The News

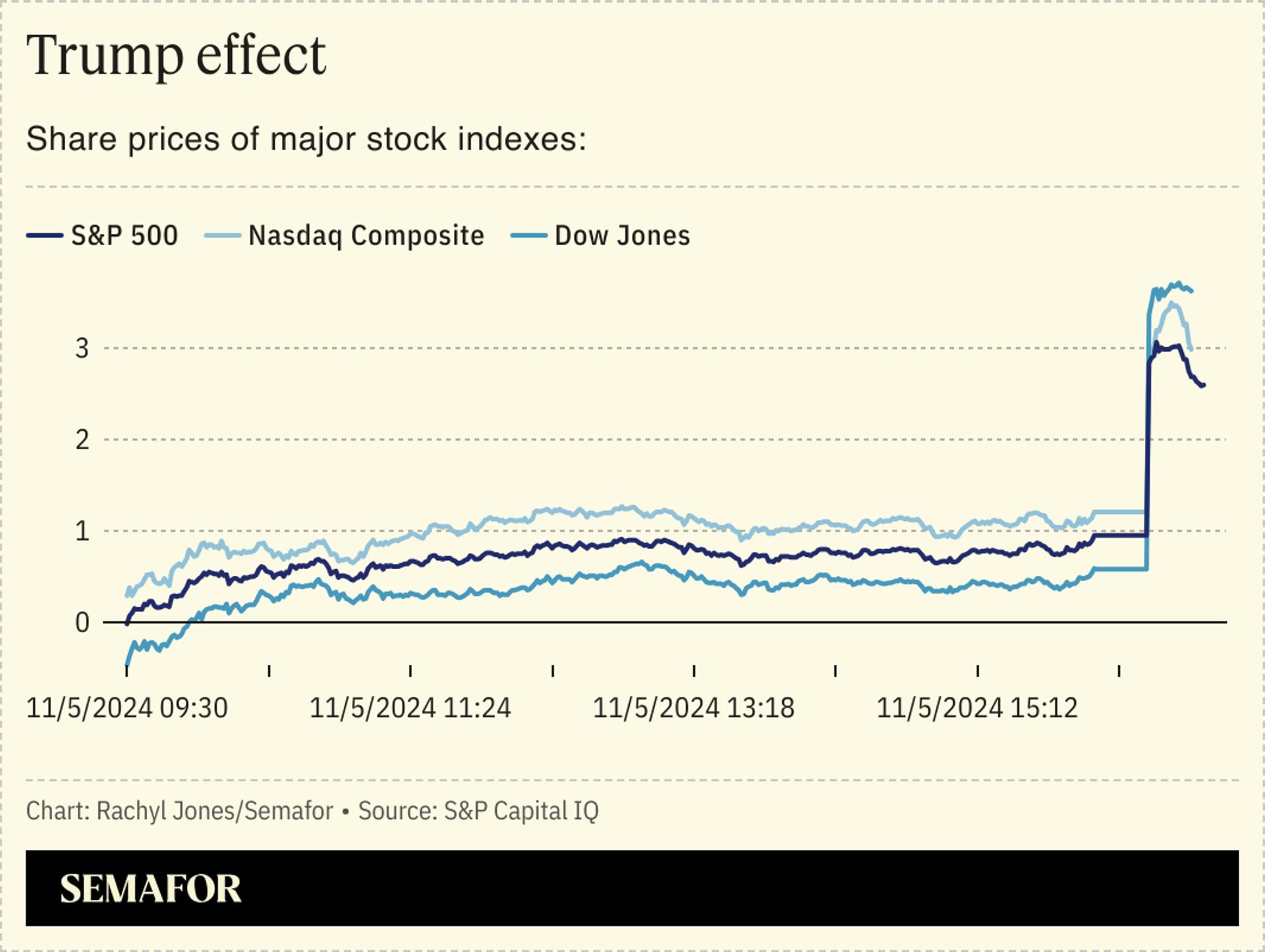

Global markets largely cheered Donald Trump’s victory, as investors bet that the president, with control of at least the Senate and possibly the House of Representatives, will make good on his promise of lower taxes, higher tariffs, lighter regulation, and boosts for US manufacturing.

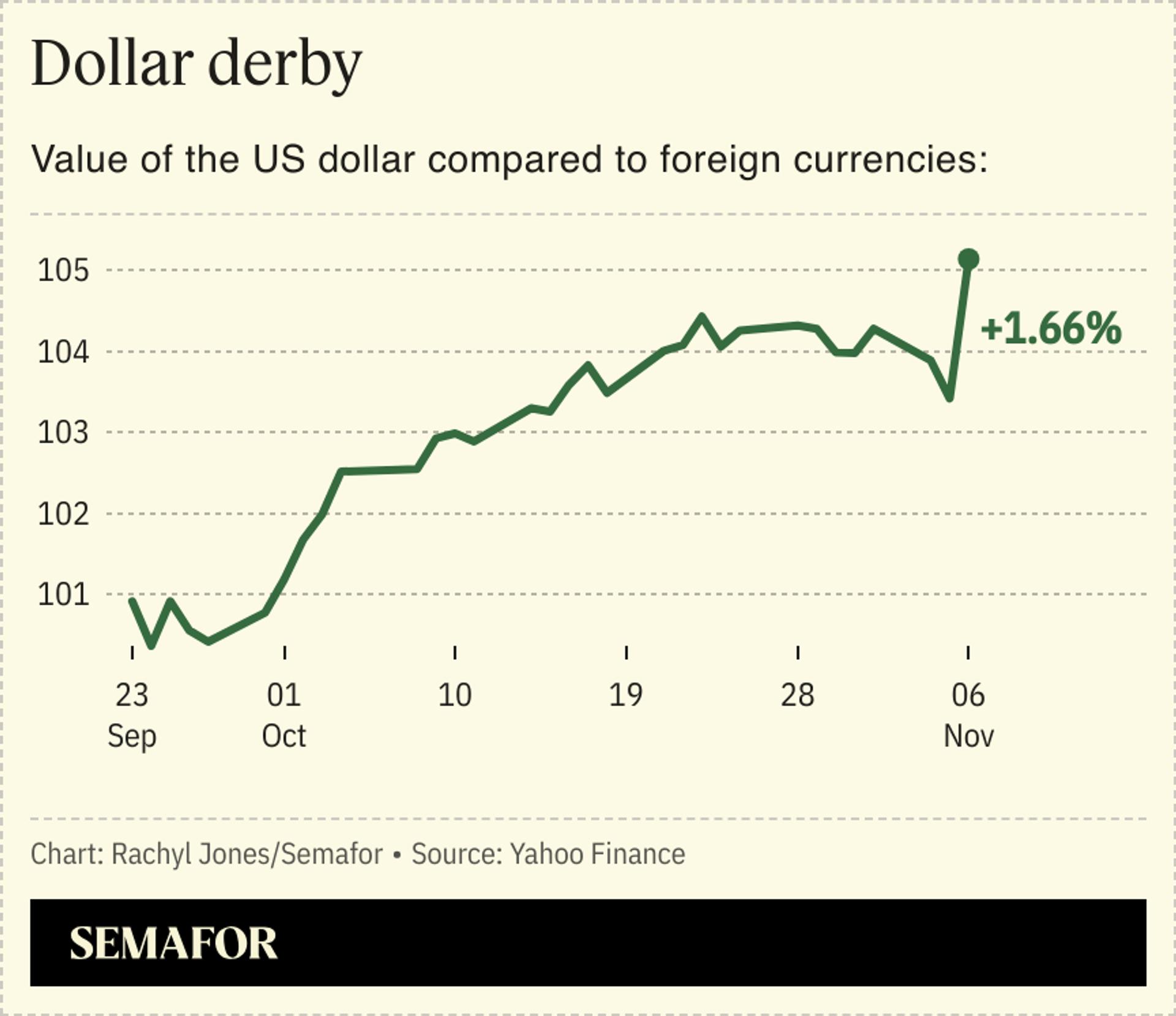

The dollar had its best day in more than two years. Bitcoin and bank stocks both surged, as did shares of industrial manufacturers that have been battered by Chinese competition. Bond yields rose as investors bet that Trump’s policies will juice a US economy that is already one of the strongest in the world.

“If you had the Trump trade on for the last six weeks, it’s been outstanding,” an analyst told Bloomberg.

Setting aside companies that reported quarterly earnings today, the 10 best-performing US stocks were seven banks, two domestic steel producers, and Tesla, which bucked a sharp decline for cleantech companies as Elon Musk’s all-in bet on Trump paid off.

The Dow Jones Industrial Average and S&P 500 hit record highs Wednesday, while the tech-heavy Nasdaq Composite rose 2.2%. The Russell 2000, which tracks small-cap stocks, rose as much as 4.8%; smaller companies tend to do better during economic expansions than megacaps.

The Chinese yuan fell sharply, as did stocks in Shanghai and Hong Kong, in a preview of the uncertainty that a Trump presidency brings. His promise of steep tariffs on nearly all Chinese goods “are causing particular angst in Asia,” one Moody’s researcher told the BBC.

Doubts about whether Trump would be willing to defend Taiwan against a Chinese invasion, which many geopolitical experts have long considered a growing threat, sent shares of Taiwanese semiconductor companies lower.

Traders in Saudi Arabia also celebrated Trump’s win by lifting the country’s market. During Trump’s first term, he built close ties with the country, choosing Riyadh for his first foreign visit and attempting to broker a peace deal between the country and Israel.

SIGNALS

US markets sing while Europe’s retreat

US stock markets surged after Trump’s decisive victory, with one analyst telling Bloomberg: “If you had the Trump trade on for the last six weeks, it’s been outstanding.” In the longer term, a Trump presidency will likely result in interest rates being higher for longer as he is likely to take a “light-touch approach” to regulation, the Financial Times wrote. In Europe, stocks retreated in London, Paris, and Frankfurt after an initial jump. A Trump presidency and a more “isolationist” US may provide a boost for European defense companies, but higher tariffs and an interest rate hike will likely “threaten the Eurozone’s economic stability,” Euronews noted.

Trump could spell trouble for the world’s second-largest economy

The yuan fell sharply as Trump declared victory. “Geopolitical risks, not least the specter of an escalation in US-China trade tensions… will preserve depreciatory pressure on the yuan,” one economist told the South China Morning Post. Trump has proposed imposing tariffs on goods from China at 60% or more, a policy that would significantly impact the country’s economy. Trump could also further stymie the recovery of China’s equity market with technology, defense, and export sectors “in the crosshairs” of his policies, Reuters noted. In addition, doubts about whether Trump would be willing to defend Taiwan against a Chinese invasion have raised concerns about the ramifications on the global economy, given Taiwan’s significant semiconductor industry, the BBC noted.