The News

US Federal Reserve chair Jerome Powell told reporters Thursday that he would not resign if President-Elect Donald Trump asked him. Powell was speaking at the central bank’s press conference Thursday following its decision to lower its benchmark interest rate.

Asked about Trump advisors’ suggestions that Powell should resign, and whether he would step down if asked by the president-elect, the central banker answered with a simple “no.” It is “not permitted under the law” for a president to fire the Fed chair, he added. Powell declined to answer other questions on concerns about the central bank’s political independence.

Trump has repeatedly criticized Powell and the central bank’s recent decisions, mooting taking more of an active role in the central bank’s decisions, which economists cautioned could potentially negatively impact monetary policy.

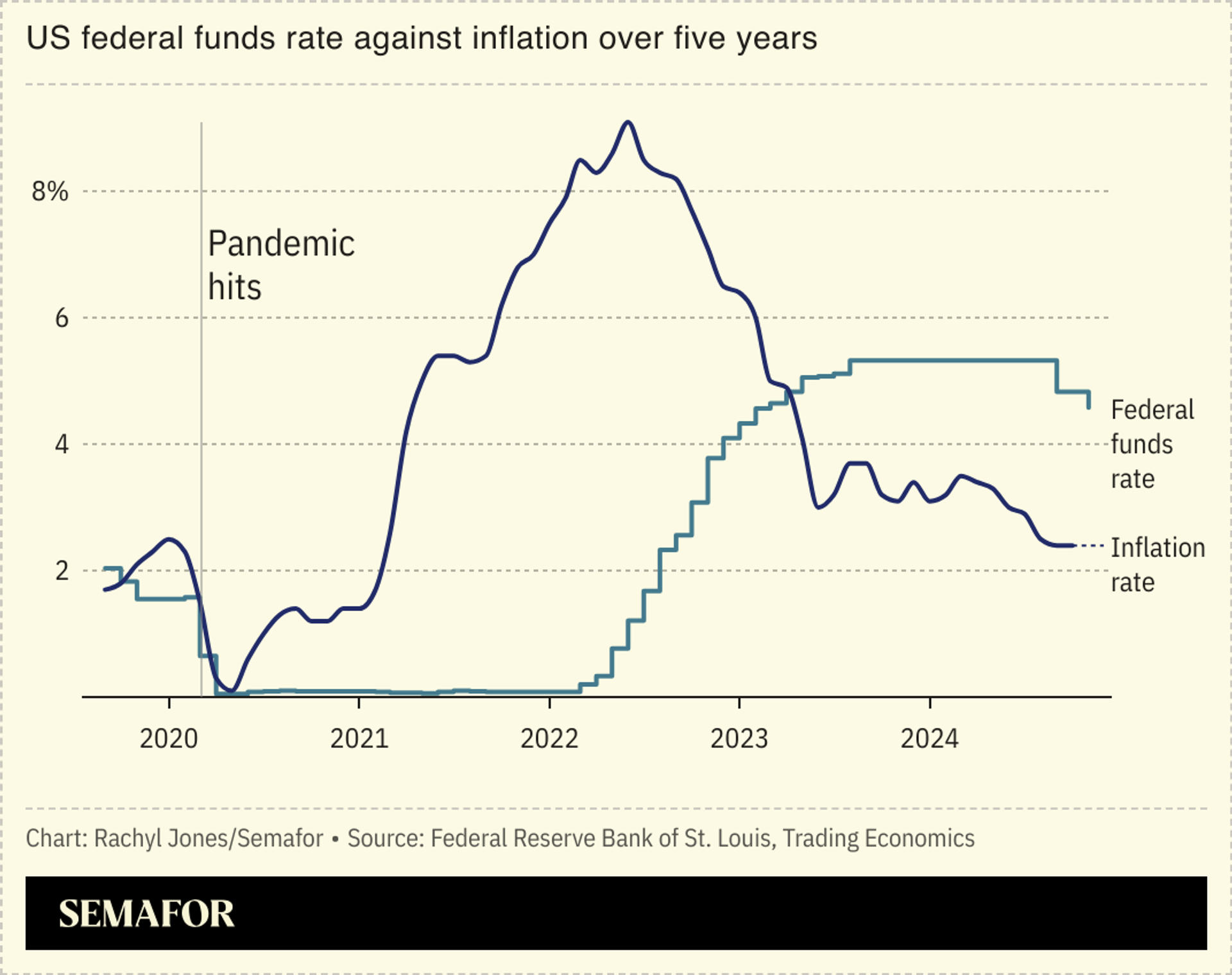

At the meeting Thursday, the central bank cut the federal funds rate by a quarter of a point, as economists and traders had expected, to a 4.5-4.75% target range. This rate cut is the bank’s second this year; more modest than the half-point rate cut made in September, the bank is slowing its pace as it tries to guide the economy toward a soft landing.

SIGNALS

Federal Reserve faces uncertainty under Trump

With Trump’s reelection, the Fed’s path forward has become murkier, Politico reported, as the central bank needs to see how the future administration’s policies might change the economy’s trajectory. Trump campaigned on pledges to hike import tariffs and restrict immigration, which economists warned could stoke inflation. Speaking on Thursday, Powell pushed back on the idea that the incoming administration had influence on near-term decisions, adding that “We don’t know what the timing and substance of any policy changes will be. We therefore don’t know what the effects on the economy would be — specifically, whether and to what extent those policies would matter for the achievement of our goal variables: maximum employment and price stability.”

Powell remains steadfast in his position

The central bank chief’s statement Thursday that he would not resign if asked echoes remarks he made during Trump’s first term in office in 2019. Trump appointed Powell in 2017, but the pair disagreed often. At the time, Trump reportedly had private conversations over whether he had the authority to fire Powell. Technically, removing him from the Fed may be feasible, Brookings Institute think tank noted, however the law requires “cause,” and policy differences may not meet that bar in court. “The Supreme Court could ultimately decide that question differently,” the think tank wrote. “If it did, that would represent one of the biggest changes in administrative law in the United States in 80 years, so don’t count on it.”

Europe’s central banks brace for change

The Bank of England also cut interest rates Thursday by a quarter-point, with the central bank’s chief warning that inflation will remain longer than expected. Across Europe, officials are concerned over potential US trade tariff hikes and the impact on already struggling economies, especially Germany. On Wednesday, Goldman Sachs downgraded its growth forecasts in Europe and the UK due to concerns that Trump’s promised policies, including likely setting tariffs on European car imports, could hurt the region’s GDP.