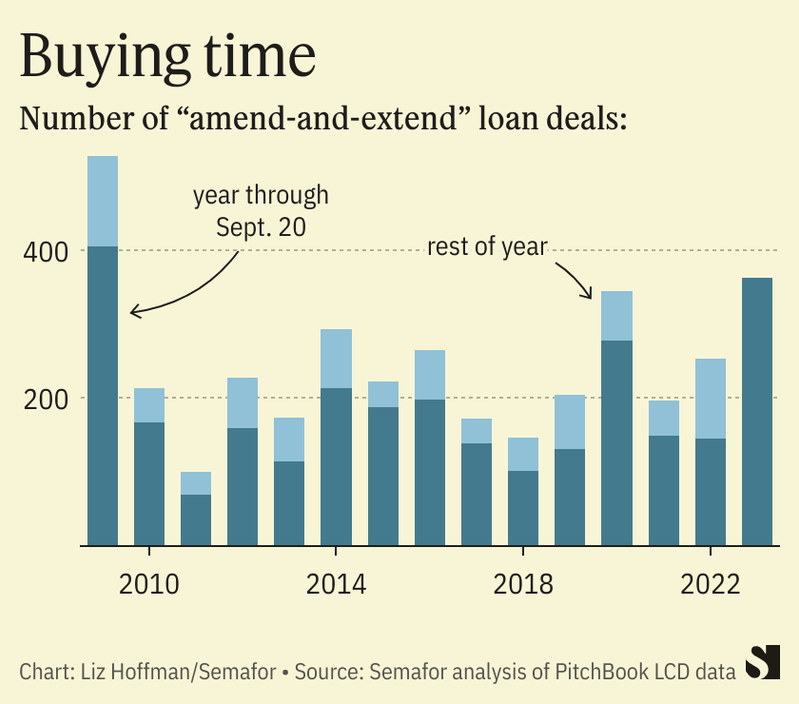

With debt payments soaring, companies and their lenders are returning to an old trick: kicking the can.

Payback schedules have been extended on $114 billion worth of U.S. loans this year, most of them to companies with private-equity owners and low credit ratings, according to Pitchbook LCD. That’s the highest since 2009, when the country was emerging from a recession.

These “amend and extend” deals — also called “amend and pretend” and, more waggishly, “pray and delay” — involve pushing out maturity dates by a few years and tossing lenders extra fees in exchange for their flexibility.

The hope is that the company will be in better shape by then. Private-equity firms “are eternal optimists,” said Carolyn Hastings, a partner at Bain Capital Credit.

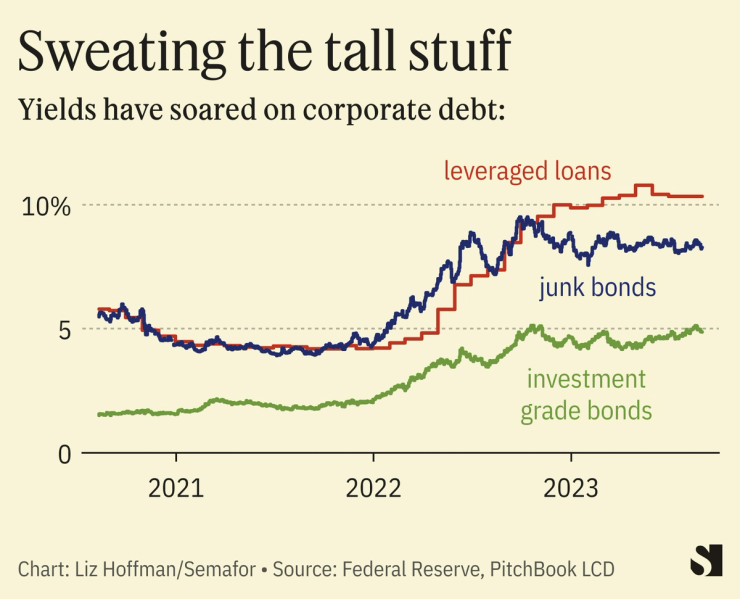

Soaring debt costs are one of the clearest ways that higher interest rates are rippling through the economy. Stressed companies lay off workers or delay initiatives: Goldman Sachs estimates that for each extra dollar of debt service, companies cut labor costs by 20 cents and physical investments by 10 cents.

That’s how the Fed accomplishes its goal of cooling the economy. But in the meantime, companies that overborrowed during the last, halcyon decade are running into trouble.

Blue-chip companies are paying more for debt than junk-rated companies were two years ago. Rates on risky loans used in buyouts have doubled since 2018, stretching companies that borrowed during a time of lower rates and rosier growth projections.

Lenders can, of course, wait until companies default and seize them. But banks and loan funds aren’t in the business of running billboard owners and dialysis clinics and scaffolding suppliers — all beneficiaries of reworked loans in the past few months. Operating businesses tend to deteriorate in creditors’ hands.

“You don’t want to take the keys, but you are going to see more of that and more forced sales,” Hastings said.

In this article:

Know More

A typical case is that of Anchor Glass, which makes bottles for Heinz ketchup and Sam Adams beer. The company was sold to one private equity firm in 2014 and then another two years later, racking up cheap debt along the way.

Last month it negotiated with lenders, including Apollo, over a $710 million loan coming due in December that charged 8% interest. The new loan comes due in 2025 and charges about 11%, and the company has the option to pay in scrip rather than cash. Its private-equity owner, CVC, put $50 million of new money into the company.

Such “pay in kind” options, which ease a borrower’s cash crunch by racking up future debt, are getting more popular. The biggest nonbank lending fund, Blue Owl Capital Corp., got 13% of the interest payments owed to it in IOU slips last quarter rather than in cash, up from 2% in 2019.

These funds, called business development companies and given special tax breaks, are required to pay out 90% of their income — cash or not — to shareholders, so higher levels of in-kind payments can stress their own finances.

“It’s funny money,” says Howard Morris, a partner at law firm Morrison Foerster in London, who said he’s seeing it more and more these days. It also adds up quickly: “The exponential amount of debt when you do get to a formal restructuring is eye-watering.”

He’d just come from a meeting with a real-estate fund in Mayfair that had set up a new team to work with lenders on troubled loans.

Liz’s view

Debt amendments work when they bridge a company over a choppy spell. The best example is the pandemic, when lenders waived payments and covenants for borrowers from big corporations down to students.

But this could get bad quickly. Companies bring money in from selling stuff, and send some of it out to service debt. A squeeze on either side can be problematic, but a squeeze on both is likely fatal.

In 2009, revenues fell during an 18-month recession. But companies’ debt payments basically stayed the same or, if anything, decreased as the benchmark rate neared zero, where it would stay for a decade.

This time around, the obvious problem is interest rates. Corporate loans are mostly floating-rate, so borrowers’ payments have gone up 11 times since the Federal Reserve began its hikes last year. Yesterday, the central bank projected rates would stay higher for longer.

But recession risk still lurks, and while economists are increasingly optimistic, they say they won’t know for sure until 2024. Of 11 tightening cycles since 1965, seven have landed hard. A wall of risky corporate debt is coming due over the next two years: About $100 billion this year, $250 billion next year, and almost $400 billion in 2025, according to S&P Global.

The credit market also looks different than it did in 2009. The risk once concentrated at the big banks has now been spread far and wide, with less oversight. Banks have to report their loan holdings to regulators, who look for sloppiness or dodgy marks. Private credit funds do not, and different firms often value the same loan at wildly different prices.

If flexible lenders can float a company through peak interest rates, then it probably makes sense.

But as Morris told me: “Sometimes it’s a sensible calculation that it’s going to take longer to realize value, and sometimes it’s just buying time,” he said. “We’re tipping toward the latter.”

Room for Disagreement

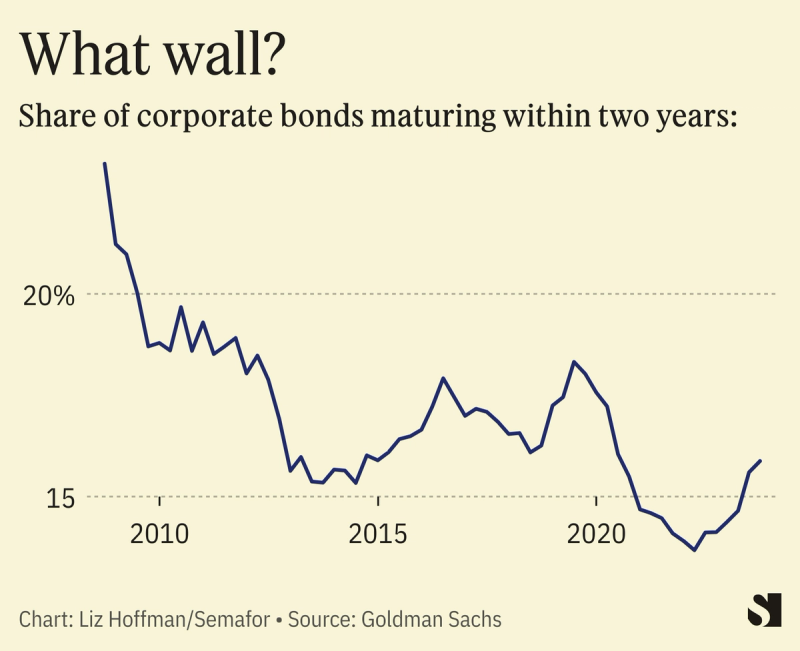

The Financial Times’ Robin Wigglesworth called the maturity wall a “near-mythical beast conjured up to scare small children, skittish investors and chief financial officers” and he’s right that the numbers aren’t as dire as they seem on first look.

Companies issued so much debt in the free-money era that relatively little is coming due anytime soon. The biggest chunk doesn’t mature until 2028, at which point the Fed’s own governors expect the baseline interest rate to be about half of what it is today.