The News

China’s central bank cut an important short-term interest rate and injected more liquidity into the market in an apparent bid to revitalize the country’s flagging economy.

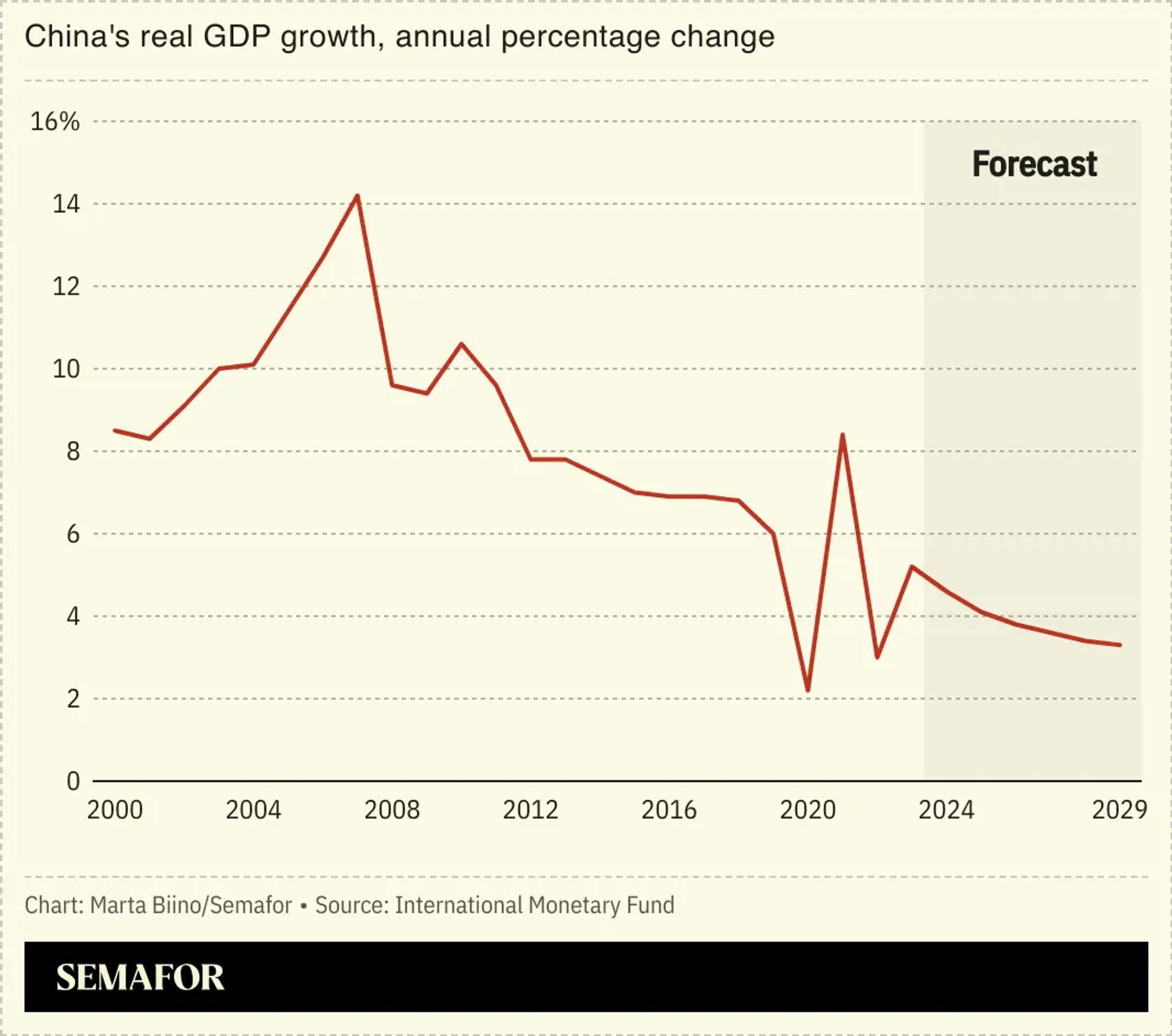

The People’s Bank of China cut the 14-day reverse repurchase interest rate to 1.85%, a reduction of 10 basis points, and injected $10.6 billion of liquidity, in an attempt to ease monetary policy and reduce the effects of deflation. China’s economy is forecast to grow only 4.6% this year, one of the lowest annual increases in decades.

On Monday, officials announced the country’s financial regulators will give a press conference Tuesday, without offering further details.

SIGNALS

Speculation of a stimulus grows, but analysts say ‘curb your enthusiasm’

The combination of the rate cut and the press conference announcement has spurred speculation that the country’s officials may be preparing to roll out a stimulus package, but “curb your enthusiasm,” analysts at Trivium China wrote in a Monday newsletter. “There’s undeniably mounting pressure on Beijing to open its checkbook,” they wrote, but cautioned that the officials taking part in Tuesday’s press conference “aren’t high enough up the food chain to announce stimulus.” Instead, the officials may be more inclined to signal more marginal changes to interest rates are ahead.

China’s deflation risk has global economic impact

The Chinese economy has slowed more in recent months than economists had originally thought: People are not spending their money, employment is down, and investment in real estate has “nosedived,” The Washington Post wrote. The “lackluster” domestic situation could disrupt other countries’ economies, as cheap Chinese exports continue to undercut local producers, essentially artificially lowering prices elsewhere. “The concern for the US is that weaker Chinese domestic demand means more Chinese exports to the rest of the world,” an economist said.

State investigations discourage entrepreneurs

Beijing’s attempts to revive China’s economy have perhaps been undermined by crackdowns targeting business and finance leaders, which may have made younger workers less interested in entering these industries, stalling the potential for entrepreneurship and wealth growth, Ruchir Sharma, the chair of Rockefeller International argued in the Financial Times. President Xi Jinping’s policy of “common prosperity,” has caused thousands of millionaires to leave the country, and the number of billionaires in China has shrunk dramatically, too. “In this new era, it’s dangerous to get too rich” in China, Sharma wrote.