The Scoop

THE SCOOP

BlackRock has held talks to buy a stake in a major US lender, HPS, people familiar with the matter said.

The deal continues one of the hottest trades among Wall Street firms: owning pieces of each other. In another similar investment, Blackstone is in talks to take a stake in Vitruvian, a London buyout firm with €16 billion, other people familiar with the matter said.

The current state of the talks couldn’t be confirmed. Bloomberg first reported the BlackRock-HPS talks, which Semafor confirmed.

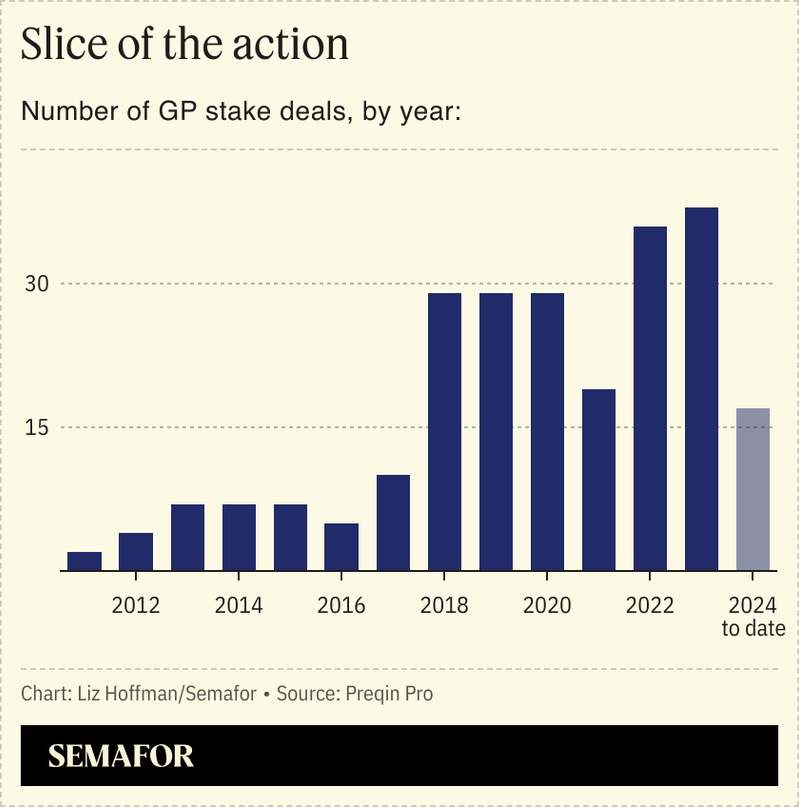

The business of money managers buying stakes in other money managers is booming. From essentially a dead start in the early 2010s, there were 38 such deals last year, and new rivals are jumping in all the time. Blue Owl raised a record $12.9 billion fund to acquire stakes in other managers last year, and is already out raising its next.

Investors benefit from a share of steady management fees and a portion of profits when investments are eventually sold. It’s a machine only Wall Street could invent, self-propelling and profitable.

A spokesman for HPS didn’t respond to multiple requests for comment. Blackstone declined to comment. Vitruvian didn’t respond to requests for comment. Bloomberg reported in March that Vitruvian was looking for investors.

HPS, which manages $117 billion, has been trying to go public but faces a frosty market that is just now showing signs of thawing. Stocks have been high enough to tempt companies, but chaotic enough to keep them away.

In this article:

Liz’s view

Three big buyers dominate this business: Blackstone, Blue Owl, and Petershill, which used to be a unit of Goldman Sachs. Former Blackstone executive Bennett Goodman’s Hunter Point made a splashy debut in the spring.

These deals are profitable. It can take a while for investors to get their money back — these are illiquid stakes of other illiquid stakes — but they generate a lot of cash from steady, predictable management fees. Annual returns can be in the high teens.

For HPS, this looks like a stopgap meant to a coming IPO that’s a bit further off than executives, who started priming the pump nearly a year ago, had planned. Getting a respected investor like BlackRock to write a big check warms the waters and essentially sets a floor under the eventual IPO price.

Update

An earlier version of this story stated that HPS had discussed taking a slug of money from Mubadala, a Gulf sovereign-wealth fund. We were at best behind the conversation, and impatiently pulled the trigger on that story before we heard back from Abu Dhabi, which was a mistake. In fact, HPS is in talks to be sold to BlackRock, Bloomberg reports.