The News

Christian-themed investment funds are finding their religious principles come with a cost — the details depend on your denomination.

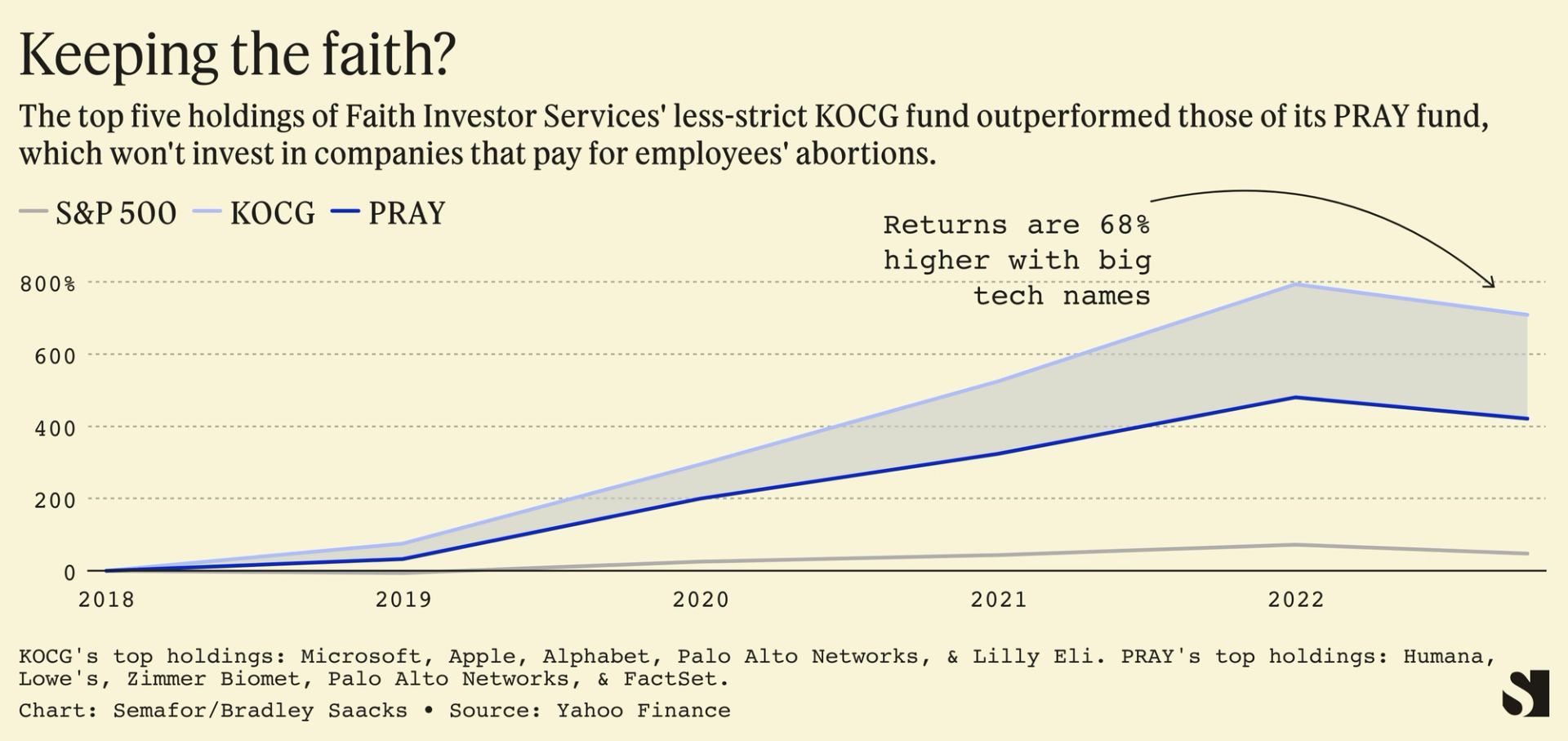

More than 130 funds managing some $22 billion in the U.S. invest along Christian principles, according to data provider Lipper. They are now trying to balance their moral values with market values. For many, specifically those that follow a “biblically responsible” framework, that means avoiding companies that cover some of the expenses of employee abortions – a list that includes some of the best-performing stocks of the past several years, including Apple, Microsoft, and Alphabet.

Catholic-specific funds operate under a different, more subtle, set of rules. The most recent guidance from the US Conference of Catholic Bishops, from November of last year, said stocks should be evaluated on “how those companies or entities protect life,” but leaves individual investment decisions up to fund managers. It leads with a verse from 1 Peter 4:10: “As each one has received a gift, use it to serve one another as good stewards of God’s varied grace.”

John Grabowski, a moral theologian who teaches at Catholic University and advises investors like the Knights of Columbus, told Semafor the line Catholic asset managers draw is between “remote material cooperation with evil” and “formal cooperation with evil.”

The former, Grabowski says, applies to companies that are neither profiting off nor directly involved with abortion, and are generally kosher for Catholic investors to own. Investing in, for example, a medical-supply company whose equipment is used to perform abortions would cross the line, said Grabowski, who has a doctorate in religious studies.

Toeing the line on ESG investments has been tricky even for non-religious managers. BlackRock, which has warned that climate change is a threat to companies’ long-term prospects, touted its support of fossil fuel companies in an effort to stay off investment blacklists in Texas.

Bradley’s view

From an investing perspective, it’s been a no-brainer to put money into Apple, despite what the company’s policy on abortions might be. This outperformance gives these companies cover from evangelical pushback.

Asset manager Faith Investor Services offers a good example: their ETF managed by the Knights of Columbus uses the bishops’ guidelines while the other, which trades under the PRAY ticker, follows the “biblically responsible” framework. The top holdings of the former are Microsoft and Apple; the top holdings of the latter are Humana, a Kentucky-based company that did not respond to inquiries about its abortion coverage policy for employees, and Lowe’s, which had a shareholder vote for disclosures on restrictive abortion laws’ impact on their workforce fail at their annual meeting.

The returns of the tech giants over the past five years trounce those of Humana and Lowe’s. Microsoft is up nearly 200% since 2017 — close to five times the S&P’s return — while Apple has returned over 250% over the same period. Humana and Lowe’s have outperformed the market with five-year returns of 107% and 132%, respectively, but still trail the larger tech companies.

Room for Disagreement

If the U.S. evangelical movement has proven anything, it can organize. The overturning of the Roe v. Wade Supreme Court precedent was a decades-long plan, and states like Florida, Louisiana, and Texas have banned the consideration of ESG funds in their state public pensions — moving investment decisions squarely into the political realm.

If the broader Christian right starts voting with their dollars, these faith-based strategies will vacuum up assets and potentially be able to make demands of the largest companies in the world. Tools like eVALUEator — which, among other things, eliminates companies for possible investment if they find any backing of Planned Parenthood or Pride organizations in charity tax filings — could dictate where money flows and where it doesn’t.

The View From The Vatican

Recent comments from Pope Francis on President Joe Biden’s support of abortion rights reveal he wants bishops to handle the debate in a pastoral way, not a political way.

The Vatican adopted a new investment policy for its own finances starting in September of this year that consolidates its investments under a single fund focused on creating a “more just and sustainable world.”

In practice, the Vatican bans investment in “pro-abortion health centers; and laboratories and pharmaceutical companies that manufacture contraceptive products and/or work with embryonic stem cells” — language that matches what Grabowski laid out about remote material cooperation and formal cooperation.

Notable

- The Vatican’s move to a more centralized investment strategy was the result of several scandals, including the purchase of several buildings in London’s posh Chelsea neighborhood.

- Inspire Investing’s anti-ESG stance has loudly planted a flag in the ground for the more extreme side of the faith-based investment industry.

- Lowe’s was not the only major retailer to face a proxy vote at their annual meeting related to abortion.

Correction

President Joe Biden supports abortion rights. A previous version of this story misstated his stance.

Separately, Apple, Microsoft, and Alphabet have been top-performing stocks over a period of several years, though not so far in 2022. A previous version of this story misstated the time period.