The News

Central bankers across the world face a tricky few months ahead with the return of Donald Trump to the White House.

The US president-elect has said he will impose widespread tariffs on imports, a move the Bank of France chief said would bring “more protectionism” that “increases risks for the global economy,” while the vice president of the European Central Bank said the consequences for global commerce would be “huge.”

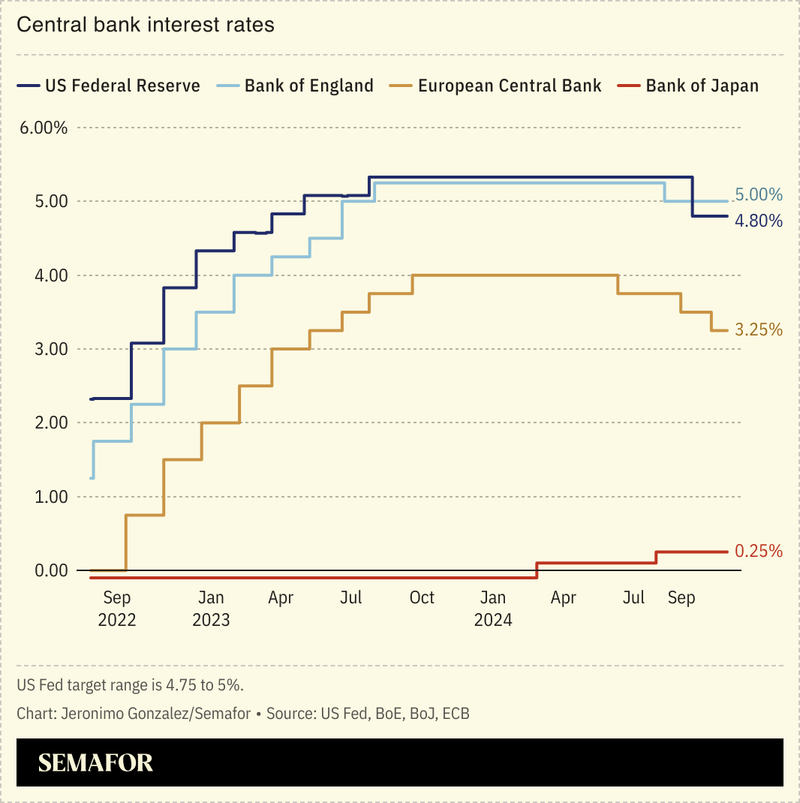

The US Federal Reserve is expected to announce a quarter-point cut in interest rates Thursday, though the outlook for the future of the American central bank remains murky, too.

SIGNALS

Trump’s policy proposals puts central banks on edge

Many mainstream economists have argued that instead of conquering inflation, Trump’s proposals, including massive import tariffs and mass deportations of migrant workers, would “make it worse,” The Associated Press reported. Most central banks, which have been on a recent rate-cutting regime, are now wondering “whether their worst fears over Donald Trump will come to pass,” Bloomberg wrote: His policy proposals could result in a strong dollar that diminishes the opportunity for emerging markets — many of which are already struggling to contain inflation — to ease their own monetary conditions. “US markets may be cheering, but economies across Asia could be big losers,” an Asia Pacific economist said.

Models can’t really predict how the global economy will react

Most central banks’ economic models are not equipped to deal with the sweeping global shifts and “tumultuous times” that could result from Trump’s policies, according to Chris Giles, the Financial Times economics commentator. If central banks rely on their modeling capabilities, which are based on data from relatively tranquil periods, they “risk being blindsided by the possible world of geopolitical tensions, vicious trade wars and a president intent on having a say in Fed decisions, vastly underestimating the potential repercussions,” Giles argued.