The News

Beijing unveiled a $1.4 trillion bailout for local governments, part of efforts to ward off a looming debt crisis and kickstart a moribund economy. The funds will help provincial authorities refinance a huge pile of loans that had left many struggling to provide basic services and pay civil servants.

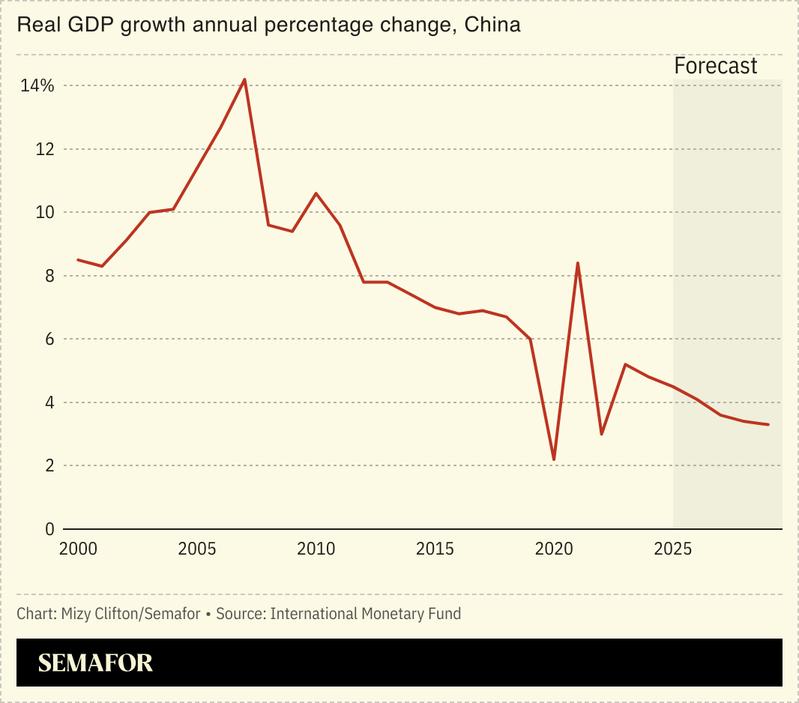

The widely expected announcement followed a five-day meeting of China’s rubber-stamp parliament. Though a huge sum, it fell short of analysts’ hopes for a broader package targeting China’s deeper economic challenges, ranging from a collapsing real-estate sector to high levels of youth unemployment: Chinese stock futures dropped, while one economist told The New York Times, “What is announced so far is likely not enough.”

SIGNALS

The measures don’t tackle China’s deeper problems

The widely expected announcement followed a five-day meeting of China’s rubber-stamp parliament. Though a huge sum, it fell short of analysts’ hopes for a broader package targeting the country’s deeper economic challenges, ranging from a collapsing real-estate sector to high levels of youth unemployment: Chinese stock futures dropped, while one economist told The New York Times, “What is announced so far is likely not enough.” The head of Asian equities at an investment management firm told Bloomberg that he hoped to see more stimulus in the future, once Beijing has assessed the direction that US President-elect Donald Trump plans to take next year regarding tariffs.

Unreliable data and ‘strong-arm’ tactics are hurting business confidence

China’s economic woes are also political, The Economist argued: Government officials are suspected of massaging data and suppressing sensitive information about the state of the economy, which has led to a “crisis of confidence” among would-be investors. Without free-flowing, accurate information, “the odds of a successful transition are low,” the outlet wrote. A similar cycle of mistrust is playing out on the level of local government: Analysts told Nikkei Asia that the “strong-arm tactics” of local authorities to plug income gaps, such as ordering entrepreneurs accused of misconduct to pay fines as a means of avoiding prosecution, risked hurting business confidence and drying up future sources of revenue.