The News

Republicans look likely to flip the U.S. House and possibly the Senate in today’s midterms. That used to be good news for big business, but its relationship with the party has grown contentious. We canvassed investors, executives and legislators about what corporate America can expect from the 118th Congress.

Majority rule:

Rep. Frank Lucas (R-Okla.), the longest-serving Republican on the House Financial Services Committee, laid out to Semafor a wide-ranging set of priorities under its likely new chairman, North Carolina’s Patrick McHenry.

- “Necessary oversight of the Biden administration and financial regulators”

- “Enact legislation that provides a framework for crypto and fintech”

- “Strengthen capital markets during this uncertain economic climate. Address concerns that financial markets are being distorted by activism”

- “The SEC [Securities and Exchange Commission] and CFPB [Consumer Financial Protection Bureau] will face particular scrutiny as these agencies attempt to put their thumb on the scale of public capital and reshape entire industries.”

Anti-“woke” animus:

The push won’t be confined to the House committee. Conservatives will be pressing Republicans in both chambers to dig into what it sees as a radical lurch by companies into political hot-button issues.

“What we really want them to do is care about their proceeds, their bottom lines,” Matt Schlapp, who heads the American Conservative Union, told Semafor. A Republican leadership is “going to take a much more hostile approach to the CEOs they deal with,” he predicted.

Billionaire influence:

Corporations are still spending on congressional races: of the 36 corporate Political Action Committee donations of at least $1 million this cycle, 31 went to Republicans, according to OpenSecrets, a nonprofit that tracks money in politics. But their money may not buy them much, says Robert Wolf, former CEO of UBS Americas and adviser to Barack Obama.

Billionaires like Elon Musk, investor Peter Thiel, and crypto mogul Sam Bankman-Fried (an investor in Semafor) have used their money and their megaphones to bankroll office-seekers and political agendas.

“Candidates today care a lot more about courting big individual donors, winning the media battle, and creating that viral moment to spur grassroots excitement than they do [about] appealing to corporate America,” Wolf told Semafor. He pointed to Republicans picking a fight with a one-time ally, the U.S. Chamber of Commerce: “It shows where the power has shifted.”

As if to underscore the point, Musk took to Twitter on Monday and encouraged “independent-minded voters” to vote Republican, a rare, blatant political endorsement by the richest person in the world.

A dire warning on the debt ceiling:

At some point next year, Congress must vote to raise or suspend the debt ceiling to keep the U.S. from defaulting on its obligations — an outcome that financial experts, regardless of party, have said would permanently damage the country’s creditworthiness and threaten the dollar’s supremacy.

Kevin McCarthy, the likely new House speaker, has said he’ll use raising the limit as a bargaining chip. In 2011, when Republicans played brinkmanship with the ceiling, the resulting panic of global investors cost taxpayers $1.3 billion in additional borrowing costs, according to the U.S. Government Accountability Office.

“It’s hard to know how far a Republican Congress intends to push the issue,” Bob Elliott, the former deputy chief investment officer of hedge fund giant Bridgewater Associates, told Semafor. But he sounded an alarm: “The failure of a divided government to raise the debt ceiling would create a catastrophic ripple across the financial markets.”

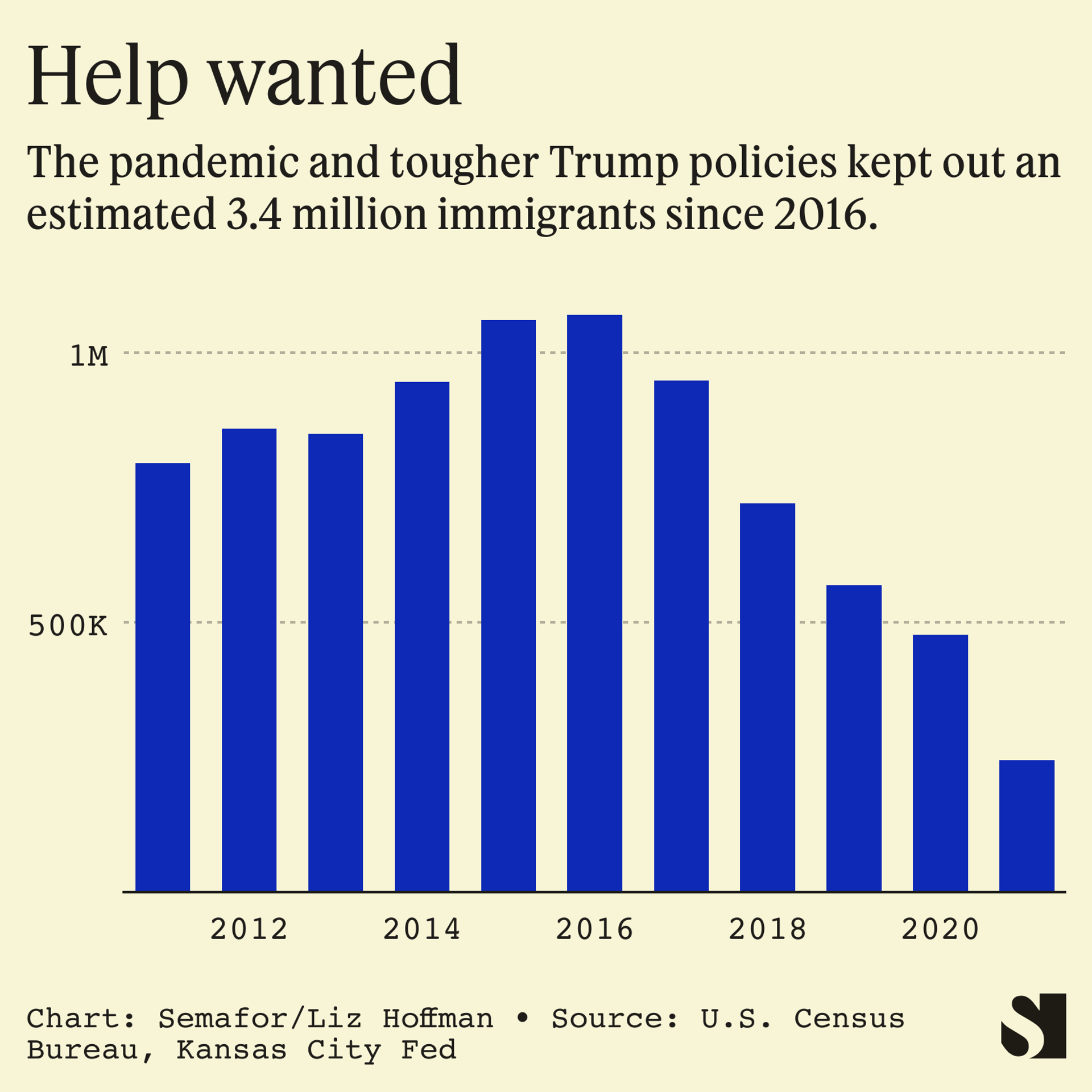

The immigration situation:

Companies are scrambling for workers and wage wars are fueling inflation. Approving more temporary visas for foreign workers might help, according to the Kansas City Fed, which says a decline in immigration under tougher Trump administration policies and, later, pandemic lockdowns contributed to the current worker shortage. Non-immigrant work visas fell from 5.5 million in 2015 to 1.5 million in 2021, it found.

Three dozen senators from both parties earlier this year urged the Department of Homeland Security to lift the 60,000 cap on visas for seasonal, non-agricultural workers.

But a bipartisan compromise isn’t likely, says Paul Ryan, the former Republican House speaker.

“I think that’d be really good for the country. I just don’t think it gets accomplished in the next Congress,” Ryan said at an investor conference last month, according to a recording of his comments. “I don’t think [Biden] will spend his political capital on that.”

In this article:

Liz’s view

The speed with which the GOP unfriended big business is breathtaking. For much of the 20th century, Republicans were the party of corporate America.

And it was just five years ago that an establishment Republican bloc, with the aid of former Wall Street executive Gary Cohn in the White House, pushed through the most corporate-friendly tax cuts in a generation.

But populism is running hot and high-profile examples of companies like Delta Air Lines and Disney wading into political debates has further eroded support for the corporate class.

Consider these two statements from two operatives on opposite sides of the spectrum.

Wolf, a liberal Democrat once famously tagged as “Obama’s favorite banker,” said: “Anytime corporations take taxpayer money and then get more active in the ever polarizing political debate, they are leading with their chin.” And Schlapp, a former White House political director for Donald Trump, told Semafor: “Right now, big business has no friends.”

Room for Disagreement

Corporate America might not like being chastised, but it will put up with some amount of brow-beating to keep its tax cuts and a light regulatory touch. A Republican majority appears poised to deliver on both.

McHenry told Semafor that the House committee he’ll likely chair come January would focus on regulatory rollback — in particular, quashing a plan by the SEC to force companies to disclose their environmental footprints.

SEC Chair Gary Gensler “is using the rulemaking process to implement social and climate policies” that overstep their authorities, he said. “Committee Republicans will work together to conduct appropriate oversight of activist regulators and market participants who have an outsized impact.”

Semafor reported last month that Gensler was getting cold feet about his proposed climate rules. You can read that story here.

Contact

Want to pass along a tip or feedback? Write to us at lhoffman@semafor.com and bsaacks@semafor.com.