The News

The rate of inflation in the US appears to be ticking up, according to the first major economic report since the reelection of Donald Trump to the presidency.

The consumer price index, a measure of the cost of goods and services, ticked up by 0.2% in October, bringing the 12-month inflation rate to 2.6%, the Bureau of Labor Statistics reported Wednesday. The increase aligns with what economists expected, but marks a reversal in a months-long trend of tempered declines. Driving the uptick were higher food and housing prices, according to the report.

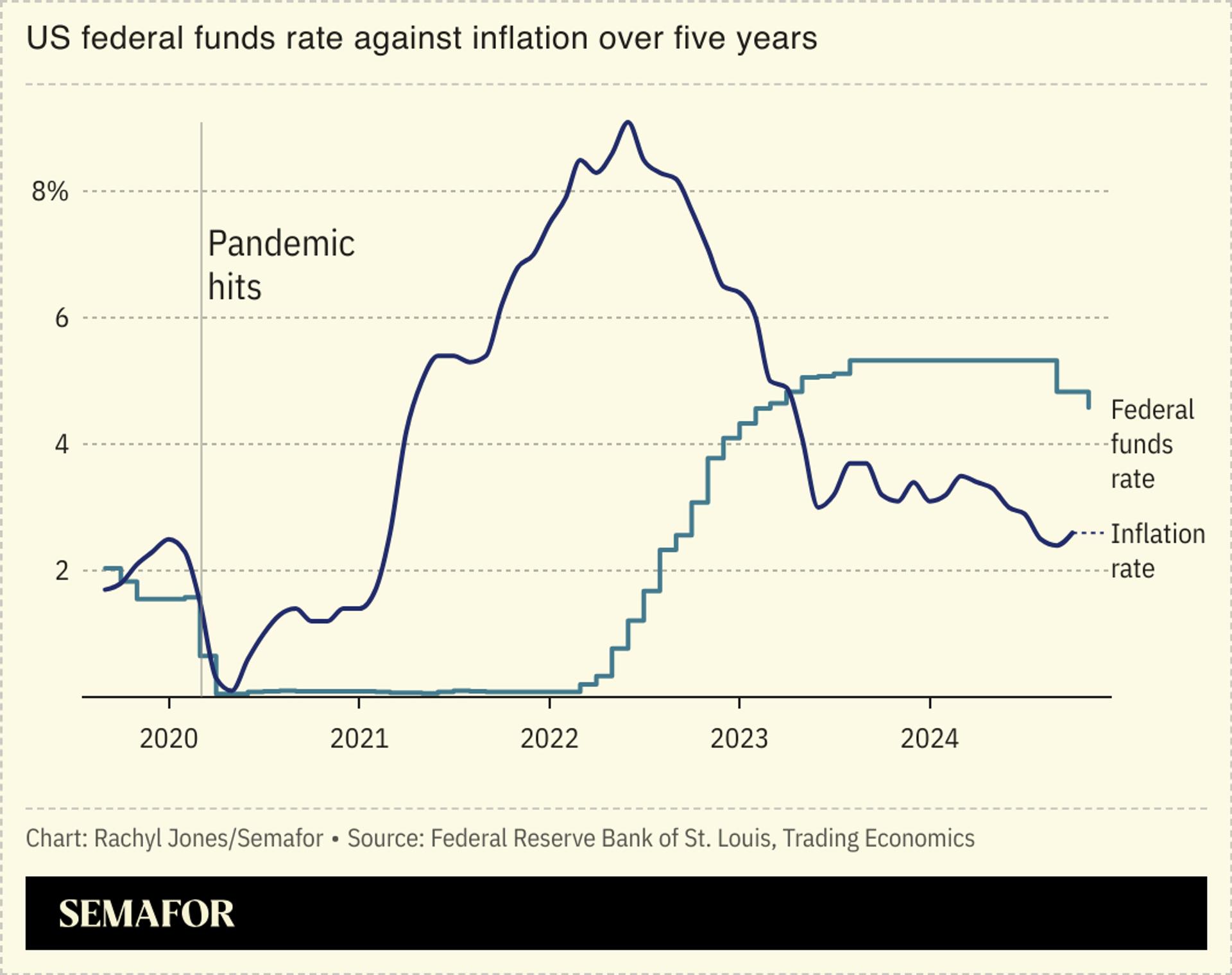

Inflation has significantly improved since 2022’s peak rate of 9.1% and the broader US economy is doing well, however, the latest economic reading indicates that pricing pressures remain. The S&P 500 and Nasdaq Composite stock indexes both slid less than 1% following the report before recovering in midday trading.

SIGNALS

It’s Trump’s turn to wrangle the economy

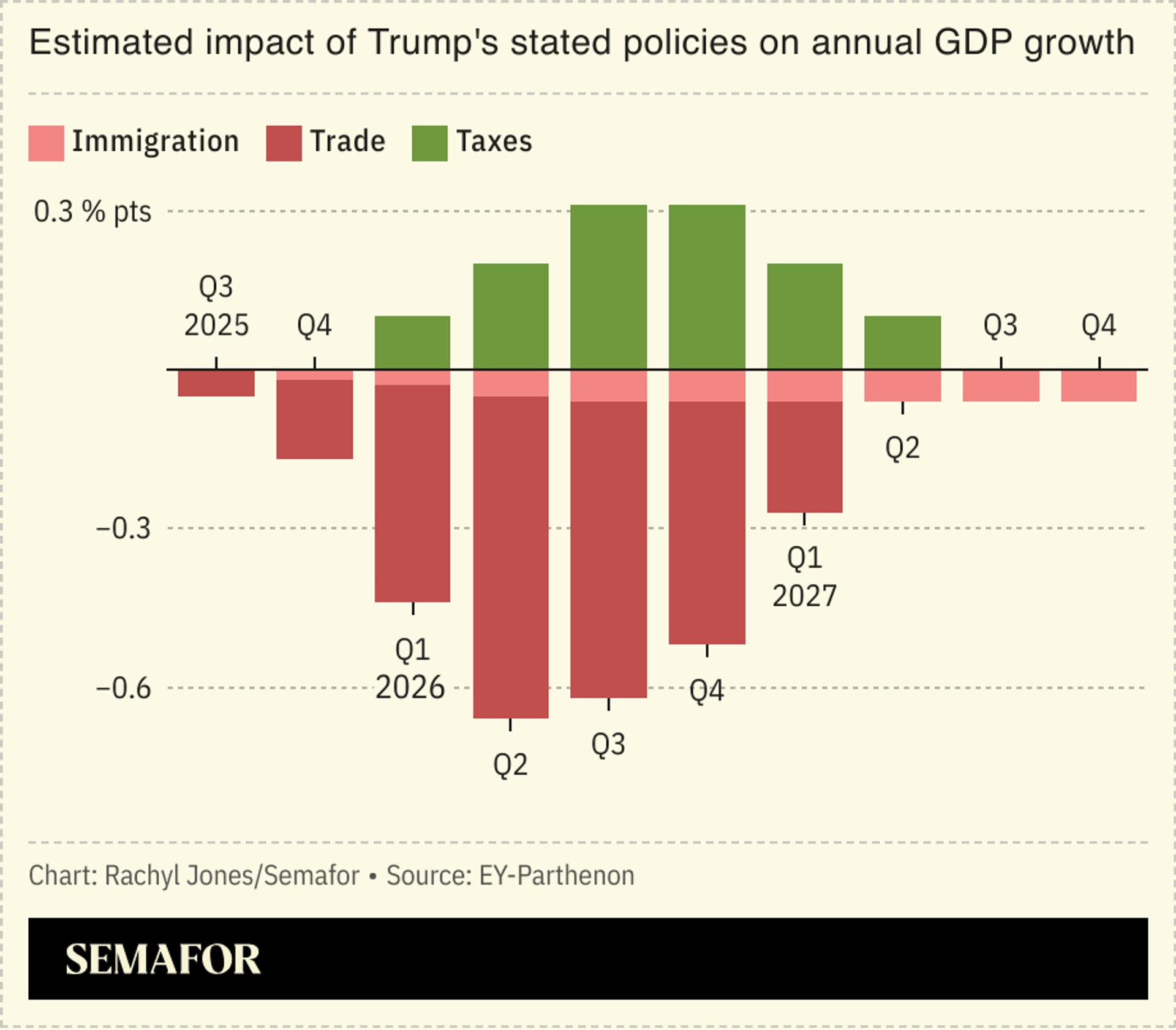

Economists have warned that the president-elect’s pledges to increase tariffs on imports and deport undocumented workers may cause inflation to rise. The question is the speed at which his policies will make their mark on the economy. According to data from EY shared with Semafor, Trump’s proposals could trim a few basis points off US GDP growth each quarter over the next few years, beginning in mid-2025. EY forecasts that across the 10 quarters from 2025 to 2027, Trump’s policies would bump the expected GDP growth only once. The impact will take at least six months after Trump takes office to be felt, EY’s Gregory Daco said. “The US economy is a big tanker,” he told Semafor. “Even with big policy changes, it just doesn’t turn that quickly.”

The Federal Reserve’s ‘last mile will be the hardest’

The inflation reading comes just after the US Federal Reserve cut borrowing costs for the second time in 2024, reaching a total reduction of 0.75% off its federal funds rate this year as the bank inches toward the 2% inflation target. Wednesday’s report suggests the central bank’s fight against rising prices is far from over, however: “The last mile of inflation’s journey back to target will be the hardest,” Wells Fargo economists wrote in a note to clients, Bloomberg reported. At its next and final meeting of 2024 in December, economists and Wall Street traders expect the Fed to lower the rate by a further 0.25% to stimulate economic growth. If the central bank lowers rates too quickly, however, it could trigger an increase in inflation.