The News

The headline rate of inflation in the US was 2.1% in September, according to new Bureau of Economic Analysis figures released Thursday — close to the Federal Reserve’s target of 2% and the lowest since February 2021.

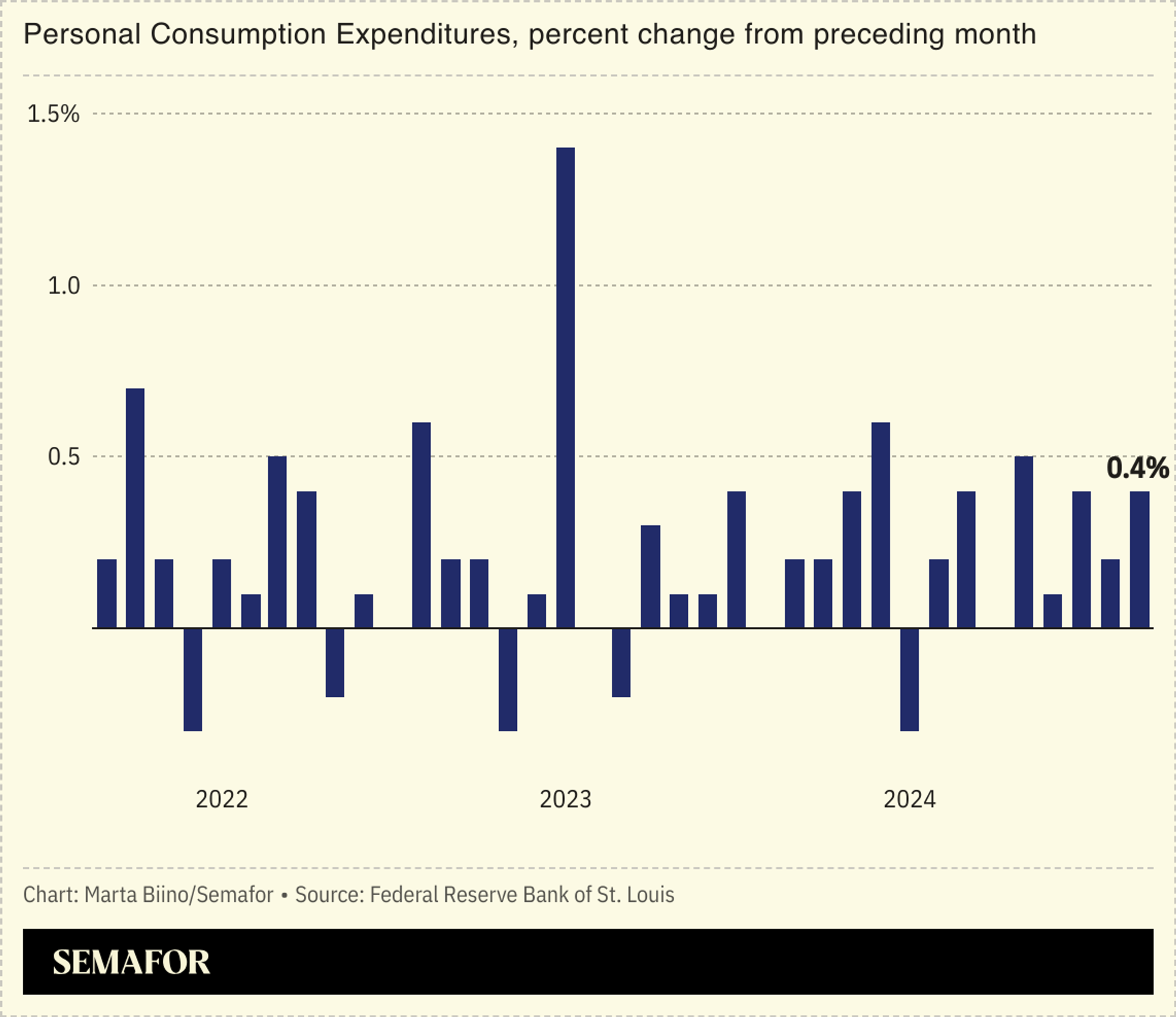

The seasonally adjusted personal consumption expenditures price index, one of the central bank’s preferred economic indicators, rose 0.2% during the last month. The core PCE, which doesn’t include volatile food and energy prices, increased 0.3%.

Despite many Americans reporting that they feel crushed by high prices, consumer spending increased, likely driven by higher wages, Bloomberg wrote. There was also a decline in saving, the outlet noted, which likely “helped prop up spending throughout the third quarter.” Overall, the numbers “offer mixed news for voters seeking to get a sense of where the economy stands heading into the Nov. 5 presidential election, with consumers continuing to spend even as inflation lingers.”

Know More

The numbers come as the Fed prepares for its November meeting, where it is widely expected to lower interest rates by 0.25%, following a similar rate cut in September.

While the headline numbers are positive, this is “no clear victory” for the Fed, finance-focused outlet Investopedia noted: Core inflation remained at 2.7%, unmoved since August. “With the Fed’s attention rotating more toward the full-employment aspect of its dual mandate,” Bloomberg wrote, “we think the steady annual core inflation measure won’t sway the Fed from its rate-cutting path.”