The News

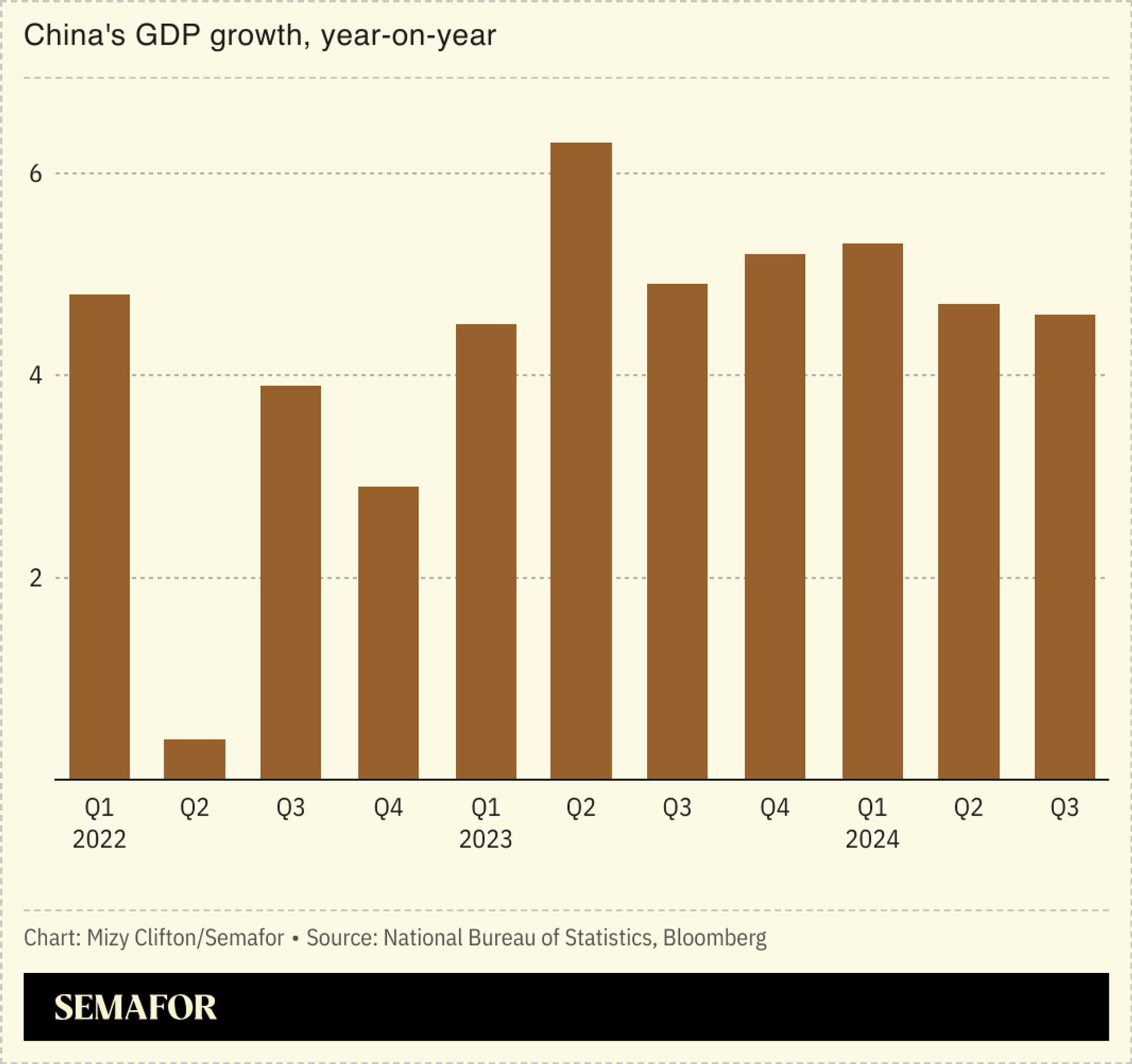

China’s economic growth in the third quarter fell to its lowest level since the country lifted pandemic-era restrictions, highlighting the risks of a flailing property sector.

Other long-term problems including mammoth debt and a rapidly aging population contributed to push quarterly economic expansion down to 4.6%, with economists suggesting Beijing’s annual growth target of 5% may be out of reach.

However, there were bright spots: the GDP growth figure was slightly higher than economists expected, while retail sales and industrial production data also beat forecasts.

SIGNALS

China’s economy is becoming more ‘Japanised’

China’s economy “has become more ‘Japanised’ than Japan’s recently,” wrote Barclays analysts cited by the Financial Times, referring to a period of economic stasis that combines slow growth, low inflation, a low policy rate, negative demographic trends, and high youth unemployment. China’s economy now resembles that of Japan in the early 1990s, when the country’s post-war, debt-funded growth boom ended. However, China may be better off in some aspects, a JPMorgan analysis noted. Its urbanization rate is lower, meaning greater potential for economic growth as people move to cities and workers shift away from agricultural jobs, while also being better positioned because of “a much larger domestic market, a larger pool of STEM graduates and comprehensive manufacturing sectors.”

China’s economic slowdown is not ‘incurable’

China’s economy is certainly facing challenges, but it is “not incurable as some would suggest,” an expert at the Economist Intelligence Unit told CNBC, citing the government’s determination to bolster the economy through a number of support measures, including a stimulus package announced in September that briefly buoyed markets. The better-than-forecast data may indicate that the economy has “bottomed out,” Bloomberg noted, and the probability that China will get back on track to reach its goal “now looks very high,” BNP Paribas’ chief China economist told the outlet, adding that even a small rebound in the fourth quarter will be enough.

Stimulus package alone unlikely to end malaise

Some analysts remain skeptical that central bank stimulus alone will turn around China’s slowdown, because it doesn’t tackle some broader issues like the property slump, — and in any case, such measures are “never strong enough to reflate the economy,” The Wall Street Journal noted. A potential key to restoring growth could lie in shoring up consumption, something Beijing policymakers have neglected in favor of an ultra-high savings economy, the Financial Times’ chief economics commentator wrote: “[China’s leaders] seem to feel that investment and production are virtuous, while consumption and income redistribution are frivolous.” He invoked the eighteenth century economist Adam Smith, who believed that “‘Consumption is the sole end and purpose of all production,’” writing: “Xi Jinping needs to embrace this truth.”